Kennebec Savings Bank decreased its position in Ameriprise Financial, Inc. (NYSE:AMP - Free Report) by 14.8% during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 3,413 shares of the financial services provider's stock after selling 592 shares during the period. Ameriprise Financial accounts for 1.7% of Kennebec Savings Bank's portfolio, making the stock its 11th largest position. Kennebec Savings Bank's holdings in Ameriprise Financial were worth $1,652,000 at the end of the most recent reporting period.

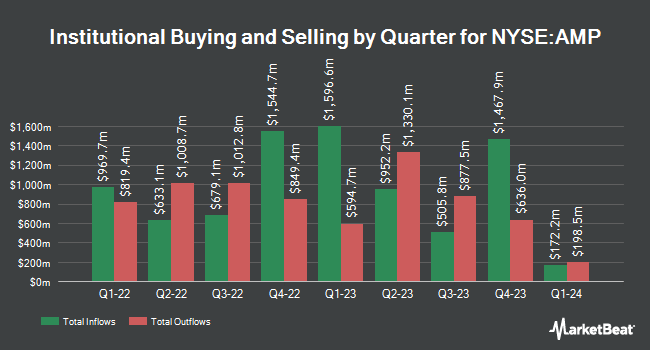

Several other hedge funds have also added to or reduced their stakes in AMP. GAMMA Investing LLC boosted its holdings in Ameriprise Financial by 49,248.9% in the first quarter. GAMMA Investing LLC now owns 2,114,108 shares of the financial services provider's stock valued at $1,023,461,000 after acquiring an additional 2,109,824 shares during the last quarter. Norges Bank bought a new position in Ameriprise Financial in the fourth quarter valued at about $689,272,000. JPMorgan Chase & Co. boosted its holdings in Ameriprise Financial by 12.1% in the fourth quarter. JPMorgan Chase & Co. now owns 4,801,913 shares of the financial services provider's stock valued at $2,556,683,000 after acquiring an additional 516,437 shares during the last quarter. Proficio Capital Partners LLC boosted its holdings in Ameriprise Financial by 79,679.4% in the fourth quarter. Proficio Capital Partners LLC now owns 371,772 shares of the financial services provider's stock valued at $197,943,000 after acquiring an additional 371,306 shares during the last quarter. Finally, Northern Trust Corp boosted its holdings in Ameriprise Financial by 19.8% in the fourth quarter. Northern Trust Corp now owns 1,268,419 shares of the financial services provider's stock valued at $675,344,000 after acquiring an additional 209,549 shares during the last quarter. Institutional investors own 83.95% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms recently issued reports on AMP. Royal Bank of Canada raised their price target on Ameriprise Financial from $550.00 to $565.00 and gave the company an "outperform" rating in a report on Tuesday, April 29th. Wall Street Zen raised Ameriprise Financial from a "sell" rating to a "hold" rating in a research note on Friday, May 30th. Raymond James raised Ameriprise Financial from a "market perform" rating to a "strong-buy" rating and set a $518.00 target price on the stock in a research note on Monday, April 7th. Morgan Stanley increased their target price on Ameriprise Financial from $507.00 to $542.00 and gave the company an "equal weight" rating in a research note on Tuesday, March 4th. Finally, Keefe, Bruyette & Woods increased their target price on Ameriprise Financial from $510.00 to $520.00 and gave the company a "market perform" rating in a research note on Wednesday, May 7th. One analyst has rated the stock with a sell rating, five have given a hold rating, two have issued a buy rating and one has given a strong buy rating to the stock. According to MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus price target of $517.13.

View Our Latest Stock Analysis on AMP

Ameriprise Financial Trading Up 2.1%

NYSE AMP opened at $518.95 on Friday. The firm has a market cap of $49.42 billion, a P/E ratio of 15.70, a P/E/G ratio of 1.15 and a beta of 1.24. The company has a debt-to-equity ratio of 1.01, a current ratio of 0.59 and a quick ratio of 0.59. The stock's 50-day moving average is $485.10 and its 200-day moving average is $516.52. Ameriprise Financial, Inc. has a one year low of $385.74 and a one year high of $582.05.

Ameriprise Financial (NYSE:AMP - Get Free Report) last released its quarterly earnings results on Thursday, April 24th. The financial services provider reported $9.50 EPS for the quarter, topping analysts' consensus estimates of $9.08 by $0.42. The company had revenue of $4.35 billion for the quarter, compared to analyst estimates of $4.45 billion. Ameriprise Financial had a return on equity of 69.35% and a net margin of 19.70%. Ameriprise Financial's revenue was up 3.6% compared to the same quarter last year. During the same quarter last year, the firm posted $8.39 earnings per share. Sell-side analysts anticipate that Ameriprise Financial, Inc. will post 38.64 earnings per share for the current fiscal year.

Ameriprise Financial Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Monday, May 19th. Stockholders of record on Monday, May 5th were given a dividend of $1.60 per share. The ex-dividend date of this dividend was Monday, May 5th. This represents a $6.40 dividend on an annualized basis and a dividend yield of 1.23%. This is a positive change from Ameriprise Financial's previous quarterly dividend of $1.48. Ameriprise Financial's dividend payout ratio (DPR) is currently 21.75%.

Ameriprise Financial announced that its board has approved a share buyback program on Thursday, April 24th that allows the company to buyback $4.50 billion in outstanding shares. This buyback authorization allows the financial services provider to reacquire up to 9.9% of its shares through open market purchases. Shares buyback programs are usually an indication that the company's board of directors believes its stock is undervalued.

Ameriprise Financial Profile

(

Free Report)

Ameriprise Financial, Inc, together with its subsidiaries, provides various financial products and services to individual and institutional clients in the United States and internationally. It operates through four segments: Advice & Wealth Management, Asset Management, Retirement & Protection Solutions, and Corporate & Other.

Further Reading

Want to see what other hedge funds are holding AMP? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Ameriprise Financial, Inc. (NYSE:AMP - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ameriprise Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ameriprise Financial wasn't on the list.

While Ameriprise Financial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.