Employees Retirement System of Texas acquired a new position in shares of Genmab A/S (NASDAQ:GMAB - Free Report) during the 4th quarter, according to its most recent 13F filing with the SEC. The firm acquired 78,950 shares of the company's stock, valued at approximately $1,648,000.

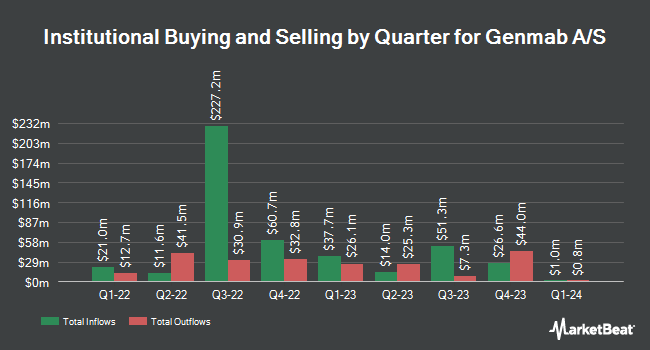

Several other institutional investors and hedge funds have also recently made changes to their positions in the company. Raymond James Financial Inc. acquired a new stake in Genmab A/S in the fourth quarter valued at approximately $2,463,000. AIMZ Investment Advisors LLC purchased a new position in shares of Genmab A/S during the 4th quarter valued at approximately $3,525,000. Mirae Asset Global Investments Co. Ltd. increased its holdings in Genmab A/S by 229.9% in the fourth quarter. Mirae Asset Global Investments Co. Ltd. now owns 49,727 shares of the company's stock valued at $1,033,000 after buying an additional 34,652 shares in the last quarter. Blue Trust Inc. increased its position in shares of Genmab A/S by 33.4% in the fourth quarter. Blue Trust Inc. now owns 5,757 shares of the company's stock valued at $120,000 after buying an additional 1,442 shares in the last quarter. Finally, Sei Investments Co. increased its holdings in Genmab A/S by 55.2% in the 4th quarter. Sei Investments Co. now owns 57,702 shares of the company's stock worth $1,205,000 after acquiring an additional 20,525 shares in the last quarter. 7.07% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

GMAB has been the topic of several research reports. William Blair raised shares of Genmab A/S from a "market perform" rating to an "outperform" rating in a research note on Tuesday, March 11th. Leerink Partnrs raised shares of Genmab A/S from a "hold" rating to a "strong-buy" rating in a research note on Thursday, February 13th. BNP Paribas upgraded Genmab A/S from a "strong sell" rating to a "hold" rating in a report on Tuesday, February 11th. HC Wainwright reiterated a "buy" rating and issued a $37.00 price objective (down from $50.00) on shares of Genmab A/S in a research note on Wednesday, April 9th. Finally, Truist Financial reduced their price objective on shares of Genmab A/S from $50.00 to $45.00 and set a "buy" rating on the stock in a report on Tuesday, March 11th. One analyst has rated the stock with a sell rating, three have given a hold rating, eight have issued a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $39.17.

Read Our Latest Stock Report on GMAB

Genmab A/S Stock Performance

Shares of NASDAQ:GMAB traded down $0.39 during trading on Friday, reaching $20.93. 823,934 shares of the stock were exchanged, compared to its average volume of 1,139,590. The firm has a market cap of $13.42 billion, a price-to-earnings ratio of 12.03, a price-to-earnings-growth ratio of 2.65 and a beta of 1.04. The firm's 50-day moving average price is $19.91 and its 200 day moving average price is $20.64. Genmab A/S has a 12-month low of $17.24 and a 12-month high of $28.96.

Genmab A/S (NASDAQ:GMAB - Get Free Report) last issued its quarterly earnings data on Thursday, May 8th. The company reported $0.31 earnings per share for the quarter, beating analysts' consensus estimates of $0.23 by $0.08. The firm had revenue of $715.00 million during the quarter, compared to analyst estimates of $5.17 billion. Genmab A/S had a return on equity of 16.78% and a net margin of 36.30%. As a group, equities research analysts forecast that Genmab A/S will post 1.45 EPS for the current year.

Genmab A/S Profile

(

Free Report)

Genmab A/S develops antibody therapeutics for the treatment of cancer and other diseases primarily in Denmark. The company markets DARZALEX, a human monoclonal antibody for the treatment of patients with multiple myeloma (MM); teprotumumab for the treatment of thyroid eye disease; and Amivantamab for advanced or metastatic gastric or esophageal cancer and NSCLC.

Featured Stories

Before you consider Genmab A/S, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genmab A/S wasn't on the list.

While Genmab A/S currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.