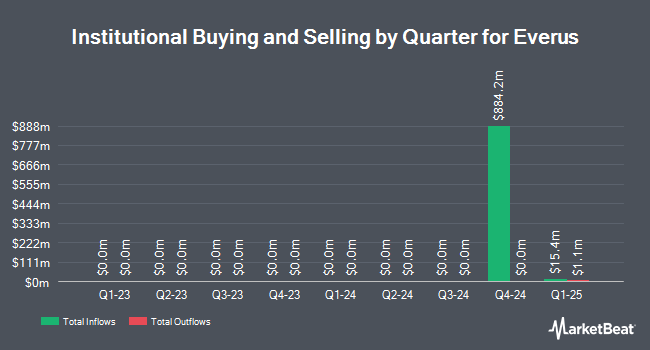

Jane Street Group LLC purchased a new position in Everus (NYSE:ECG - Free Report) in the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm purchased 25,076 shares of the company's stock, valued at approximately $1,649,000.

Other institutional investors have also recently made changes to their positions in the company. Vanguard Group Inc. acquired a new stake in shares of Everus in the fourth quarter valued at about $365,965,000. Dimensional Fund Advisors LP purchased a new position in Everus during the fourth quarter worth about $120,578,000. Invesco Ltd. purchased a new stake in shares of Everus in the 4th quarter valued at approximately $65,337,000. Alliancebernstein L.P. purchased a new stake in shares of Everus in the 4th quarter valued at approximately $53,131,000. Finally, American Century Companies Inc. purchased a new stake in shares of Everus in the 4th quarter valued at approximately $49,650,000.

Everus Stock Performance

Shares of ECG opened at $59.39 on Monday. Everus has a 52-week low of $31.38 and a 52-week high of $77.93. The company has a 50-day simple moving average of $41.05 and a 200-day simple moving average of $54.31. The company has a current ratio of 1.58, a quick ratio of 1.50 and a debt-to-equity ratio of 0.47.

Everus (NYSE:ECG - Get Free Report) last issued its quarterly earnings data on Tuesday, May 13th. The company reported $0.72 EPS for the quarter, beating analysts' consensus estimates of $0.43 by $0.29. The business had revenue of $826.63 million during the quarter, compared to analyst estimates of $676.35 million. Everus's revenue for the quarter was up 32.1% on a year-over-year basis. On average, analysts predict that Everus will post 2.49 earnings per share for the current year.

Insiders Place Their Bets

In related news, Director Edward A. Ryan purchased 1,400 shares of the company's stock in a transaction that occurred on Tuesday, February 25th. The stock was acquired at an average price of $38.02 per share, for a total transaction of $53,228.00. Following the completion of the purchase, the director now owns 14,928 shares in the company, valued at approximately $567,562.56. This represents a 10.35% increase in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Rocca Michael Della purchased 1,050 shares of the company's stock in a transaction that occurred on Tuesday, February 18th. The stock was bought at an average price of $47.56 per share, with a total value of $49,938.00. Following the purchase, the director now owns 2,027 shares of the company's stock, valued at approximately $96,404.12. The trade was a 107.47% increase in their position. The disclosure for this purchase can be found here. Insiders have bought 3,750 shares of company stock valued at $153,853 in the last ninety days. Insiders own 0.21% of the company's stock.

Analysts Set New Price Targets

Several equities research analysts recently weighed in on ECG shares. Stifel Nicolaus upped their target price on shares of Everus from $55.00 to $71.00 and gave the stock a "buy" rating in a research note on Friday. DA Davidson boosted their price target on shares of Everus from $58.00 to $68.00 and gave the stock a "neutral" rating in a report on Thursday.

Check Out Our Latest Analysis on ECG

Everus Profile

(

Free Report)

Everus Construction Group is providing a full spectrum of construction services through its electrical and mechanical and transmission and distribution specialty contracting services principally in United States. Its specialty contracting services are provided to utility, transportation, commercial, industrial, institutional, renewable and other customers.

See Also

Want to see what other hedge funds are holding ECG? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Everus (NYSE:ECG - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Everus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Everus wasn't on the list.

While Everus currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.