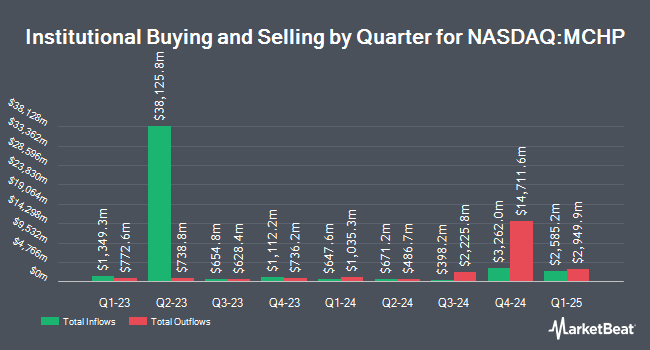

GTS Securities LLC raised its holdings in shares of Microchip Technology Incorporated (NASDAQ:MCHP - Free Report) by 32.2% in the 4th quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 68,410 shares of the semiconductor company's stock after acquiring an additional 16,652 shares during the quarter. GTS Securities LLC's holdings in Microchip Technology were worth $3,923,000 at the end of the most recent reporting period.

Several other hedge funds also recently made changes to their positions in the business. Vise Technologies Inc. grew its stake in shares of Microchip Technology by 33.5% during the 4th quarter. Vise Technologies Inc. now owns 4,284 shares of the semiconductor company's stock worth $246,000 after acquiring an additional 1,075 shares in the last quarter. Northwest Bank & Trust Co grew its stake in shares of Microchip Technology by 3.0% in the fourth quarter. Northwest Bank & Trust Co now owns 7,392 shares of the semiconductor company's stock valued at $424,000 after buying an additional 217 shares in the last quarter. Patrick Mauro Investment Advisor INC. grew its stake in shares of Microchip Technology by 99.0% in the fourth quarter. Patrick Mauro Investment Advisor INC. now owns 67,203 shares of the semiconductor company's stock valued at $3,854,000 after buying an additional 33,437 shares in the last quarter. Orion Capital Management LLC bought a new position in shares of Microchip Technology in the fourth quarter valued at $41,000. Finally, Vista Investment Management grew its stake in shares of Microchip Technology by 2.6% in the fourth quarter. Vista Investment Management now owns 26,767 shares of the semiconductor company's stock valued at $1,535,000 after buying an additional 673 shares in the last quarter. 91.51% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several equities analysts recently weighed in on MCHP shares. TD Cowen raised their target price on shares of Microchip Technology from $35.00 to $55.00 and gave the company a "hold" rating in a research note on Friday, May 9th. Morgan Stanley raised their target price on shares of Microchip Technology from $39.00 to $50.00 and gave the company an "equal weight" rating in a research note on Friday, May 9th. Stifel Nicolaus raised their target price on shares of Microchip Technology from $60.00 to $70.00 and gave the company a "buy" rating in a research note on Friday, May 9th. Citigroup raised their target price on shares of Microchip Technology from $50.00 to $55.00 and gave the company a "buy" rating in a research note on Friday, May 9th. Finally, Wall Street Zen cut shares of Microchip Technology from a "hold" rating to a "sell" rating in a research note on Monday, February 10th. One analyst has rated the stock with a sell rating, five have given a hold rating, thirteen have given a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, Microchip Technology currently has a consensus rating of "Moderate Buy" and an average price target of $67.42.

Check Out Our Latest Research Report on Microchip Technology

Insider Transactions at Microchip Technology

In related news, CFO James Eric Bjornholt sold 3,724 shares of the business's stock in a transaction dated Tuesday, February 25th. The stock was sold at an average price of $60.88, for a total value of $226,717.12. Following the completion of the transaction, the chief financial officer now owns 33,272 shares of the company's stock, valued at $2,025,599.36. The trade was a 10.07% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, Director Karlton D. Johnson sold 494 shares of the business's stock in a transaction dated Tuesday, May 20th. The shares were sold at an average price of $60.69, for a total value of $29,980.86. Following the completion of the transaction, the director now directly owns 3,468 shares of the company's stock, valued at approximately $210,472.92. This trade represents a 12.47% decrease in their position. The disclosure for this sale can be found here. Insiders own 2.10% of the company's stock.

Microchip Technology Trading Down 2.0%

MCHP stock opened at $58.05 on Friday. Microchip Technology Incorporated has a one year low of $34.13 and a one year high of $100.57. The company has a debt-to-equity ratio of 1.12, a current ratio of 2.25 and a quick ratio of 1.23. The stock has a market cap of $31.27 billion, a price-to-earnings ratio of 103.66 and a beta of 1.42. The company has a fifty day moving average price of $48.03 and a two-hundred day moving average price of $55.63.

Microchip Technology (NASDAQ:MCHP - Get Free Report) last posted its earnings results on Thursday, May 8th. The semiconductor company reported $0.11 earnings per share for the quarter, topping analysts' consensus estimates of $0.10 by $0.01. Microchip Technology had a return on equity of 12.62% and a net margin of 6.49%. The company had revenue of $970.50 million during the quarter, compared to the consensus estimate of $962.86 million. During the same quarter last year, the firm earned $0.57 earnings per share. The company's revenue was down 26.8% on a year-over-year basis. Equities analysts anticipate that Microchip Technology Incorporated will post 1.03 EPS for the current year.

Microchip Technology Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Thursday, June 5th. Stockholders of record on Thursday, May 22nd will be issued a dividend of $0.455 per share. This represents a $1.82 dividend on an annualized basis and a dividend yield of 3.14%. The ex-dividend date is Thursday, May 22nd. Microchip Technology's dividend payout ratio is currently -18,200.00%.

Microchip Technology Profile

(

Free Report)

Microchip Technology Incorporated engages in the development, manufacture, and sale of smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia. The company offers general purpose 8-bit, 16-bit, and 32-bit mixed-signal microcontrollers; 32-bit embedded mixed-signal microprocessors; and specialized microcontrollers for automotive, industrial, computing, communications, lighting, power supplies, motor control, human machine interface, security, wired connectivity, and wireless connectivity applications.

Read More

Want to see what other hedge funds are holding MCHP? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Microchip Technology Incorporated (NASDAQ:MCHP - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Microchip Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microchip Technology wasn't on the list.

While Microchip Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report