Grove Bank & Trust raised its stake in Eli Lilly and Company (NYSE:LLY - Free Report) by 23.6% during the 1st quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 9,947 shares of the company's stock after buying an additional 1,899 shares during the period. Eli Lilly and Company makes up about 1.1% of Grove Bank & Trust's investment portfolio, making the stock its 18th largest holding. Grove Bank & Trust's holdings in Eli Lilly and Company were worth $8,215,000 as of its most recent filing with the SEC.

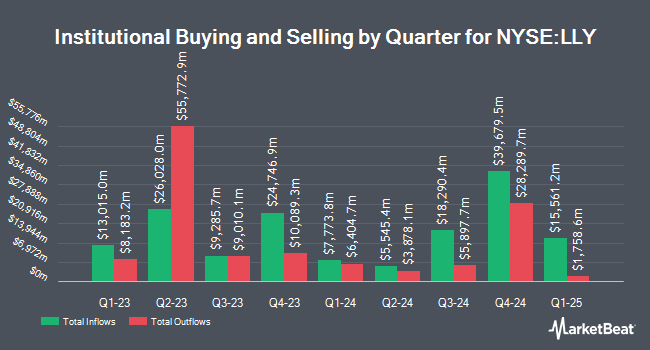

Several other institutional investors also recently modified their holdings of LLY. Knightsbridge Asset Management LLC raised its stake in Eli Lilly and Company by 1.9% during the 4th quarter. Knightsbridge Asset Management LLC now owns 813 shares of the company's stock valued at $628,000 after purchasing an additional 15 shares during the period. Centerpoint Advisory Group acquired a new stake in Eli Lilly and Company during the 4th quarter valued at $514,000. LS Investment Advisors LLC raised its stake in Eli Lilly and Company by 1.7% during the 1st quarter. LS Investment Advisors LLC now owns 2,340 shares of the company's stock valued at $1,933,000 after purchasing an additional 40 shares during the period. CSM Advisors LLC raised its stake in Eli Lilly and Company by 30.6% during the 4th quarter. CSM Advisors LLC now owns 1,045 shares of the company's stock valued at $807,000 after purchasing an additional 245 shares during the period. Finally, Proficio Capital Partners LLC raised its stake in Eli Lilly and Company by 30.2% during the 4th quarter. Proficio Capital Partners LLC now owns 6,739 shares of the company's stock valued at $5,202,000 after purchasing an additional 1,562 shares during the period. Institutional investors own 82.53% of the company's stock.

Eli Lilly and Company Stock Down 1.4%

LLY stock opened at $807.62 on Tuesday. The company has a debt-to-equity ratio of 2.00, a current ratio of 1.15 and a quick ratio of 0.97. Eli Lilly and Company has a 52-week low of $677.09 and a 52-week high of $972.53. The company has a 50-day moving average of $777.10 and a two-hundred day moving average of $801.77. The stock has a market capitalization of $765.41 billion, a price-to-earnings ratio of 68.97, a price-to-earnings-growth ratio of 1.40 and a beta of 0.40.

Eli Lilly and Company (NYSE:LLY - Get Free Report) last released its quarterly earnings results on Thursday, May 1st. The company reported $3.34 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $4.64 by ($1.30). Eli Lilly and Company had a net margin of 23.51% and a return on equity of 85.24%. The firm had revenue of $12.73 billion for the quarter, compared to the consensus estimate of $12.77 billion. During the same quarter last year, the company earned $2.58 earnings per share. The firm's revenue was up 45.2% on a year-over-year basis. As a group, equities research analysts anticipate that Eli Lilly and Company will post 23.48 EPS for the current year.

Eli Lilly and Company Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Tuesday, June 10th. Shareholders of record on Friday, May 16th were issued a dividend of $1.50 per share. This represents a $6.00 dividend on an annualized basis and a yield of 0.74%. The ex-dividend date was Friday, May 16th. Eli Lilly and Company's dividend payout ratio (DPR) is 48.82%.

Analysts Set New Price Targets

LLY has been the topic of several recent analyst reports. Erste Group Bank downgraded shares of Eli Lilly and Company from a "buy" rating to a "hold" rating in a research note on Thursday, June 5th. Wall Street Zen upgraded shares of Eli Lilly and Company from a "hold" rating to a "buy" rating in a report on Saturday, June 7th. Cantor Fitzgerald began coverage on shares of Eli Lilly and Company in a report on Tuesday, April 22nd. They set an "overweight" rating and a $975.00 price target on the stock. Hsbc Global Res cut shares of Eli Lilly and Company from a "strong-buy" rating to a "moderate sell" rating in a report on Monday, April 28th. Finally, Wells Fargo & Company restated an "overweight" rating on shares of Eli Lilly and Company in a report on Thursday, May 1st. One analyst has rated the stock with a sell rating, three have issued a hold rating and eighteen have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $1,011.37.

View Our Latest Stock Analysis on Eli Lilly and Company

About Eli Lilly and Company

(

Free Report)

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals worldwide. The company offers Basaglar, Humalog, Humalog Mix 75/25, Humalog U-100, Humalog U-200, Humalog Mix 50/50, insulin lispro, insulin lispro protamine, insulin lispro mix 75/25, Humulin, Humulin 70/30, Humulin N, Humulin R, and Humulin U-500 for diabetes; Jardiance, Mounjaro, and Trulicity for type 2 diabetes; and Zepbound for obesity.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Eli Lilly and Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eli Lilly and Company wasn't on the list.

While Eli Lilly and Company currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.