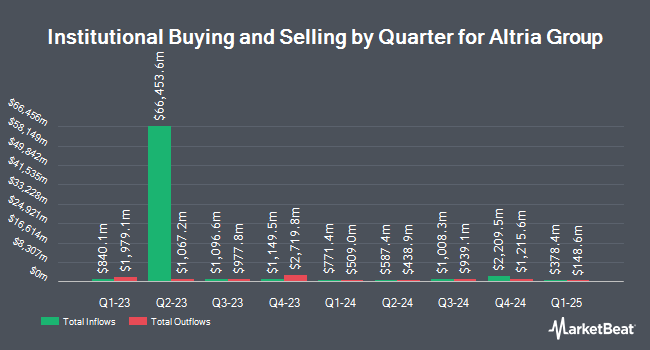

Kingswood Wealth Advisors LLC boosted its holdings in Altria Group, Inc. (NYSE:MO - Free Report) by 370.4% in the 1st quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 106,015 shares of the company's stock after acquiring an additional 83,478 shares during the quarter. Kingswood Wealth Advisors LLC's holdings in Altria Group were worth $6,250,000 as of its most recent filing with the SEC.

Several other large investors have also recently bought and sold shares of MO. Redwood Park Advisors LLC purchased a new position in shares of Altria Group in the fourth quarter valued at $26,000. VSM Wealth Advisory LLC purchased a new position in shares of Altria Group in the fourth quarter valued at $29,000. Marshall Investment Management LLC purchased a new position in shares of Altria Group in the fourth quarter valued at $32,000. Promus Capital LLC purchased a new position in shares of Altria Group in the fourth quarter valued at $33,000. Finally, Pinney & Scofield Inc. purchased a new position in shares of Altria Group in the fourth quarter valued at $33,000. Hedge funds and other institutional investors own 57.41% of the company's stock.

Altria Group Trading Up 0.3%

Shares of NYSE:MO opened at $58.97 on Wednesday. The stock's 50-day moving average price is $58.86 and its two-hundred day moving average price is $56.12. Altria Group, Inc. has a 12-month low of $44.41 and a 12-month high of $61.26. The firm has a market cap of $99.33 billion, a price-to-earnings ratio of 9.88, a PEG ratio of 3.43 and a beta of 0.60.

Altria Group (NYSE:MO - Get Free Report) last issued its quarterly earnings results on Tuesday, April 29th. The company reported $1.23 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.19 by $0.04. Altria Group had a negative return on equity of 295.44% and a net margin of 43.09%. The firm had revenue of $4.52 billion for the quarter, compared to analyst estimates of $4.64 billion. During the same period last year, the company earned $1.15 EPS. The firm's quarterly revenue was down 4.2% on a year-over-year basis. As a group, research analysts forecast that Altria Group, Inc. will post 5.32 earnings per share for the current fiscal year.

Altria Group Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Thursday, July 10th. Shareholders of record on Monday, June 16th will be paid a $1.02 dividend. This represents a $4.08 dividend on an annualized basis and a yield of 6.92%. The ex-dividend date is Monday, June 16th. Altria Group's payout ratio is 68.34%.

Analysts Set New Price Targets

A number of research analysts have recently weighed in on MO shares. Stifel Nicolaus raised their price target on Altria Group from $60.00 to $63.00 and gave the company a "buy" rating in a research report on Wednesday, April 30th. Needham & Company LLC upgraded Altria Group to a "hold" rating in a research report on Thursday, May 22nd. Wall Street Zen lowered Altria Group from a "buy" rating to a "hold" rating in a research note on Thursday, May 1st. UBS Group increased their price objective on Altria Group from $46.00 to $47.00 and gave the company a "sell" rating in a research note on Wednesday, April 30th. Finally, Deutsche Bank Aktiengesellschaft set a $60.00 price objective on Altria Group in a research note on Tuesday, April 1st. Two investment analysts have rated the stock with a sell rating, five have assigned a hold rating and two have issued a buy rating to the stock. According to data from MarketBeat, the stock presently has an average rating of "Hold" and a consensus target price of $56.00.

Read Our Latest Stock Analysis on Altria Group

Altria Group Company Profile

(

Free Report)

Altria Group, Inc, through its subsidiaries, manufactures and sells smokeable and oral tobacco products in the United States. The company offers cigarettes primarily under the Marlboro brand; large cigars and pipe tobacco under the Black & Mild brand; moist smokeless tobacco and snus products under the Copenhagen, Skoal, Red Seal, and Husky brands; oral nicotine pouches under the on! brand; and e-vapor products under the NJOY ACE brand.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Altria Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altria Group wasn't on the list.

While Altria Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.