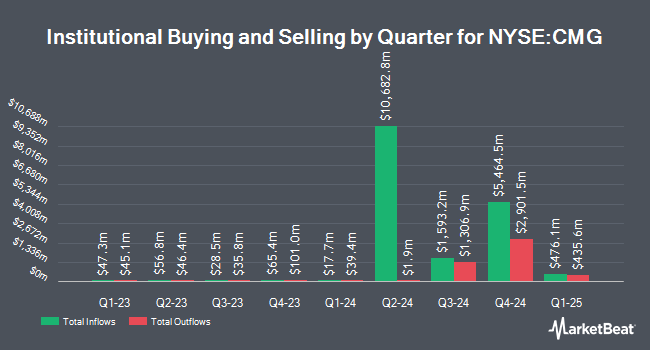

Elk River Wealth Management LLC grew its stake in shares of Chipotle Mexican Grill, Inc. (NYSE:CMG - Free Report) by 1,903.9% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 69,135 shares of the restaurant operator's stock after acquiring an additional 65,685 shares during the quarter. Elk River Wealth Management LLC's holdings in Chipotle Mexican Grill were worth $3,471,000 as of its most recent SEC filing.

Several other hedge funds have also recently modified their holdings of the stock. Union Bancaire Privee UBP SA acquired a new position in Chipotle Mexican Grill in the 4th quarter worth approximately $32,742,000. Revolve Wealth Partners LLC grew its stake in shares of Chipotle Mexican Grill by 4.7% during the 4th quarter. Revolve Wealth Partners LLC now owns 4,804 shares of the restaurant operator's stock worth $290,000 after purchasing an additional 214 shares during the period. Trilogy Capital Inc. grew its stake in shares of Chipotle Mexican Grill by 21.6% during the 4th quarter. Trilogy Capital Inc. now owns 33,235 shares of the restaurant operator's stock worth $2,004,000 after purchasing an additional 5,904 shares during the period. Bleakley Financial Group LLC grew its stake in shares of Chipotle Mexican Grill by 3.7% during the 4th quarter. Bleakley Financial Group LLC now owns 42,503 shares of the restaurant operator's stock worth $2,563,000 after purchasing an additional 1,532 shares during the period. Finally, YANKCOM Partnership acquired a new stake in shares of Chipotle Mexican Grill during the 4th quarter worth approximately $209,000. Institutional investors and hedge funds own 91.31% of the company's stock.

Analyst Ratings Changes

A number of brokerages have recently commented on CMG. Morgan Stanley dropped their price objective on shares of Chipotle Mexican Grill from $67.00 to $65.00 and set an "overweight" rating on the stock in a research note on Thursday, April 24th. Redburn Atlantic began coverage on shares of Chipotle Mexican Grill in a research note on Tuesday. They set a "neutral" rating and a $55.00 price objective on the stock. Stifel Nicolaus dropped their price objective on shares of Chipotle Mexican Grill from $68.00 to $65.00 and set a "buy" rating on the stock in a research note on Wednesday, March 19th. Loop Capital dropped their price target on shares of Chipotle Mexican Grill from $65.00 to $63.00 and set a "buy" rating on the stock in a research note on Thursday, April 24th. Finally, Stephens reissued an "equal weight" rating and issued a $49.00 price target on shares of Chipotle Mexican Grill in a research note on Monday. Ten equities research analysts have rated the stock with a hold rating, nineteen have assigned a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $61.37.

Get Our Latest Stock Report on CMG

Chipotle Mexican Grill Stock Performance

Shares of NYSE CMG traded down $0.52 during trading on Tuesday, hitting $50.61. 13,990,299 shares of the company were exchanged, compared to its average volume of 13,480,028. Chipotle Mexican Grill, Inc. has a 12-month low of $44.46 and a 12-month high of $69.26. The company has a fifty day moving average price of $50.12 and a 200-day moving average price of $54.51. The firm has a market capitalization of $68.19 billion, a PE ratio of 45.59, a P/E/G ratio of 2.04 and a beta of 1.06.

Chipotle Mexican Grill (NYSE:CMG - Get Free Report) last posted its quarterly earnings results on Wednesday, April 23rd. The restaurant operator reported $0.29 EPS for the quarter, topping the consensus estimate of $0.28 by $0.01. The business had revenue of $2.88 billion for the quarter, compared to analyst estimates of $2.98 billion. Chipotle Mexican Grill had a return on equity of 42.92% and a net margin of 13.56%. The company's quarterly revenue was up 6.4% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $13.37 EPS. Research analysts anticipate that Chipotle Mexican Grill, Inc. will post 1.29 earnings per share for the current fiscal year.

Insider Buying and Selling at Chipotle Mexican Grill

In other Chipotle Mexican Grill news, insider Roger E. Theodoredis sold 113,875 shares of Chipotle Mexican Grill stock in a transaction dated Monday, June 2nd. The stock was sold at an average price of $49.70, for a total value of $5,659,587.50. Following the completion of the transaction, the insider now directly owns 109,815 shares of the company's stock, valued at $5,457,805.50. The trade was a 50.91% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. 0.81% of the stock is currently owned by corporate insiders.

Chipotle Mexican Grill Profile

(

Free Report)

Chipotle Mexican Grill, Inc, together with its subsidiaries, owns and operates Chipotle Mexican Grill restaurants. It sells food and beverages through offering burritos, burrito bowls, quesadillas, tacos, and salads. The company also provides delivery and related services its app and website. It has operations in the United States, Canada, France, Germany, and the United Kingdom.

Further Reading

Before you consider Chipotle Mexican Grill, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chipotle Mexican Grill wasn't on the list.

While Chipotle Mexican Grill currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.