Fifth Third Bancorp increased its holdings in Meritage Homes Corporation (NYSE:MTH - Free Report) by 122.3% during the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 49,695 shares of the construction company's stock after purchasing an additional 27,338 shares during the quarter. Fifth Third Bancorp owned 0.07% of Meritage Homes worth $3,522,000 at the end of the most recent quarter.

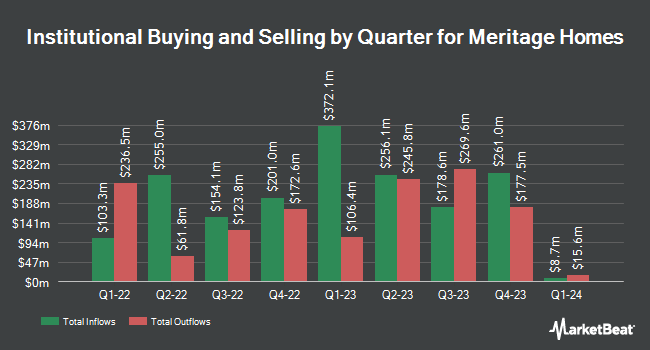

Other institutional investors and hedge funds also recently modified their holdings of the company. Assenagon Asset Management S.A. lifted its position in shares of Meritage Homes by 177.3% in the 1st quarter. Assenagon Asset Management S.A. now owns 33,287 shares of the construction company's stock valued at $2,359,000 after acquiring an additional 21,285 shares in the last quarter. Handelsbanken Fonder AB lifted its stake in Meritage Homes by 100.0% in the 1st quarter. Handelsbanken Fonder AB now owns 19,046 shares of the construction company's stock worth $1,350,000 after acquiring an additional 9,523 shares in the last quarter. SG Americas Securities LLC purchased a new stake in Meritage Homes in the 1st quarter worth about $1,171,000. GAMMA Investing LLC grew its stake in Meritage Homes by 182.1% during the 1st quarter. GAMMA Investing LLC now owns 2,880 shares of the construction company's stock valued at $204,000 after acquiring an additional 1,859 shares in the last quarter. Finally, Yousif Capital Management LLC increased its holdings in shares of Meritage Homes by 97.0% in the 1st quarter. Yousif Capital Management LLC now owns 28,498 shares of the construction company's stock valued at $2,020,000 after purchasing an additional 14,030 shares during the period. Institutional investors and hedge funds own 98.44% of the company's stock.

Analyst Ratings Changes

Several research firms recently commented on MTH. JPMorgan Chase & Co. decreased their price target on shares of Meritage Homes from $89.00 to $70.00 and set a "neutral" rating for the company in a report on Thursday, May 1st. Wall Street Zen lowered shares of Meritage Homes from a "hold" rating to a "sell" rating in a research note on Monday, March 24th. Bank of America assumed coverage on shares of Meritage Homes in a research note on Monday, May 5th. They issued a "buy" rating and a $82.00 price target on the stock. Keefe, Bruyette & Woods cut their price objective on Meritage Homes from $90.00 to $77.00 and set a "market perform" rating for the company in a report on Monday, April 28th. Finally, Seaport Res Ptn upgraded Meritage Homes from a "strong sell" rating to a "hold" rating in a research note on Thursday, March 6th. One analyst has rated the stock with a sell rating, five have issued a hold rating and five have assigned a buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus target price of $97.72.

Get Our Latest Stock Report on Meritage Homes

Meritage Homes Stock Performance

MTH traded down $0.20 during trading on Wednesday, hitting $62.37. The stock had a trading volume of 469,899 shares, compared to its average volume of 877,490. The firm has a market cap of $4.48 billion, a PE ratio of 5.09 and a beta of 1.37. The company has a current ratio of 2.28, a quick ratio of 2.28 and a debt-to-equity ratio of 0.35. Meritage Homes Corporation has a 12 month low of $59.27 and a 12 month high of $106.99. The company has a 50 day simple moving average of $66.09 and a 200-day simple moving average of $74.01.

Meritage Homes (NYSE:MTH - Get Free Report) last released its earnings results on Wednesday, April 23rd. The construction company reported $1.69 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.71 by ($0.02). Meritage Homes had a net margin of 11.50% and a return on equity of 14.28%. The business had revenue of $1.36 billion during the quarter, compared to analyst estimates of $1.34 billion. During the same period last year, the business earned $5.06 EPS. The business's quarterly revenue was down 8.5% compared to the same quarter last year. Analysts expect that Meritage Homes Corporation will post 9.44 EPS for the current year.

Meritage Homes Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Monday, June 30th. Shareholders of record on Monday, June 16th will be issued a $0.43 dividend. This represents a $1.72 dividend on an annualized basis and a yield of 2.76%. The ex-dividend date is Monday, June 16th. Meritage Homes's dividend payout ratio (DPR) is presently 14.06%.

Insiders Place Their Bets

In other news, Director Joseph Keough acquired 4,000 shares of the stock in a transaction dated Thursday, June 12th. The shares were acquired at an average cost of $66.16 per share, for a total transaction of $264,640.00. Following the completion of the transaction, the director now owns 41,700 shares in the company, valued at approximately $2,758,872. This trade represents a 10.61% increase in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through the SEC website. Company insiders own 2.20% of the company's stock.

Meritage Homes Profile

(

Free Report)

Meritage Homes Corporation, together with its subsidiaries, designs and builds single-family attached and detached homes in the United States. The company operates through two segments, Homebuilding and Financial Services. It acquires and develops land; and constructs, markets, and sells homes for entry-level and first move-up buyers in Arizona, California, Colorado, Utah, Texas, Florida, Georgia, North Carolina, South Carolina, and Tennessee.

See Also

Before you consider Meritage Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Meritage Homes wasn't on the list.

While Meritage Homes currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.