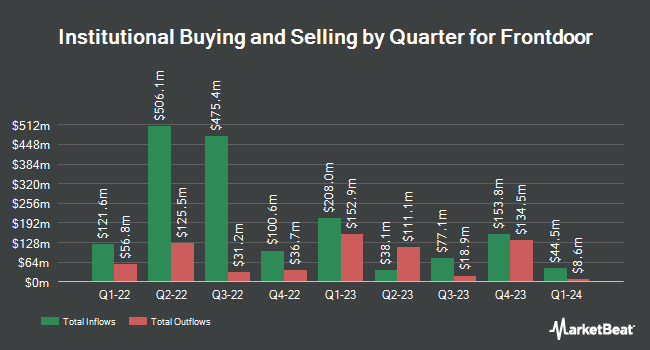

GAMMA Investing LLC increased its holdings in shares of Frontdoor, Inc. (NASDAQ:FTDR - Free Report) by 4,376.9% during the first quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 94,014 shares of the company's stock after acquiring an additional 91,914 shares during the period. GAMMA Investing LLC owned approximately 0.13% of Frontdoor worth $3,612,000 as of its most recent SEC filing.

A number of other institutional investors have also recently modified their holdings of FTDR. Bessemer Group Inc. grew its position in shares of Frontdoor by 514.7% during the 4th quarter. Bessemer Group Inc. now owns 627 shares of the company's stock valued at $34,000 after acquiring an additional 525 shares during the period. TD Private Client Wealth LLC boosted its holdings in Frontdoor by 12.9% in the 4th quarter. TD Private Client Wealth LLC now owns 1,597 shares of the company's stock worth $87,000 after buying an additional 183 shares during the last quarter. Blue Trust Inc. boosted its holdings in Frontdoor by 315.3% in the 4th quarter. Blue Trust Inc. now owns 1,632 shares of the company's stock worth $89,000 after buying an additional 1,239 shares during the last quarter. Nkcfo LLC acquired a new stake in Frontdoor in the 4th quarter worth about $96,000. Finally, Smartleaf Asset Management LLC boosted its holdings in Frontdoor by 360.9% in the 4th quarter. Smartleaf Asset Management LLC now owns 2,484 shares of the company's stock worth $136,000 after buying an additional 1,945 shares during the last quarter.

Analyst Upgrades and Downgrades

Several equities research analysts recently issued reports on the company. The Goldman Sachs Group lowered their price objective on Frontdoor from $46.00 to $40.00 and set a "sell" rating on the stock in a report on Monday, March 3rd. JPMorgan Chase & Co. boosted their target price on Frontdoor from $50.00 to $55.00 and gave the stock a "neutral" rating in a report on Tuesday, June 3rd.

Read Our Latest Report on Frontdoor

Frontdoor Trading Down 0.8%

NASDAQ:FTDR traded down $0.48 on Friday, reaching $56.43. 412,640 shares of the company's stock were exchanged, compared to its average volume of 729,246. The company has a quick ratio of 1.42, a current ratio of 1.42 and a debt-to-equity ratio of 2.16. The firm has a market capitalization of $4.15 billion, a price-to-earnings ratio of 18.69 and a beta of 1.27. The business has a fifty day moving average of $49.37 and a 200-day moving average of $51.11. Frontdoor, Inc. has a 52-week low of $32.95 and a 52-week high of $63.49.

Frontdoor (NASDAQ:FTDR - Get Free Report) last announced its quarterly earnings results on Thursday, May 1st. The company reported $0.64 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.37 by $0.27. The firm had revenue of $426.00 million during the quarter, compared to the consensus estimate of $416.37 million. Frontdoor had a return on equity of 132.99% and a net margin of 12.87%. The firm's quarterly revenue was up 12.7% compared to the same quarter last year. During the same period in the prior year, the company posted $0.44 earnings per share. As a group, analysts expect that Frontdoor, Inc. will post 3.07 earnings per share for the current year.

Frontdoor Profile

(

Free Report)

Frontdoor, Inc provides home warranties in the United States in the United States. Its customizable home warranties help customers protect and maintain their homes from costly and unplanned breakdowns of essential home systems and appliances. The company's home warranty customers subscribe to an annual service plan agreement that covers the repair or replacement of principal components of approximately 20 home systems and appliances, including electrical, plumbing, water heaters, refrigerators, dishwashers, and ranges/ovens/cooktops, as well as electronics, pools, and spas and pumps; and heating, ventilation, and air conditioning systems.

Read More

Before you consider Frontdoor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Frontdoor wasn't on the list.

While Frontdoor currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.