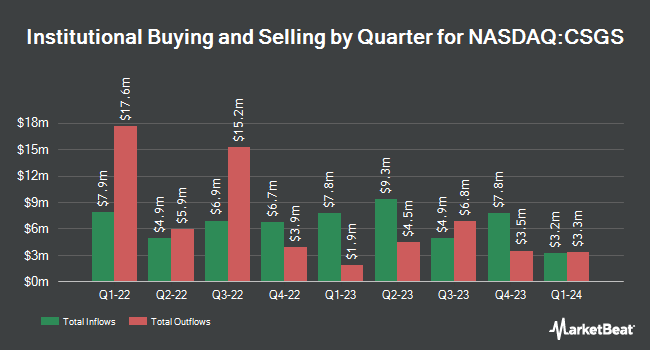

Livforsakringsbolaget Skandia Omsesidigt bought a new stake in CSG Systems International, Inc. (NASDAQ:CSGS - Free Report) during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission. The firm bought 28,000 shares of the technology company's stock, valued at approximately $1,695,000. Livforsakringsbolaget Skandia Omsesidigt owned about 0.10% of CSG Systems International at the end of the most recent quarter.

A number of other institutional investors have also modified their holdings of CSGS. Polaris Capital Management LLC lifted its holdings in shares of CSG Systems International by 10.7% during the fourth quarter. Polaris Capital Management LLC now owns 33,000 shares of the technology company's stock worth $1,687,000 after purchasing an additional 3,200 shares during the period. New York State Common Retirement Fund raised its position in CSG Systems International by 3.1% during the 4th quarter. New York State Common Retirement Fund now owns 169,880 shares of the technology company's stock worth $8,683,000 after buying an additional 5,034 shares during the last quarter. Handelsbanken Fonder AB lifted its stake in shares of CSG Systems International by 15.9% in the 4th quarter. Handelsbanken Fonder AB now owns 8,030 shares of the technology company's stock worth $410,000 after acquiring an additional 1,100 shares during the period. Amundi boosted its holdings in shares of CSG Systems International by 1.0% in the fourth quarter. Amundi now owns 18,027 shares of the technology company's stock valued at $910,000 after acquiring an additional 179 shares in the last quarter. Finally, River Road Asset Management LLC increased its stake in shares of CSG Systems International by 18.7% during the fourth quarter. River Road Asset Management LLC now owns 104,783 shares of the technology company's stock worth $5,355,000 after acquiring an additional 16,519 shares during the period. Institutional investors and hedge funds own 91.07% of the company's stock.

Wall Street Analysts Forecast Growth

CSGS has been the subject of a number of recent analyst reports. Jefferies Financial Group began coverage on shares of CSG Systems International in a research report on Friday, February 21st. They issued a "buy" rating and a $75.00 price objective for the company. Sidoti upgraded CSG Systems International to a "strong-buy" rating in a research note on Monday, May 19th. Finally, Wells Fargo & Company dropped their price objective on CSG Systems International from $65.00 to $58.00 and set an "equal weight" rating on the stock in a report on Tuesday, April 22nd. One equities research analyst has rated the stock with a hold rating, seven have issued a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat, the stock has an average rating of "Buy" and a consensus price target of $70.71.

View Our Latest Stock Report on CSGS

CSG Systems International Price Performance

Shares of NASDAQ:CSGS traded down $1.99 during trading on Friday, hitting $63.07. 183,351 shares of the stock were exchanged, compared to its average volume of 254,573. The company has a market cap of $1.83 billion, a PE ratio of 20.75, a P/E/G ratio of 1.68 and a beta of 0.90. The company has a current ratio of 1.46, a quick ratio of 1.58 and a debt-to-equity ratio of 1.88. The company has a fifty day moving average price of $62.22 and a two-hundred day moving average price of $59.14. CSG Systems International, Inc. has a 12-month low of $39.56 and a 12-month high of $67.60.

CSG Systems International (NASDAQ:CSGS - Get Free Report) last posted its earnings results on Wednesday, May 7th. The technology company reported $1.14 EPS for the quarter, topping analysts' consensus estimates of $1.00 by $0.14. The company had revenue of $271.55 million for the quarter, compared to the consensus estimate of $274.10 million. CSG Systems International had a return on equity of 39.42% and a net margin of 7.25%. CSG Systems International's quarterly revenue was up 1.5% compared to the same quarter last year. During the same period in the previous year, the business earned $1.01 earnings per share. On average, analysts forecast that CSG Systems International, Inc. will post 3.83 EPS for the current year.

CSG Systems International Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, July 2nd. Shareholders of record on Wednesday, June 18th will be issued a dividend of $0.32 per share. The ex-dividend date is Wednesday, June 18th. This represents a $1.28 annualized dividend and a yield of 2.03%. CSG Systems International's dividend payout ratio (DPR) is currently 43.69%.

About CSG Systems International

(

Free Report)

CSG Systems International, Inc, together with its subsidiaries, provides revenue management and digital monetization, customer experience, and payment solutions primarily to the communications industry in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. It offers Advanced Convergent Platform, a private SaaS platform; and related solutions, including service technician management, analytics, electronic bill presentment, etc.

Recommended Stories

Before you consider CSG Systems International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CSG Systems International wasn't on the list.

While CSG Systems International currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.