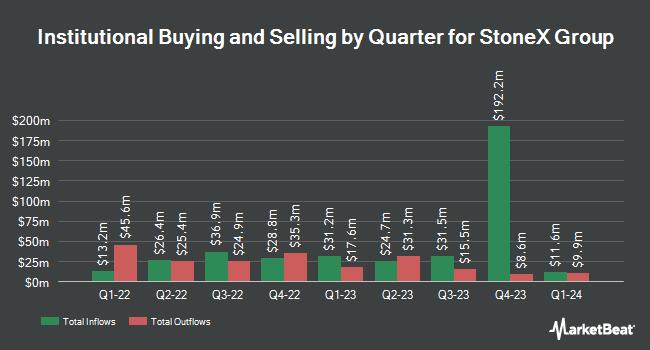

Deutsche Bank AG raised its holdings in shares of StoneX Group Inc. (NASDAQ:SNEX - Free Report) by 20.2% during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 48,101 shares of the company's stock after acquiring an additional 8,084 shares during the quarter. Deutsche Bank AG owned approximately 0.15% of StoneX Group worth $4,712,000 as of its most recent SEC filing.

Other large investors have also recently made changes to their positions in the company. Barclays PLC boosted its position in shares of StoneX Group by 359.4% during the third quarter. Barclays PLC now owns 46,755 shares of the company's stock valued at $3,828,000 after buying an additional 36,577 shares during the period. Principal Financial Group Inc. increased its position in shares of StoneX Group by 11.0% during the third quarter. Principal Financial Group Inc. now owns 149,442 shares of the company's stock worth $12,236,000 after purchasing an additional 14,784 shares in the last quarter. Crossmark Global Holdings Inc. purchased a new stake in shares of StoneX Group during the fourth quarter valued at $219,000. Atomi Financial Group Inc. grew its holdings in shares of StoneX Group by 43.2% during the fourth quarter. Atomi Financial Group Inc. now owns 3,966 shares of the company's stock valued at $389,000 after buying an additional 1,197 shares during the last quarter. Finally, Sheets Smith Wealth Management grew its holdings in shares of StoneX Group by 4.3% during the fourth quarter. Sheets Smith Wealth Management now owns 5,495 shares of the company's stock valued at $538,000 after buying an additional 227 shares during the last quarter. 75.93% of the stock is owned by institutional investors.

Insider Buying and Selling at StoneX Group

In other StoneX Group news, President Charles M. Lyon sold 13,000 shares of the firm's stock in a transaction on Thursday, May 15th. The shares were sold at an average price of $86.92, for a total transaction of $1,129,960.00. Following the transaction, the president now directly owns 122,080 shares of the company's stock, valued at approximately $10,611,193.60. This trade represents a 9.62% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. Also, CEO Philip Andrew Smith sold 9,000 shares of the firm's stock in a transaction on Friday, April 4th. The stock was sold at an average price of $69.56, for a total transaction of $626,040.00. Following the transaction, the chief executive officer now directly owns 342,711 shares in the company, valued at $23,838,977.16. The trade was a 2.56% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 130,082 shares of company stock valued at $11,021,613 in the last 90 days. Company insiders own 11.70% of the company's stock.

StoneX Group Price Performance

SNEX stock traded up $0.57 during mid-day trading on Friday, reaching $85.53. The company's stock had a trading volume of 241,428 shares, compared to its average volume of 288,919. The stock has a market cap of $4.18 billion, a PE ratio of 10.22 and a beta of 0.63. The company has a current ratio of 1.77, a quick ratio of 1.29 and a debt-to-equity ratio of 1.33. StoneX Group Inc. has a fifty-two week low of $46.43 and a fifty-two week high of $97.17. The company's 50 day moving average is $82.26 and its two-hundred day moving average is $75.07.

StoneX Group (NASDAQ:SNEX - Get Free Report) last posted its quarterly earnings data on Wednesday, May 14th. The company reported $1.41 earnings per share for the quarter, topping analysts' consensus estimates of $1.32 by $0.09. The firm had revenue of $956.00 million during the quarter, compared to analysts' expectations of $907.30 million. StoneX Group had a net margin of 0.26% and a return on equity of 16.83%. Equities research analysts expect that StoneX Group Inc. will post 8.7 EPS for the current year.

Wall Street Analysts Forecast Growth

Separately, William Blair assumed coverage on shares of StoneX Group in a report on Wednesday, March 26th. They issued an "outperform" rating on the stock.

Read Our Latest Stock Analysis on StoneX Group

About StoneX Group

(

Free Report)

StoneX Group Inc operates as a global financial services network that connects companies, organizations, traders, and investors to market ecosystem worldwide. The company operates through Commercial, Institutional, Retail, and Global Payments segments. The Commercial segment provides risk management and hedging, exchange-traded and OTC products execution and clearing, voice brokerage, market intelligence, physical trading, and commodity financing and logistics services.

Featured Articles

Before you consider StoneX Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and StoneX Group wasn't on the list.

While StoneX Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.