New York State Common Retirement Fund decreased its position in shares of CoStar Group, Inc. (NASDAQ:CSGP - Free Report) by 16.0% during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 217,225 shares of the technology company's stock after selling 41,255 shares during the period. New York State Common Retirement Fund owned 0.05% of CoStar Group worth $17,211,000 at the end of the most recent quarter.

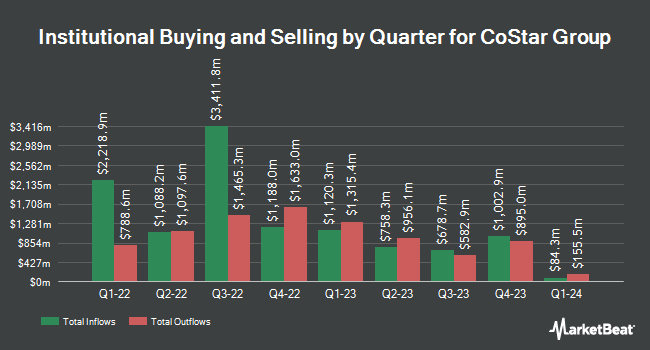

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Wayfinding Financial LLC bought a new stake in shares of CoStar Group during the first quarter valued at approximately $29,000. Annis Gardner Whiting Capital Advisors LLC raised its position in shares of CoStar Group by 414.4% during the fourth quarter. Annis Gardner Whiting Capital Advisors LLC now owns 499 shares of the technology company's stock valued at $36,000 after buying an additional 402 shares during the last quarter. Colonial Trust Co SC raised its position in shares of CoStar Group by 27.4% during the fourth quarter. Colonial Trust Co SC now owns 674 shares of the technology company's stock valued at $48,000 after buying an additional 145 shares during the last quarter. Farther Finance Advisors LLC raised its position in shares of CoStar Group by 77.1% during the fourth quarter. Farther Finance Advisors LLC now owns 850 shares of the technology company's stock valued at $61,000 after buying an additional 370 shares during the last quarter. Finally, CVA Family Office LLC raised its position in shares of CoStar Group by 28.3% during the first quarter. CVA Family Office LLC now owns 843 shares of the technology company's stock valued at $67,000 after buying an additional 186 shares during the last quarter. Institutional investors own 96.60% of the company's stock.

CoStar Group Trading Down 0.3%

CSGP stock traded down $0.25 during mid-day trading on Friday, reaching $84.70. 2,046,044 shares of the stock traded hands, compared to its average volume of 2,894,063. The company has a debt-to-equity ratio of 0.12, a quick ratio of 6.01 and a current ratio of 6.01. CoStar Group, Inc. has a one year low of $68.26 and a one year high of $86.45. The stock has a market capitalization of $35.73 billion, a PE ratio of 292.07, a PEG ratio of 4.29 and a beta of 0.89. The business has a 50-day moving average price of $79.20 and a two-hundred day moving average price of $77.44.

Analysts Set New Price Targets

Several research firms have recently issued reports on CSGP. Royal Bank Of Canada reiterated a "sector perform" rating and set a $83.00 price objective on shares of CoStar Group in a research report on Tuesday, June 24th. JMP Securities reiterated a "market outperform" rating and set a $85.00 price objective on shares of CoStar Group in a research report on Wednesday, April 30th. Wells Fargo & Company reiterated an "underweight" rating and set a $70.00 price objective (up previously from $65.00) on shares of CoStar Group in a research report on Wednesday. Needham & Company LLC lifted their price objective on shares of CoStar Group from $87.00 to $98.00 and gave the company a "buy" rating in a research report on Wednesday, April 30th. Finally, Bank of America began coverage on shares of CoStar Group in a research report on Friday, May 30th. They issued a "neutral" rating and a $79.00 price target on the stock. Two equities research analysts have rated the stock with a sell rating, four have given a hold rating, ten have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, CoStar Group presently has an average rating of "Moderate Buy" and an average target price of $88.46.

Get Our Latest Stock Analysis on CoStar Group

CoStar Group Company Profile

(

Free Report)

CoStar Group, Inc provides information, analytics, and online marketplace services to the commercial real estate, hospitality, residential, and related professionals industries in the United States, Canada, Europe, the Asia Pacific, and Latin America. The company offers CoStar Property that provides inventory of office, industrial, retail, multifamily, hospitality, and student housing properties and land; CoStar Sales, a robust database of comparable commercial real estate sales transactions; CoStar Market Analytics to view and report on aggregated market and submarket trends; and CoStar Tenant, an online business-to-business prospecting and analytical tool that provides tenant information.

See Also

Before you consider CoStar Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CoStar Group wasn't on the list.

While CoStar Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.