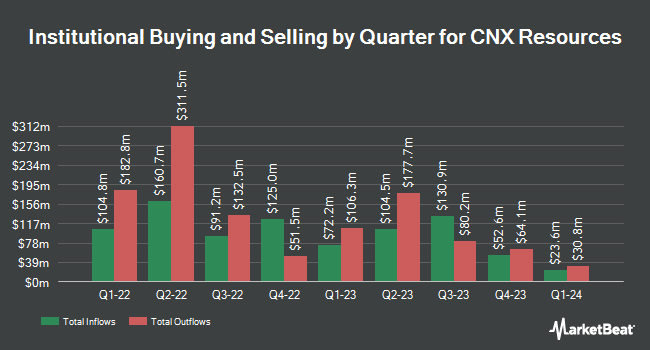

Janney Montgomery Scott LLC reduced its holdings in CNX Resources Corporation. (NYSE:CNX - Free Report) by 10.3% in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 66,144 shares of the oil and gas producer's stock after selling 7,567 shares during the quarter. Janney Montgomery Scott LLC's holdings in CNX Resources were worth $2,082,000 at the end of the most recent quarter.

Several other hedge funds have also modified their holdings of the business. Bessemer Group Inc. raised its holdings in CNX Resources by 131.5% during the fourth quarter. Bessemer Group Inc. now owns 926 shares of the oil and gas producer's stock worth $34,000 after purchasing an additional 526 shares during the last quarter. Harvest Fund Management Co. Ltd purchased a new stake in shares of CNX Resources in the fourth quarter valued at $39,000. VSM Wealth Advisory LLC purchased a new stake in CNX Resources during the fourth quarter valued at about $55,000. Harbor Capital Advisors Inc. purchased a new stake in CNX Resources during the first quarter valued at about $61,000. Finally, Sound Income Strategies LLC purchased a new stake in CNX Resources during the first quarter valued at about $63,000. 95.16% of the stock is owned by institutional investors and hedge funds.

CNX Resources Price Performance

CNX opened at $33.54 on Friday. The stock has a fifty day moving average of $31.78 and a 200-day moving average of $31.48. The firm has a market capitalization of $4.85 billion, a P/E ratio of -16.28, a PEG ratio of 0.31 and a beta of 0.66. CNX Resources Corporation. has a 12-month low of $23.85 and a 12-month high of $41.93. The company has a quick ratio of 0.25, a current ratio of 0.27 and a debt-to-equity ratio of 0.63.

Insider Activity

In other news, Director J. Palmer Clarkson acquired 10,000 shares of the business's stock in a transaction that occurred on Monday, May 12th. The stock was acquired at an average cost of $31.20 per share, for a total transaction of $312,000.00. Following the completion of the acquisition, the director now owns 245,433 shares in the company, valued at approximately $7,657,509.60. The trade was a 4.25% increase in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Corporate insiders own 3.10% of the company's stock.

Wall Street Analyst Weigh In

A number of brokerages have commented on CNX. JPMorgan Chase & Co. boosted their price objective on CNX Resources from $32.00 to $33.00 and gave the stock an "underweight" rating in a research note on Thursday, March 13th. Piper Sandler upped their target price on CNX Resources from $21.00 to $25.00 and gave the company an "underweight" rating in a report on Tuesday, May 13th. Mizuho upped their target price on CNX Resources from $35.00 to $36.00 and gave the company an "underperform" rating in a report on Tuesday, May 13th. Scotiabank raised CNX Resources from a "sector underperform" rating to a "sector perform" rating and set a $33.00 price objective for the company in a report on Friday, April 11th. Finally, Bank of America decreased their price target on CNX Resources from $32.00 to $27.00 and set an "underperform" rating for the company in a research note on Tuesday, April 1st. Eight equities research analysts have rated the stock with a sell rating, seven have assigned a hold rating and one has issued a buy rating to the company. According to MarketBeat, the company presently has an average rating of "Hold" and an average price target of $31.58.

Read Our Latest Stock Analysis on CNX

CNX Resources Company Profile

(

Free Report)

CNX Resources Corporation, an independent natural gas and midstream company, engages in the acquisition, exploration, development, and production of natural gas properties in the Appalachian Basin. The company operates in two segments, Shale and Coalbed Methane (CBM). It produces and sells pipeline quality natural gas primarily for gas wholesalers.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CNX Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CNX Resources wasn't on the list.

While CNX Resources currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.