GTS Securities LLC cut its holdings in Prologis, Inc. (NYSE:PLD - Free Report) by 80.7% during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 4,596 shares of the real estate investment trust's stock after selling 19,157 shares during the period. GTS Securities LLC's holdings in Prologis were worth $486,000 as of its most recent SEC filing.

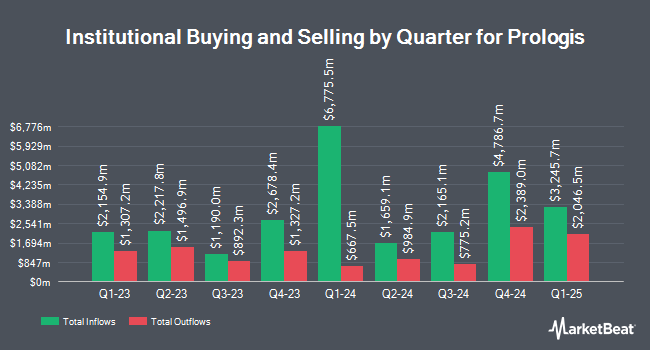

Other institutional investors have also added to or reduced their stakes in the company. Aviva PLC grew its stake in Prologis by 36.6% during the fourth quarter. Aviva PLC now owns 695,187 shares of the real estate investment trust's stock valued at $73,481,000 after acquiring an additional 186,187 shares in the last quarter. Zurcher Kantonalbank Zurich Cantonalbank lifted its position in Prologis by 29.8% during the fourth quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 784,360 shares of the real estate investment trust's stock valued at $82,907,000 after purchasing an additional 179,880 shares during the last quarter. Allstate Corp lifted its position in Prologis by 111.7% during the fourth quarter. Allstate Corp now owns 74,518 shares of the real estate investment trust's stock valued at $7,877,000 after purchasing an additional 39,321 shares during the last quarter. Massachusetts Financial Services Co. MA lifted its position in Prologis by 2.1% during the fourth quarter. Massachusetts Financial Services Co. MA now owns 16,596,799 shares of the real estate investment trust's stock valued at $1,754,282,000 after purchasing an additional 334,907 shares during the last quarter. Finally, Banco Santander S.A. lifted its position in Prologis by 88.0% during the fourth quarter. Banco Santander S.A. now owns 4,683 shares of the real estate investment trust's stock valued at $495,000 after purchasing an additional 2,192 shares during the last quarter. 93.50% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

PLD has been the subject of several research reports. Barclays lowered their price objective on shares of Prologis from $132.00 to $119.00 and set an "overweight" rating for the company in a research report on Wednesday, April 30th. Robert W. Baird lowered their target price on shares of Prologis from $126.00 to $120.00 and set an "outperform" rating for the company in a report on Wednesday, May 7th. BMO Capital Markets lowered their target price on shares of Prologis from $105.00 to $95.00 and set an "outperform" rating for the company in a report on Monday, April 14th. Scotiabank raised their target price on shares of Prologis from $97.00 to $100.00 and gave the stock a "sector underperform" rating in a report on Monday, May 12th. Finally, Wall Street Zen upgraded shares of Prologis from a "sell" rating to a "hold" rating in a report on Friday. One research analyst has rated the stock with a sell rating, eight have given a hold rating, ten have issued a buy rating and two have issued a strong buy rating to the stock. According to MarketBeat, Prologis currently has an average rating of "Moderate Buy" and a consensus target price of $120.42.

Read Our Latest Analysis on Prologis

Prologis Stock Performance

NYSE:PLD traded down $0.59 during trading hours on Friday, hitting $108.64. 7,261,566 shares of the company were exchanged, compared to its average volume of 4,165,353. The stock has a market capitalization of $100.81 billion, a price-to-earnings ratio of 27.16, a PEG ratio of 2.70 and a beta of 1.25. Prologis, Inc. has a 52-week low of $85.35 and a 52-week high of $132.57. The company has a debt-to-equity ratio of 0.53, a current ratio of 0.75 and a quick ratio of 0.43. The company's 50 day moving average price is $103.94 and its 200-day moving average price is $110.56.

Prologis (NYSE:PLD - Get Free Report) last released its earnings results on Wednesday, April 16th. The real estate investment trust reported $1.42 earnings per share for the quarter, topping the consensus estimate of $1.38 by $0.04. The company had revenue of $1.99 billion for the quarter, compared to the consensus estimate of $1.99 billion. Prologis had a net margin of 45.50% and a return on equity of 6.44%. As a group, research analysts forecast that Prologis, Inc. will post 5.73 earnings per share for the current year.

Prologis Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Monday, June 30th. Shareholders of record on Tuesday, June 17th will be given a dividend of $1.01 per share. This represents a $4.04 annualized dividend and a yield of 3.72%. The ex-dividend date is Tuesday, June 17th. Prologis's dividend payout ratio is presently 101.00%.

About Prologis

(

Free Report)

Prologis, Inc is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. At March 31, 2024, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 1.2 billion square feet (115 million square meters) in 19 countries.

Recommended Stories

Before you consider Prologis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prologis wasn't on the list.

While Prologis currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.