Jackson Creek Investment Advisors LLC lessened its holdings in Carpenter Technology Corporation (NYSE:CRS - Free Report) by 28.0% in the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 7,676 shares of the basic materials company's stock after selling 2,992 shares during the period. Jackson Creek Investment Advisors LLC's holdings in Carpenter Technology were worth $1,391,000 at the end of the most recent quarter.

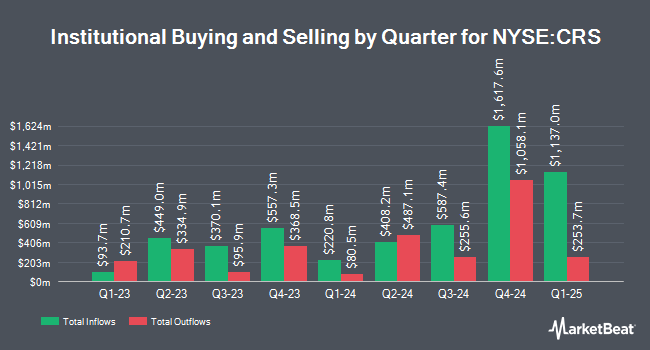

Other hedge funds have also recently added to or reduced their stakes in the company. FMR LLC increased its holdings in shares of Carpenter Technology by 28.3% during the fourth quarter. FMR LLC now owns 4,444,608 shares of the basic materials company's stock worth $754,295,000 after buying an additional 979,313 shares in the last quarter. SurgoCap Partners LP increased its holdings in shares of Carpenter Technology by 117.6% during the fourth quarter. SurgoCap Partners LP now owns 1,442,069 shares of the basic materials company's stock worth $244,734,000 after buying an additional 779,357 shares in the last quarter. Norges Bank acquired a new stake in shares of Carpenter Technology during the fourth quarter worth approximately $100,505,000. GAMMA Investing LLC increased its holdings in shares of Carpenter Technology by 19,404.3% during the first quarter. GAMMA Investing LLC now owns 479,221 shares of the basic materials company's stock worth $86,825,000 after buying an additional 476,764 shares in the last quarter. Finally, Freestone Grove Partners LP acquired a new stake in shares of Carpenter Technology during the fourth quarter worth approximately $69,285,000. Institutional investors and hedge funds own 92.03% of the company's stock.

Carpenter Technology Stock Performance

CRS traded up $1.43 on Friday, reaching $288.16. The company had a trading volume of 25,244 shares, compared to its average volume of 809,875. Carpenter Technology Corporation has a fifty-two week low of $115.52 and a fifty-two week high of $290.84. The stock has a market cap of $14.34 billion, a P/E ratio of 40.75, a P/E/G ratio of 0.92 and a beta of 1.39. The company's fifty day moving average is $252.72 and its 200 day moving average is $210.98. The company has a debt-to-equity ratio of 0.39, a quick ratio of 1.89 and a current ratio of 3.75.

Carpenter Technology (NYSE:CRS - Get Free Report) last posted its quarterly earnings data on Thursday, April 24th. The basic materials company reported $1.88 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.74 by $0.14. Carpenter Technology had a net margin of 12.26% and a return on equity of 21.16%. The firm had revenue of $727.00 million during the quarter, compared to the consensus estimate of $729.67 million. During the same quarter in the previous year, the firm posted $1.19 EPS. The business's revenue for the quarter was up 6.1% compared to the same quarter last year. As a group, analysts predict that Carpenter Technology Corporation will post 6.83 earnings per share for the current fiscal year.

Carpenter Technology announced that its board has approved a stock repurchase program on Thursday, April 24th that allows the company to buyback $400.00 million in shares. This buyback authorization allows the basic materials company to repurchase up to 4% of its shares through open market purchases. Shares buyback programs are typically an indication that the company's board of directors believes its stock is undervalued.

Wall Street Analyst Weigh In

Several research firms have recently commented on CRS. Benchmark increased their price target on shares of Carpenter Technology from $250.00 to $300.00 and gave the company a "buy" rating in a research note on Monday, June 9th. JPMorgan Chase & Co. increased their price objective on Carpenter Technology from $245.00 to $305.00 and gave the company an "overweight" rating in a research report on Tuesday, June 17th. Cowen reaffirmed a "buy" rating on shares of Carpenter Technology in a report on Thursday, June 12th. Finally, Northcoast Research raised shares of Carpenter Technology from a "sell" rating to a "neutral" rating in a report on Wednesday, April 9th. One analyst has rated the stock with a hold rating and four have given a buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $278.33.

Get Our Latest Report on Carpenter Technology

Insider Buying and Selling

In other Carpenter Technology news, Director I Martin Inglis sold 3,433 shares of the company's stock in a transaction that occurred on Tuesday, April 29th. The shares were sold at an average price of $197.66, for a total value of $678,566.78. Following the completion of the transaction, the director directly owned 6,732 shares in the company, valued at approximately $1,330,647.12. This represents a 33.77% decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, Director Anastasios John Hart sold 1,000 shares of the firm's stock in a transaction on Thursday, June 12th. The stock was sold at an average price of $243.72, for a total transaction of $243,720.00. The disclosure for this sale can be found here. 2.90% of the stock is owned by corporate insiders.

About Carpenter Technology

(

Free Report)

Carpenter Technology Corporation engages in the manufacture, fabrication, and distribution of specialty metals in the United States, Europe, the Asia Pacific, Mexico, Canada, and internationally. It operates in two segments, Specialty Alloys Operations and Performance Engineered Products. The company offers specialty alloys, including titanium alloys, powder metals, stainless steels, alloy steels, and tool steels, as well as additives, and metal powders and parts.

Featured Articles

Want to see what other hedge funds are holding CRS? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Carpenter Technology Corporation (NYSE:CRS - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Carpenter Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carpenter Technology wasn't on the list.

While Carpenter Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report