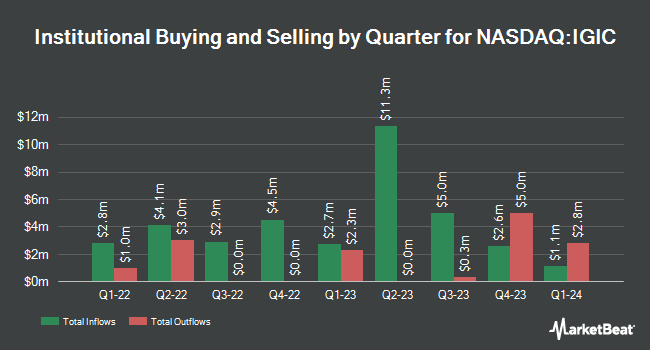

Westwood Holdings Group Inc. lessened its holdings in shares of International General Insurance Holdings Ltd. (NASDAQ:IGIC - Free Report) by 11.2% during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 985,314 shares of the company's stock after selling 124,386 shares during the period. Westwood Holdings Group Inc. owned 2.14% of International General Insurance worth $23,411,000 as of its most recent filing with the Securities and Exchange Commission.

Other hedge funds also recently made changes to their positions in the company. Quantbot Technologies LP acquired a new position in International General Insurance during the 4th quarter worth $87,000. PNC Financial Services Group Inc. bought a new stake in International General Insurance in the fourth quarter worth about $95,000. State of Wyoming bought a new stake in International General Insurance in the fourth quarter worth about $107,000. Geneos Wealth Management Inc. bought a new stake in International General Insurance in the fourth quarter worth about $177,000. Finally, BNP Paribas Financial Markets bought a new stake in shares of International General Insurance in the 4th quarter worth approximately $199,000. Institutional investors own 54.24% of the company's stock.

International General Insurance Stock Down 1.6%

Shares of NASDAQ:IGIC opened at $23.70 on Tuesday. The company's fifty day moving average is $24.68 and its two-hundred day moving average is $24.80. International General Insurance Holdings Ltd. has a 12-month low of $13.81 and a 12-month high of $27.76. The company has a market cap of $1.07 billion, a P/E ratio of 7.75 and a beta of 0.24.

International General Insurance (NASDAQ:IGIC - Get Free Report) last posted its quarterly earnings results on Tuesday, May 6th. The company reported $0.42 earnings per share for the quarter, missing the consensus estimate of $0.47 by ($0.05). The business had revenue of $129.00 million for the quarter, compared to analyst estimates of $135.50 million. International General Insurance had a net margin of 26.24% and a return on equity of 22.78%. Equities research analysts anticipate that International General Insurance Holdings Ltd. will post 3.18 earnings per share for the current year.

International General Insurance Announces Dividend

The business also recently declared a -- dividend, which was paid on Tuesday, April 22nd. Stockholders of record on Friday, April 4th were paid a $0.85 dividend. This represents a dividend yield of 0.4%. The ex-dividend date of this dividend was Friday, April 4th. International General Insurance's dividend payout ratio (DPR) is presently 7.35%.

Wall Street Analysts Forecast Growth

IGIC has been the topic of a number of research reports. Oppenheimer boosted their target price on shares of International General Insurance from $30.00 to $32.00 and gave the stock an "outperform" rating in a report on Thursday, February 27th. Royal Bank of Canada boosted their price objective on International General Insurance from $28.00 to $31.00 and gave the stock an "outperform" rating in a report on Thursday, February 27th.

Read Our Latest Analysis on International General Insurance

International General Insurance Company Profile

(

Free Report)

International General Insurance Holdings Ltd. engages in the provision of specialty insurance and reinsurance solutions worldwide. The company operates through three segments: Specialty Long-tail, Specialty Short-tail, and Reinsurance. It is involved in underwriting a portfolio of specialty risks, including energy, property, construction and engineering, ports and terminals, general aviation, political violence, professional lines, financial institutions, motor, marine liability, contingency, marine, treaty, and casualty insurance and reinsurance.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider International General Insurance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International General Insurance wasn't on the list.

While International General Insurance currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.