Professional Advisory Services Inc. lowered its holdings in Fiserv, Inc. (NYSE:FI - Free Report) by 9.9% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 125,922 shares of the business services provider's stock after selling 13,792 shares during the quarter. Fiserv comprises approximately 3.9% of Professional Advisory Services Inc.'s investment portfolio, making the stock its 7th largest holding. Professional Advisory Services Inc.'s holdings in Fiserv were worth $27,807,000 at the end of the most recent quarter.

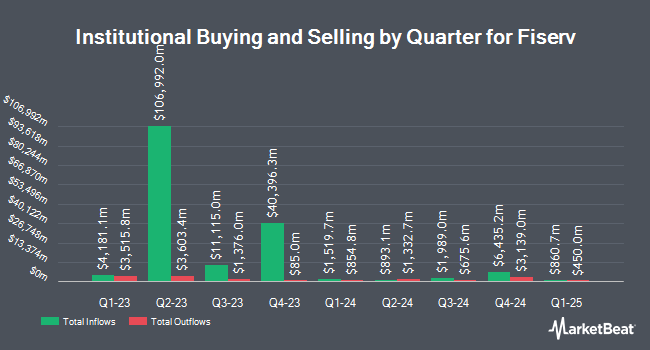

Several other hedge funds have also bought and sold shares of FI. Norges Bank purchased a new position in Fiserv during the 4th quarter worth $1,406,452,000. GAMMA Investing LLC boosted its holdings in Fiserv by 21,681.0% during the 1st quarter. GAMMA Investing LLC now owns 3,821,905 shares of the business services provider's stock worth $843,991,000 after acquiring an additional 3,804,358 shares during the last quarter. Raymond James Financial Inc. purchased a new position in Fiserv during the 4th quarter worth $614,982,000. Kovitz Investment Group Partners LLC boosted its holdings in Fiserv by 343.7% during the 4th quarter. Kovitz Investment Group Partners LLC now owns 2,806,579 shares of the business services provider's stock worth $576,527,000 after acquiring an additional 2,174,025 shares during the last quarter. Finally, Alliancebernstein L.P. boosted its holdings in shares of Fiserv by 65.6% in the 4th quarter. Alliancebernstein L.P. now owns 5,437,246 shares of the business services provider's stock worth $1,116,919,000 after buying an additional 2,153,554 shares during the last quarter. Institutional investors and hedge funds own 90.98% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts recently weighed in on FI shares. Mizuho set a $200.00 price target on shares of Fiserv in a report on Thursday, May 15th. Piper Sandler set a $218.00 price target on shares of Fiserv in a report on Friday, April 25th. JPMorgan Chase & Co. cut their price target on shares of Fiserv from $211.00 to $210.00 and set an "overweight" rating on the stock in a report on Monday, May 19th. Jefferies Financial Group cut their price target on shares of Fiserv from $180.00 to $165.00 and set a "hold" rating on the stock in a report on Tuesday, May 27th. Finally, Barclays cut their price target on shares of Fiserv from $265.00 to $230.00 and set an "overweight" rating on the stock in a report on Monday, April 28th. Two analysts have rated the stock with a sell rating, one has assigned a hold rating, twenty-three have issued a buy rating and two have assigned a strong buy rating to the company. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of $220.27.

Get Our Latest Research Report on FI

Fiserv Stock Up 0.9%

Shares of NYSE FI opened at $166.90 on Friday. Fiserv, Inc. has a 12 month low of $146.25 and a 12 month high of $238.59. The company has a current ratio of 1.06, a quick ratio of 1.07 and a debt-to-equity ratio of 0.86. The firm has a market capitalization of $92.54 billion, a price-to-earnings ratio of 30.96, a PEG ratio of 1.52 and a beta of 0.91. The business has a 50-day moving average of $185.54 and a 200-day moving average of $205.44.

Fiserv (NYSE:FI - Get Free Report) last issued its quarterly earnings data on Thursday, April 24th. The business services provider reported $2.14 EPS for the quarter, topping the consensus estimate of $2.08 by $0.06. Fiserv had a return on equity of 17.93% and a net margin of 15.31%. The company had revenue of $4.79 billion during the quarter, compared to analyst estimates of $4.86 billion. During the same quarter in the previous year, the firm earned $1.88 earnings per share. Fiserv's revenue was up 5.1% on a year-over-year basis. Sell-side analysts expect that Fiserv, Inc. will post 10.23 earnings per share for the current fiscal year.

Fiserv announced that its Board of Directors has initiated a stock buyback program on Thursday, February 20th that permits the company to repurchase 60,000,000 shares. This repurchase authorization permits the business services provider to buy shares of its stock through open market purchases. Shares repurchase programs are usually an indication that the company's board of directors believes its shares are undervalued.

Insider Transactions at Fiserv

In other news, EVP Andrew Gelb sold 5,652 shares of the business's stock in a transaction dated Wednesday, May 28th. The stock was sold at an average price of $160.00, for a total transaction of $904,320.00. Following the completion of the transaction, the executive vice president now owns 25,385 shares of the company's stock, valued at approximately $4,061,600. The trade was a 18.21% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, insider Adam L. Rosman sold 2,512 shares of the business's stock in a transaction dated Tuesday, May 27th. The stock was sold at an average price of $160.68, for a total value of $403,628.16. Following the transaction, the insider now directly owns 53,385 shares of the company's stock, valued at $8,577,901.80. The trade was a 4.49% decrease in their position. The disclosure for this sale can be found here. 0.75% of the stock is owned by insiders.

Fiserv Company Profile

(

Free Report)

Fiserv, Inc, together with its subsidiaries, provides payments and financial services technology services in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally. It operates through Merchant Acceptance, Financial Technology, and Payments and Network segments.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Fiserv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fiserv wasn't on the list.

While Fiserv currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report