Envestnet Portfolio Solutions Inc. decreased its holdings in shares of Keysight Technologies Inc. (NYSE:KEYS - Free Report) by 60.8% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 3,882 shares of the scientific and technical instruments company's stock after selling 6,024 shares during the quarter. Envestnet Portfolio Solutions Inc.'s holdings in Keysight Technologies were worth $581,000 at the end of the most recent quarter.

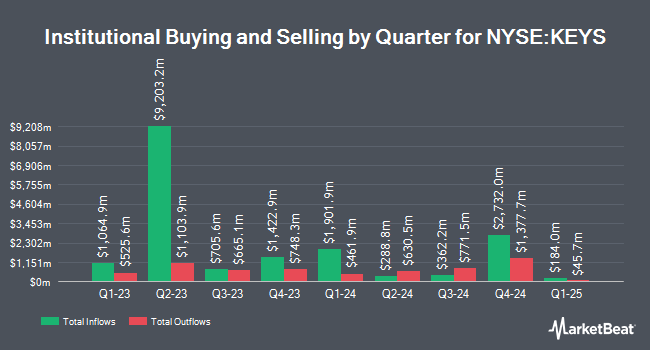

Several other hedge funds and other institutional investors also recently modified their holdings of KEYS. Kovitz Investment Group Partners LLC boosted its stake in Keysight Technologies by 364.6% in the fourth quarter. Kovitz Investment Group Partners LLC now owns 4,652,311 shares of the scientific and technical instruments company's stock worth $747,301,000 after buying an additional 3,650,953 shares in the last quarter. Price T Rowe Associates Inc. MD boosted its stake in Keysight Technologies by 29.0% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 16,114,952 shares of the scientific and technical instruments company's stock worth $2,588,546,000 after buying an additional 3,621,349 shares in the last quarter. Norges Bank purchased a new stake in Keysight Technologies in the fourth quarter worth approximately $320,707,000. Point72 Asset Management L.P. boosted its stake in Keysight Technologies by 343.6% in the fourth quarter. Point72 Asset Management L.P. now owns 1,008,192 shares of the scientific and technical instruments company's stock worth $161,946,000 after buying an additional 780,893 shares in the last quarter. Finally, GAMMA Investing LLC boosted its stake in Keysight Technologies by 36,268.6% in the first quarter. GAMMA Investing LLC now owns 750,647 shares of the scientific and technical instruments company's stock worth $112,424,000 after buying an additional 748,583 shares in the last quarter. Hedge funds and other institutional investors own 84.58% of the company's stock.

Keysight Technologies Trading Up 0.6%

KEYS opened at $165.08 on Friday. The firm has a market cap of $28.41 billion, a price-to-earnings ratio of 38.75, a PEG ratio of 2.24 and a beta of 1.09. The company has a current ratio of 3.39, a quick ratio of 2.75 and a debt-to-equity ratio of 0.46. Keysight Technologies Inc. has a 12 month low of $119.72 and a 12 month high of $186.20. The stock has a fifty day moving average price of $156.03 and a 200-day moving average price of $159.03.

Keysight Technologies (NYSE:KEYS - Get Free Report) last announced its quarterly earnings data on Tuesday, May 20th. The scientific and technical instruments company reported $1.70 earnings per share for the quarter, beating analysts' consensus estimates of $1.65 by $0.05. The business had revenue of $1.32 billion for the quarter, compared to analyst estimates of $1.28 billion. Keysight Technologies had a return on equity of 19.65% and a net margin of 14.50%. The company's revenue was up 7.4% on a year-over-year basis. During the same period in the prior year, the company earned $1.41 earnings per share. As a group, equities research analysts anticipate that Keysight Technologies Inc. will post 6.32 earnings per share for the current fiscal year.

Analyst Ratings Changes

KEYS has been the subject of a number of analyst reports. Morgan Stanley increased their price objective on Keysight Technologies from $156.00 to $180.00 and gave the company an "overweight" rating in a research note on Tuesday, May 13th. Bank of America upped their target price on Keysight Technologies from $165.00 to $170.00 and gave the company an "underperform" rating in a report on Thursday, May 22nd. Robert W. Baird upped their target price on Keysight Technologies from $180.00 to $190.00 and gave the company an "outperform" rating in a report on Thursday, February 27th. Wall Street Zen downgraded Keysight Technologies from a "strong-buy" rating to a "buy" rating in a report on Saturday, March 22nd. Finally, JPMorgan Chase & Co. upped their target price on Keysight Technologies from $172.00 to $177.00 and gave the company an "overweight" rating in a report on Wednesday, May 21st. One equities research analyst has rated the stock with a sell rating and nine have given a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average price target of $183.00.

Get Our Latest Analysis on KEYS

Insider Activity

In related news, CEO Satish Dhanasekaran sold 658 shares of Keysight Technologies stock in a transaction on Friday, May 30th. The stock was sold at an average price of $157.78, for a total value of $103,819.24. Following the completion of the transaction, the chief executive officer now directly owns 115,576 shares in the company, valued at approximately $18,235,581.28. This trade represents a 0.57% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, SVP Ingrid A. Estrada sold 10,000 shares of Keysight Technologies stock in a transaction dated Friday, June 20th. The stock was sold at an average price of $158.97, for a total value of $1,589,700.00. Following the sale, the senior vice president now directly owns 108,590 shares of the company's stock, valued at $17,262,552.30. This trade represents a 8.43% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 19,615 shares of company stock valued at $3,113,460. 0.61% of the stock is currently owned by corporate insiders.

Keysight Technologies Company Profile

(

Free Report)

Keysight Technologies, Inc provides electronic design and test solutions to commercial communications, networking, aerospace, defense and government, automotive, energy, semiconductor, electronic, and education industries in the Americas, Europe, and the Asia Pacific. The company operates in two segments, Communications Solutions Group and Electronic Industrial Solutions Group.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Keysight Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Keysight Technologies wasn't on the list.

While Keysight Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report