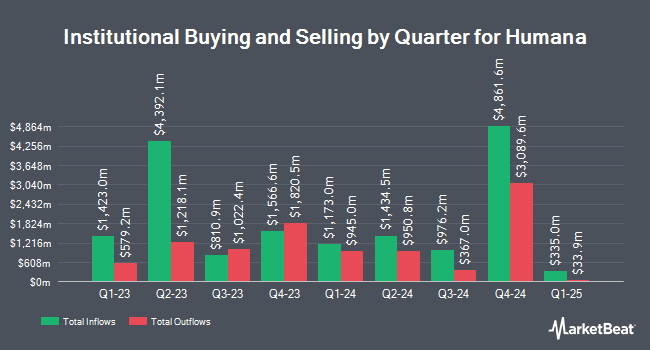

DekaBank Deutsche Girozentrale boosted its holdings in shares of Humana Inc. (NYSE:HUM - Free Report) by 2.6% during the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 57,151 shares of the insurance provider's stock after buying an additional 1,449 shares during the period. DekaBank Deutsche Girozentrale's holdings in Humana were worth $14,996,000 as of its most recent SEC filing.

A number of other institutional investors have also recently bought and sold shares of the business. denkapparat Operations GmbH bought a new position in shares of Humana during the fourth quarter valued at $323,000. Allstate Corp bought a new position in shares of Humana during the fourth quarter valued at $905,000. Deutsche Bank AG lifted its holdings in shares of Humana by 18.2% during the fourth quarter. Deutsche Bank AG now owns 631,371 shares of the insurance provider's stock valued at $160,185,000 after acquiring an additional 97,071 shares during the period. Janney Montgomery Scott LLC bought a new position in shares of Humana during the first quarter valued at $1,309,000. Finally, Fred Alger Management LLC bought a new position in shares of Humana during the fourth quarter valued at $451,000. Institutional investors and hedge funds own 92.38% of the company's stock.

Analyst Ratings Changes

Several research analysts recently issued reports on HUM shares. Oppenheimer upped their price target on shares of Humana from $300.00 to $310.00 and gave the stock an "outperform" rating in a research report on Thursday, May 1st. Bank of America reduced their price target on shares of Humana from $320.00 to $260.00 and set a "neutral" rating on the stock in a research report on Tuesday, June 17th. Robert W. Baird upped their price target on shares of Humana from $270.00 to $300.00 and gave the stock a "neutral" rating in a research report on Tuesday, April 15th. Mizuho upped their price target on shares of Humana from $305.00 to $316.00 and gave the stock an "outperform" rating in a research report on Wednesday, April 9th. Finally, Cantor Fitzgerald reissued a "neutral" rating and set a $290.00 price objective on shares of Humana in a report on Thursday, May 1st. Sixteen investment analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus target price of $280.76.

View Our Latest Research Report on Humana

Humana Stock Performance

Humana stock traded down $1.80 during midday trading on Friday, reaching $230.38. The stock had a trading volume of 1,077,538 shares, compared to its average volume of 1,814,856. Humana Inc. has a 12 month low of $212.45 and a 12 month high of $406.46. The firm's 50-day moving average price is $238.33 and its 200 day moving average price is $258.48. The firm has a market capitalization of $27.80 billion, a PE ratio of 16.29, a P/E/G ratio of 1.75 and a beta of 0.44. The company has a quick ratio of 1.91, a current ratio of 1.91 and a debt-to-equity ratio of 0.71.

Humana (NYSE:HUM - Get Free Report) last posted its earnings results on Wednesday, April 30th. The insurance provider reported $11.58 EPS for the quarter, topping the consensus estimate of $10.07 by $1.51. The business had revenue of $32.11 billion during the quarter, compared to analysts' expectations of $32 billion. Humana had a return on equity of 14.47% and a net margin of 1.42%. The firm's revenue was up 8.4% on a year-over-year basis. During the same period in the previous year, the business earned $7.23 earnings per share. As a group, research analysts predict that Humana Inc. will post 16.47 earnings per share for the current fiscal year.

Humana Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Friday, July 25th. Stockholders of record on Friday, June 27th will be given a $0.885 dividend. This represents a $3.54 annualized dividend and a dividend yield of 1.54%. The ex-dividend date of this dividend is Friday, June 27th. Humana's dividend payout ratio is currently 25.04%.

Humana Company Profile

(

Free Report)

Humana Inc, together with its subsidiaries, provides medical and specialty insurance products in the United States. It operates through two segments, Insurance and CenterWell. The company offers medical and supplemental benefit plans to individuals. It has a contract with Centers for Medicare and Medicaid Services to administer the Limited Income Newly Eligible Transition prescription drug plan program; and contracts with various states to provide Medicaid, dual eligible, and long-term support services benefits.

Featured Stories

Before you consider Humana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Humana wasn't on the list.

While Humana currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.