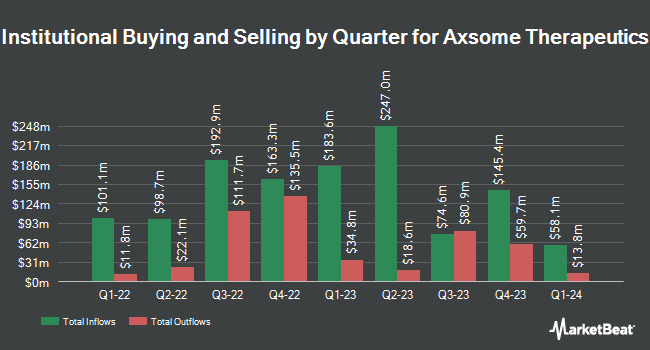

Edgestream Partners L.P. bought a new position in shares of Axsome Therapeutics, Inc. (NASDAQ:AXSM - Free Report) in the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor bought 70,086 shares of the company's stock, valued at approximately $8,174,000. Edgestream Partners L.P. owned about 0.14% of Axsome Therapeutics at the end of the most recent quarter.

Other large investors have also added to or reduced their stakes in the company. Intech Investment Management LLC boosted its holdings in Axsome Therapeutics by 46.5% during the fourth quarter. Intech Investment Management LLC now owns 16,028 shares of the company's stock worth $1,356,000 after purchasing an additional 5,087 shares during the last quarter. Raymond James Financial Inc. acquired a new stake in Axsome Therapeutics in the fourth quarter valued at $14,771,000. Charles Schwab Investment Management Inc. lifted its stake in Axsome Therapeutics by 1.7% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 328,034 shares of the company's stock valued at $27,755,000 after acquiring an additional 5,438 shares during the last quarter. Principal Financial Group Inc. lifted its stake in Axsome Therapeutics by 42.8% in the first quarter. Principal Financial Group Inc. now owns 295,671 shares of the company's stock valued at $34,484,000 after acquiring an additional 88,606 shares during the last quarter. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its stake in Axsome Therapeutics by 20.8% in the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 57,642 shares of the company's stock valued at $4,877,000 after acquiring an additional 9,928 shares during the last quarter. Institutional investors and hedge funds own 81.49% of the company's stock.

Wall Street Analyst Weigh In

A number of analysts have commented on the stock. Morgan Stanley assumed coverage on shares of Axsome Therapeutics in a research note on Thursday, July 3rd. They issued an "overweight" rating and a $190.00 price target for the company. Oppenheimer assumed coverage on shares of Axsome Therapeutics in a research note on Tuesday, June 3rd. They issued an "outperform" rating and a $185.00 price target for the company. Royal Bank Of Canada cut their price target on shares of Axsome Therapeutics from $193.00 to $186.00 and set an "outperform" rating for the company in a research note on Thursday, June 12th. Cantor Fitzgerald upgraded shares of Axsome Therapeutics to a "strong-buy" rating in a research note on Wednesday, May 14th. Finally, Mizuho raised their target price on shares of Axsome Therapeutics from $212.00 to $216.00 and gave the stock an "outperform" rating in a research note on Thursday, March 27th. One analyst has rated the stock with a hold rating, fifteen have assigned a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, Axsome Therapeutics currently has an average rating of "Buy" and an average target price of $172.33.

Check Out Our Latest Stock Analysis on Axsome Therapeutics

Axsome Therapeutics Price Performance

AXSM stock traded up $0.92 during mid-day trading on Thursday, hitting $112.24. The stock had a trading volume of 512,298 shares, compared to its average volume of 667,390. The company has a current ratio of 2.03, a quick ratio of 1.96 and a debt-to-equity ratio of 3.48. Axsome Therapeutics, Inc. has a 52 week low of $72.21 and a 52 week high of $139.13. The firm has a market capitalization of $5.53 billion, a P/E ratio of -19.45 and a beta of 0.46. The firm has a fifty day simple moving average of $106.47 and a 200 day simple moving average of $108.95.

Insider Buying and Selling at Axsome Therapeutics

In related news, COO Mark L. Jacobson sold 25,000 shares of Axsome Therapeutics stock in a transaction that occurred on Monday, June 9th. The shares were sold at an average price of $110.44, for a total transaction of $2,761,000.00. Following the sale, the chief operating officer directly owned 5,783 shares of the company's stock, valued at approximately $638,674.52. The trade was a 81.21% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, General Counsel Hunter R. Murdock sold 7,500 shares of Axsome Therapeutics stock in a transaction that occurred on Tuesday, June 17th. The shares were sold at an average price of $100.26, for a total transaction of $751,950.00. The disclosure for this sale can be found here. Insiders have sold a total of 93,437 shares of company stock valued at $9,834,215 in the last ninety days. 22.30% of the stock is currently owned by company insiders.

About Axsome Therapeutics

(

Free Report)

Axsome Therapeutics, Inc, a biopharmaceutical company, engages in the development of novel therapies for central nervous system (CNS) disorders in the United States. The company's commercial product portfolio includes Auvelity (dextromethorphan-bupropion), a N-methyl-D-aspartate receptor antagonist with multimodal activity indicated for the treatment of major depressive disorder; and Sunosi (solriamfetol), a medication indicated to the treatment of excessive daytime sleepiness in patients with narcolepsy or obstructive sleep apnea.

See Also

Before you consider Axsome Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axsome Therapeutics wasn't on the list.

While Axsome Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.