Edgestream Partners L.P. lifted its position in shares of Match Group Inc. (NASDAQ:MTCH - Free Report) by 37.7% during the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 96,199 shares of the technology company's stock after acquiring an additional 26,317 shares during the quarter. Edgestream Partners L.P.'s holdings in Match Group were worth $3,001,000 at the end of the most recent reporting period.

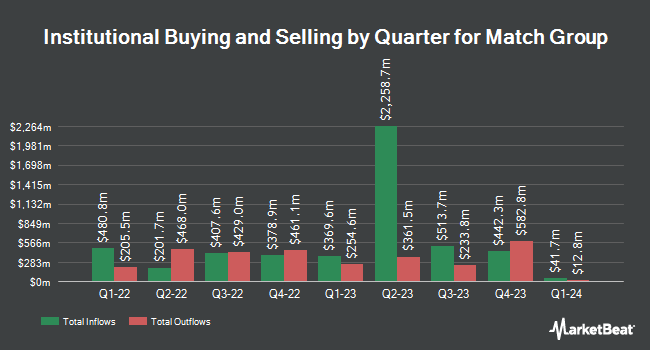

Several other hedge funds also recently modified their holdings of the company. Secured Retirement Advisors LLC boosted its holdings in shares of Match Group by 33.4% during the 1st quarter. Secured Retirement Advisors LLC now owns 29,092 shares of the technology company's stock valued at $908,000 after acquiring an additional 7,290 shares in the last quarter. CWM LLC raised its position in Match Group by 33.7% during the 1st quarter. CWM LLC now owns 12,528 shares of the technology company's stock worth $391,000 after purchasing an additional 3,155 shares during the last quarter. Nisa Investment Advisors LLC raised its position in Match Group by 16.0% during the 1st quarter. Nisa Investment Advisors LLC now owns 69,003 shares of the technology company's stock worth $2,153,000 after purchasing an additional 9,493 shares during the last quarter. Rehmann Capital Advisory Group raised its position in Match Group by 29.4% during the 1st quarter. Rehmann Capital Advisory Group now owns 23,808 shares of the technology company's stock worth $743,000 after purchasing an additional 5,408 shares during the last quarter. Finally, Flossbach Von Storch SE raised its position in Match Group by 1.2% during the 1st quarter. Flossbach Von Storch SE now owns 742,895 shares of the technology company's stock worth $23,178,000 after purchasing an additional 8,500 shares during the last quarter. Institutional investors and hedge funds own 94.05% of the company's stock.

Insider Transactions at Match Group

In related news, CEO Spencer M. Rascoff purchased 70,885 shares of the firm's stock in a transaction that occurred on Friday, May 9th. The stock was bought at an average cost of $28.05 per share, with a total value of $1,988,324.25. Following the completion of the purchase, the chief executive officer directly owned 137,478 shares in the company, valued at approximately $3,856,257.90. This represents a 106.45% increase in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. 0.64% of the stock is currently owned by insiders.

Analyst Ratings Changes

Several brokerages recently issued reports on MTCH. Barclays lowered their target price on Match Group from $52.00 to $46.00 and set an "overweight" rating for the company in a research report on Friday, May 9th. Citigroup lowered their target price on Match Group from $31.00 to $30.00 and set a "neutral" rating for the company in a research report on Friday, May 9th. UBS Group lowered their target price on Match Group from $34.00 to $31.00 and set a "neutral" rating for the company in a research report on Tuesday, April 29th. Stifel Nicolaus lowered their target price on Match Group from $35.00 to $29.00 and set a "hold" rating for the company in a research report on Wednesday, April 23rd. Finally, Bank of America lowered their target price on Match Group from $36.00 to $33.00 and set a "neutral" rating for the company in a research report on Monday, April 21st. One equities research analyst has rated the stock with a sell rating, fifteen have given a hold rating and eight have issued a buy rating to the stock. According to MarketBeat.com, the company has a consensus rating of "Hold" and an average price target of $35.96.

Get Our Latest Research Report on Match Group

Match Group Stock Up 0.4%

NASDAQ:MTCH traded up $0.13 during midday trading on Thursday, hitting $32.35. The company had a trading volume of 4,126,411 shares, compared to its average volume of 4,685,533. Match Group Inc. has a 52-week low of $26.39 and a 52-week high of $38.84. The stock's fifty day moving average price is $30.71 and its 200-day moving average price is $31.36. The company has a market capitalization of $8.10 billion, a PE ratio of 16.01, a P/E/G ratio of 0.71 and a beta of 1.34.

Match Group Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, July 18th. Investors of record on Thursday, July 3rd will be paid a $0.19 dividend. This represents a $0.76 dividend on an annualized basis and a yield of 2.35%. The ex-dividend date is Thursday, July 3rd. Match Group's payout ratio is currently 37.62%.

About Match Group

(

Free Report)

Match Group, Inc engages in the provision of dating products. Its portfolio of brands includes Tinder, Hinge, Match, Meetic, OkCupid, Pairs, Plenty Of Fish, Azar, BLK, and Hakuna, as well as a various other brands, each built to increase users' likelihood of connecting with others. Its services are available in over 40 languages to users worldwide.

See Also

Before you consider Match Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Match Group wasn't on the list.

While Match Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.