Two Sigma Investments LP decreased its holdings in HCI Group, Inc. (NYSE:HCI - Free Report) by 13.1% in the 4th quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 104,754 shares of the insurance provider's stock after selling 15,856 shares during the quarter. Two Sigma Investments LP owned approximately 0.99% of HCI Group worth $12,207,000 as of its most recent SEC filing.

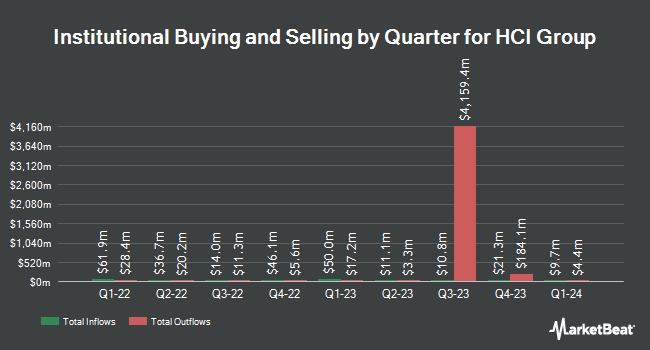

Several other institutional investors have also recently bought and sold shares of the business. ProShare Advisors LLC bought a new position in HCI Group in the 4th quarter valued at $291,000. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its position in HCI Group by 5.5% in the 4th quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 4,702 shares of the insurance provider's stock valued at $548,000 after purchasing an additional 247 shares during the last quarter. Jacobs Levy Equity Management Inc. bought a new position in HCI Group in the 4th quarter valued at $255,000. Graham Capital Management L.P. raised its position in HCI Group by 8.5% in the 4th quarter. Graham Capital Management L.P. now owns 8,864 shares of the insurance provider's stock valued at $1,033,000 after purchasing an additional 695 shares during the last quarter. Finally, FJ Capital Management LLC raised its position in HCI Group by 65.7% in the 4th quarter. FJ Capital Management LLC now owns 62,250 shares of the insurance provider's stock valued at $7,254,000 after purchasing an additional 24,682 shares during the last quarter. Institutional investors own 86.99% of the company's stock.

Analysts Set New Price Targets

Separately, JMP Securities lifted their price objective on HCI Group from $210.00 to $225.00 and gave the company a "market outperform" rating in a research report on Monday, May 19th. Two investment analysts have rated the stock with a hold rating and three have issued a buy rating to the company. According to data from MarketBeat.com, HCI Group currently has a consensus rating of "Moderate Buy" and a consensus price target of $160.00.

View Our Latest Report on HCI

HCI Group Trading Down 0.5%

Shares of HCI stock traded down $0.80 on Thursday, reaching $161.74. 5,326 shares of the stock were exchanged, compared to its average volume of 136,445. The stock has a market cap of $1.87 billion, a PE ratio of 13.53 and a beta of 1.23. HCI Group, Inc. has a one year low of $83.65 and a one year high of $176.40. The company has a debt-to-equity ratio of 0.40, a current ratio of 0.47 and a quick ratio of 0.47. The stock has a 50 day moving average price of $150.25 and a 200 day moving average price of $130.79.

HCI Group (NYSE:HCI - Get Free Report) last released its earnings results on Thursday, May 8th. The insurance provider reported $5.35 earnings per share for the quarter, topping analysts' consensus estimates of $4.49 by $0.86. The company had revenue of $216.43 million during the quarter, compared to the consensus estimate of $214.89 million. HCI Group had a return on equity of 34.17% and a net margin of 19.37%. Equities research analysts forecast that HCI Group, Inc. will post 6.78 EPS for the current fiscal year.

HCI Group Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, June 20th. Stockholders of record on Friday, May 16th will be given a dividend of $0.40 per share. The ex-dividend date of this dividend is Friday, May 16th. This represents a $1.60 dividend on an annualized basis and a dividend yield of 0.99%. HCI Group's payout ratio is currently 15.47%.

About HCI Group

(

Free Report)

HCI Group, Inc, together with its subsidiaries, engages in the property and casualty insurance, insurance management, reinsurance, real estate, and information technology businesses in Florida. It provides residential insurance products, such as homeowners, fire, flood, and wind-only insurance to homeowners, condominium owners, and tenants for properties, as well as offers reinsurance programs.

See Also

Before you consider HCI Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HCI Group wasn't on the list.

While HCI Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.