Deutsche Bank AG lessened its position in FuelCell Energy, Inc. (NASDAQ:FCEL - Free Report) by 94.8% in the 4th quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 20,418 shares of the energy company's stock after selling 371,981 shares during the quarter. Deutsche Bank AG owned approximately 0.10% of FuelCell Energy worth $185,000 as of its most recent filing with the SEC.

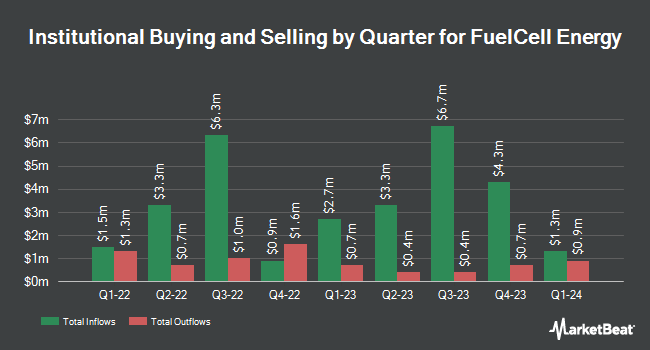

Other hedge funds have also made changes to their positions in the company. Marshall Wace LLP purchased a new stake in shares of FuelCell Energy in the 4th quarter valued at approximately $860,000. Federated Hermes Inc. purchased a new stake in shares of FuelCell Energy in the 4th quarter valued at approximately $1,357,000. Canada Pension Plan Investment Board purchased a new stake in shares of FuelCell Energy in the 4th quarter valued at approximately $30,000. Susquehanna Fundamental Investments LLC purchased a new stake in shares of FuelCell Energy in the 4th quarter valued at approximately $444,000. Finally, ExodusPoint Capital Management LP purchased a new stake in shares of FuelCell Energy in the 4th quarter valued at approximately $112,000. Hedge funds and other institutional investors own 42.78% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, B. Riley reduced their price target on shares of FuelCell Energy from $12.00 to $9.00 and set a "neutral" rating for the company in a research report on Wednesday, March 12th. Two investment analysts have rated the stock with a sell rating and five have issued a hold rating to the company's stock. According to MarketBeat.com, the stock presently has an average rating of "Hold" and an average price target of $10.03.

View Our Latest Research Report on FuelCell Energy

FuelCell Energy Stock Up 0.2%

FCEL stock traded up $0.01 during midday trading on Wednesday, reaching $5.64. The company had a trading volume of 1,064,694 shares, compared to its average volume of 1,238,875. FuelCell Energy, Inc. has a 1 year low of $3.58 and a 1 year high of $30.90. The company has a current ratio of 6.01, a quick ratio of 4.48 and a debt-to-equity ratio of 0.20. The company has a market capitalization of $128.11 million, a P/E ratio of -0.71 and a beta of 4.12. The company has a 50 day moving average of $4.35 and a two-hundred day moving average of $7.10.

FuelCell Energy (NASDAQ:FCEL - Get Free Report) last released its earnings results on Tuesday, March 11th. The energy company reported ($1.42) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($1.52) by $0.10. FuelCell Energy had a negative net margin of 113.09% and a negative return on equity of 18.58%. The company had revenue of $19.00 million during the quarter, compared to the consensus estimate of $35.37 million. During the same quarter in the prior year, the firm earned ($1.25) EPS. On average, equities research analysts expect that FuelCell Energy, Inc. will post -6.11 earnings per share for the current fiscal year.

About FuelCell Energy

(

Free Report)

FuelCell Energy, Inc, together with its subsidiaries, manufactures and sells stationary fuel cell and electrolysis platforms that decarbonize power and produce hydrogen. The company provides various configurations and applications of its platform, including on-site power, utility grid support, and microgrid, as well as distributed hydrogen; solid oxide-based electrolysis; solutions for long duration hydrogen-based energy storage and electrolysis technology; and carbon capture, separation, and utilization systems.

Featured Stories

Before you consider FuelCell Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FuelCell Energy wasn't on the list.

While FuelCell Energy currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.