Crossmark Global Holdings Inc. boosted its position in Nice (NASDAQ:NICE - Free Report) by 46.4% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 9,764 shares of the technology company's stock after buying an additional 3,094 shares during the quarter. Crossmark Global Holdings Inc.'s holdings in Nice were worth $1,505,000 at the end of the most recent quarter.

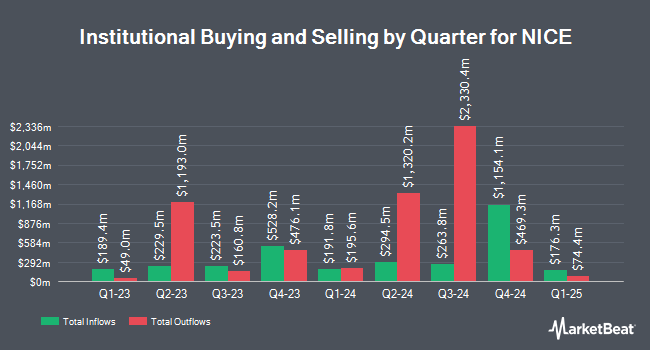

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Charles Schwab Investment Management Inc. increased its stake in shares of Nice by 28.5% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 5,168 shares of the technology company's stock valued at $878,000 after acquiring an additional 1,145 shares during the period. Victory Capital Management Inc. increased its position in shares of Nice by 55.6% during the 4th quarter. Victory Capital Management Inc. now owns 92,542 shares of the technology company's stock valued at $15,717,000 after purchasing an additional 33,058 shares during the period. Atria Investments Inc raised its stake in shares of Nice by 39.2% in the 4th quarter. Atria Investments Inc now owns 1,720 shares of the technology company's stock worth $292,000 after buying an additional 484 shares in the last quarter. Proficio Capital Partners LLC acquired a new stake in shares of Nice in the fourth quarter valued at $5,106,000. Finally, Raymond James Financial Inc. acquired a new stake in shares of Nice in the fourth quarter valued at $26,810,000. Institutional investors and hedge funds own 63.34% of the company's stock.

Nice Price Performance

Shares of Nice stock traded down $8.17 on Friday, hitting $154.84. The company had a trading volume of 485,157 shares, compared to its average volume of 514,403. Nice has a twelve month low of $137.19 and a twelve month high of $200.65. The stock has a 50-day moving average of $166.59 and a 200-day moving average of $161.53. The firm has a market capitalization of $9.79 billion, a P/E ratio of 18.27, a P/E/G ratio of 1.48 and a beta of 1.00.

Nice (NASDAQ:NICE - Get Free Report) last released its earnings results on Thursday, May 15th. The technology company reported $2.87 earnings per share for the quarter, beating analysts' consensus estimates of $2.84 by $0.03. Nice had a net margin of 16.77% and a return on equity of 16.37%. The business had revenue of $700.19 million during the quarter, compared to the consensus estimate of $699.46 million. During the same quarter last year, the firm earned $2.58 earnings per share. The firm's revenue for the quarter was up 6.2% compared to the same quarter last year. Equities analysts predict that Nice will post 9.85 EPS for the current year.

Analyst Upgrades and Downgrades

Several research firms have issued reports on NICE. Royal Bank Of Canada reaffirmed an "outperform" rating and issued a $200.00 price target on shares of Nice in a report on Wednesday, June 18th. JMP Securities reaffirmed a "market outperform" rating and set a $300.00 target price on shares of Nice in a research report on Wednesday, June 18th. Citigroup reduced their target price on Nice from $214.00 to $211.00 and set a "buy" rating for the company in a report on Monday, May 19th. Cantor Fitzgerald reissued a "neutral" rating and issued a $161.00 price target on shares of Nice in a research note on Wednesday, June 18th. Finally, DA Davidson boosted their price objective on Nice from $185.00 to $195.00 and gave the stock a "buy" rating in a report on Friday, June 20th. Four equities research analysts have rated the stock with a hold rating and ten have assigned a buy rating to the company's stock. According to MarketBeat, Nice has a consensus rating of "Moderate Buy" and a consensus target price of $209.75.

Get Our Latest Report on NICE

Nice Profile

(

Free Report)

NICE Ltd., together with its subsidiaries, provides cloud platforms for AI-driven digital business solutions worldwide. It offers CXone, a cloud native open platform; Enlighten, an AI engine for the customer engagement market; and smart self service enable organizations to address consumers' needs; and journey orchestration solutions that empower organizations to connect and route customers to deal with the customer's request, and connects them using real time AI-based routing.

Featured Stories

Before you consider Nice, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nice wasn't on the list.

While Nice currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.