GAMMA Investing LLC grew its holdings in shares of Sable Offshore Corp. (NYSE:SOC - Free Report) by 2,920.0% in the 1st quarter, according to its most recent disclosure with the SEC. The fund owned 31,408 shares of the company's stock after acquiring an additional 30,368 shares during the period. GAMMA Investing LLC's holdings in Sable Offshore were worth $797,000 as of its most recent SEC filing.

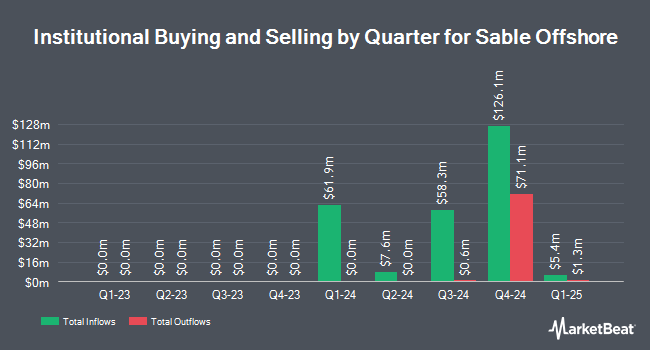

Several other large investors have also recently modified their holdings of the business. Invesco Ltd. increased its position in shares of Sable Offshore by 2.7% during the fourth quarter. Invesco Ltd. now owns 26,030 shares of the company's stock worth $596,000 after buying an additional 679 shares during the period. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its holdings in shares of Sable Offshore by 3.6% during the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 28,720 shares of the company's stock valued at $658,000 after buying an additional 1,000 shares during the last quarter. MetLife Investment Management LLC grew its holdings in shares of Sable Offshore by 5.5% during the fourth quarter. MetLife Investment Management LLC now owns 31,240 shares of the company's stock valued at $715,000 after buying an additional 1,634 shares during the last quarter. Summit Securities Group LLC bought a new position in shares of Sable Offshore during the fourth quarter valued at about $53,000. Finally, Legal & General Group Plc lifted its position in shares of Sable Offshore by 7.2% during the fourth quarter. Legal & General Group Plc now owns 43,284 shares of the company's stock valued at $991,000 after purchasing an additional 2,890 shares in the last quarter. Institutional investors own 26.19% of the company's stock.

Sable Offshore Price Performance

NYSE:SOC opened at $22.67 on Wednesday. The company has a fifty day moving average of $23.81 and a 200 day moving average of $24.07. Sable Offshore Corp. has a 52 week low of $13.66 and a 52 week high of $35.00. The company has a current ratio of 1.67, a quick ratio of 1.57 and a debt-to-equity ratio of 3.04.

Sable Offshore (NYSE:SOC - Get Free Report) last issued its quarterly earnings data on Tuesday, May 13th. The company reported ($1.05) EPS for the quarter, missing the consensus estimate of ($0.42) by ($0.63). The business had revenue of $78.00 million for the quarter, compared to analyst estimates of $21.00 million. On average, equities research analysts predict that Sable Offshore Corp. will post -6.39 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

SOC has been the topic of several research reports. Roth Capital set a $37.00 price objective on shares of Sable Offshore and gave the stock a "buy" rating in a research report on Friday, May 23rd. BWS Financial reaffirmed a "sell" rating and set a $6.00 price objective on shares of Sable Offshore in a research note on Tuesday, May 13th. Benchmark boosted their price target on shares of Sable Offshore from $37.00 to $47.00 and gave the stock a "buy" rating in a research note on Tuesday, May 20th. Roth Mkm began coverage on shares of Sable Offshore in a research note on Thursday, March 27th. They issued a "buy" rating and a $30.00 price target for the company. Finally, Jefferies Financial Group restated a "buy" rating on shares of Sable Offshore in a report on Monday, May 26th. One analyst has rated the stock with a sell rating and six have assigned a buy rating to the stock. According to MarketBeat.com, Sable Offshore presently has a consensus rating of "Moderate Buy" and an average target price of $30.33.

View Our Latest Research Report on Sable Offshore

Insider Transactions at Sable Offshore

In related news, major shareholder Global Icav Pilgrim sold 143,806 shares of the stock in a transaction dated Thursday, April 17th. The shares were sold at an average price of $25.37, for a total transaction of $3,648,358.22. Following the sale, the insider now directly owns 10,100,569 shares of the company's stock, valued at approximately $256,251,435.53. This represents a 1.40% decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Insiders own 36.36% of the company's stock.

Sable Offshore Company Profile

(

Free Report)

Sable Offshore Corp. engages in the oil and gas exploration and development activities in the United States. The company operates through three platforms located in federal waters offshore California. It owns and operates 16 federal leases across approximately 76,000 acres and subsea pipelines, which transport crude oil, natural gas, and produced water from the platforms to the onshore processing facilities.

Featured Stories

Want to see what other hedge funds are holding SOC? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Sable Offshore Corp. (NYSE:SOC - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sable Offshore, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sable Offshore wasn't on the list.

While Sable Offshore currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.