Fullcircle Wealth LLC purchased a new stake in nVent Electric PLC (NYSE:NVT - Free Report) in the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 4,199 shares of the company's stock, valued at approximately $229,000.

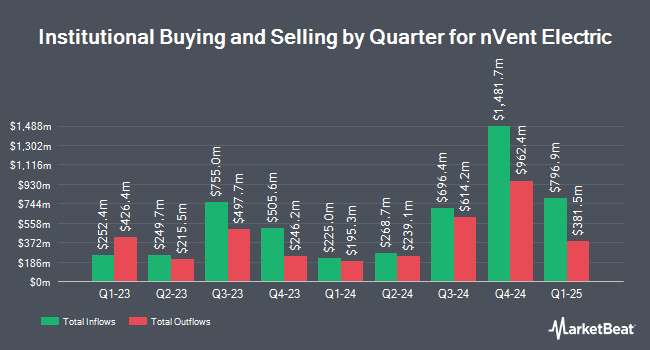

A number of other institutional investors and hedge funds have also recently bought and sold shares of the business. Capital A Wealth Management LLC bought a new position in shares of nVent Electric in the fourth quarter worth $27,000. Whipplewood Advisors LLC boosted its holdings in shares of nVent Electric by 467.3% in the first quarter. Whipplewood Advisors LLC now owns 607 shares of the company's stock worth $32,000 after buying an additional 500 shares during the period. Park Square Financial Group LLC purchased a new position in shares of nVent Electric in the fourth quarter worth approximately $38,000. First Horizon Advisors Inc. raised its holdings in shares of nVent Electric by 58.0% during the first quarter. First Horizon Advisors Inc. now owns 817 shares of the company's stock valued at $43,000 after acquiring an additional 300 shares during the period. Finally, CX Institutional purchased a new stake in shares of nVent Electric in the 1st quarter valued at approximately $54,000. Hedge funds and other institutional investors own 90.05% of the company's stock.

Analyst Ratings Changes

Several brokerages recently commented on NVT. Barclays boosted their price target on nVent Electric from $70.00 to $74.00 and gave the company an "overweight" rating in a research note on Monday, June 9th. The Goldman Sachs Group raised their price objective on nVent Electric from $78.00 to $87.00 and gave the company a "buy" rating in a research note on Monday. KeyCorp increased their price target on nVent Electric from $60.00 to $72.00 and gave the company an "overweight" rating in a report on Monday, May 5th. Citigroup dropped their target price on shares of nVent Electric from $85.00 to $59.00 and set a "buy" rating on the stock in a report on Monday, April 14th. Finally, CL King upgraded nVent Electric from a "neutral" rating to a "buy" rating and set a $70.00 target price for the company in a research note on Monday, March 17th. Six analysts have rated the stock with a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat, the stock currently has an average rating of "Buy" and an average price target of $72.83.

View Our Latest Stock Report on nVent Electric

Insider Activity at nVent Electric

In other nVent Electric news, EVP Lynnette R. Heath sold 4,041 shares of the company's stock in a transaction that occurred on Thursday, May 8th. The shares were sold at an average price of $61.35, for a total value of $247,915.35. Following the completion of the sale, the executive vice president owned 32,665 shares of the company's stock, valued at approximately $2,003,997.75. This represents a 11.01% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. 2.50% of the stock is currently owned by company insiders.

nVent Electric Stock Performance

NVT traded down $0.10 during trading on Tuesday, reaching $74.41. 2,002,642 shares of the company's stock were exchanged, compared to its average volume of 1,958,764. nVent Electric PLC has a fifty-two week low of $41.71 and a fifty-two week high of $81.55. The company has a quick ratio of 2.42, a current ratio of 2.87 and a debt-to-equity ratio of 0.48. The company has a market capitalization of $12.25 billion, a P/E ratio of 21.26, a PEG ratio of 1.49 and a beta of 1.31. The business has a 50 day moving average price of $67.10 and a 200 day moving average price of $63.05.

nVent Electric (NYSE:NVT - Get Free Report) last announced its earnings results on Friday, May 2nd. The company reported $0.67 earnings per share for the quarter, topping analysts' consensus estimates of $0.66 by $0.01. The company had revenue of $809.30 million during the quarter, compared to the consensus estimate of $790.74 million. nVent Electric had a net margin of 18.22% and a return on equity of 13.54%. The company's revenue was up 10.5% on a year-over-year basis. During the same period in the previous year, the firm posted $0.78 earnings per share. As a group, analysts predict that nVent Electric PLC will post 3.04 earnings per share for the current fiscal year.

nVent Electric Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Friday, August 1st. Stockholders of record on Friday, July 18th will be given a dividend of $0.20 per share. The ex-dividend date is Friday, July 18th. This represents a $0.80 annualized dividend and a dividend yield of 1.08%. nVent Electric's payout ratio is currently 22.86%.

nVent Electric Profile

(

Free Report)

nVent Electric plc, together with its subsidiaries, designs, manufactures, markets, installs, and services electrical connection and protection solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and internationally. The company operates through three segments: Enclosures, Electrical & Fastening Solutions, and Thermal Management.

Featured Articles

Before you consider nVent Electric, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and nVent Electric wasn't on the list.

While nVent Electric currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.