Lord & Richards Wealth Management LLC lifted its holdings in Chemed Corporation (NYSE:CHE - Free Report) by 109.1% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 2,032 shares of the company's stock after buying an additional 1,060 shares during the quarter. Chemed makes up about 1.4% of Lord & Richards Wealth Management LLC's holdings, making the stock its 21st biggest holding. Lord & Richards Wealth Management LLC's holdings in Chemed were worth $1,250,000 at the end of the most recent quarter.

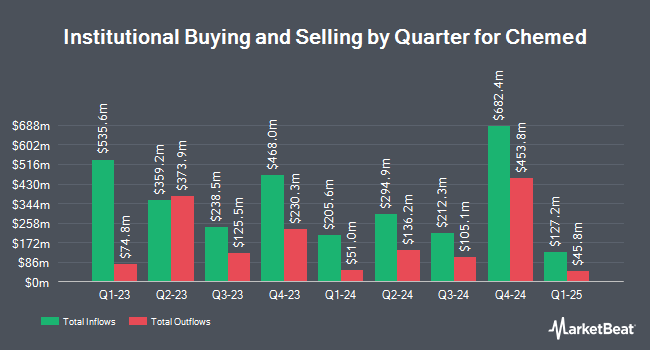

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Alpine Bank Wealth Management purchased a new stake in shares of Chemed in the 1st quarter worth about $29,000. HM Payson & Co. purchased a new stake in shares of Chemed in the 1st quarter worth about $30,000. Whipplewood Advisors LLC grew its position in shares of Chemed by 54.5% in the 1st quarter. Whipplewood Advisors LLC now owns 51 shares of the company's stock worth $31,000 after buying an additional 18 shares during the period. Brown Brothers Harriman & Co. grew its position in shares of Chemed by 633.3% in the 4th quarter. Brown Brothers Harriman & Co. now owns 88 shares of the company's stock worth $47,000 after buying an additional 76 shares during the period. Finally, Versant Capital Management Inc grew its position in Chemed by 600.0% during the 1st quarter. Versant Capital Management Inc now owns 98 shares of the company's stock valued at $60,000 after purchasing an additional 84 shares during the last quarter. 95.85% of the stock is owned by hedge funds and other institutional investors.

Insider Activity

In other news, EVP Spencer S. Lee sold 1,500 shares of the stock in a transaction that occurred on Friday, May 16th. The shares were sold at an average price of $577.99, for a total value of $866,985.00. Following the transaction, the executive vice president owned 14,627 shares in the company, valued at $8,454,259.73. This represents a 9.30% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, CEO Kevin J. Mcnamara sold 1,500 shares of the stock in a transaction that occurred on Monday, May 5th. The stock was sold at an average price of $576.45, for a total transaction of $864,675.00. Following the completion of the transaction, the chief executive officer owned 101,197 shares in the company, valued at $58,335,010.65. This trade represents a 1.46% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 4,500 shares of company stock worth $2,598,450 in the last 90 days. Company insiders own 3.29% of the company's stock.

Chemed Price Performance

CHE stock traded up $3.96 during trading on Wednesday, hitting $457.68. 122,805 shares of the stock traded hands, compared to its average volume of 112,180. The stock has a market cap of $6.70 billion, a price-to-earnings ratio of 22.29, a price-to-earnings-growth ratio of 2.18 and a beta of 0.50. The firm's 50 day moving average is $537.60 and its two-hundred day moving average is $559.38. Chemed Corporation has a 1 year low of $452.25 and a 1 year high of $623.61.

Chemed (NYSE:CHE - Get Free Report) last posted its earnings results on Wednesday, April 23rd. The company reported $5.63 earnings per share (EPS) for the quarter, beating the consensus estimate of $5.59 by $0.04. The business had revenue of $646.94 million for the quarter, compared to analysts' expectations of $641.78 million. Chemed had a net margin of 12.40% and a return on equity of 27.58%. The business's revenue for the quarter was up 9.8% compared to the same quarter last year. During the same quarter in the prior year, the business earned $5.20 EPS. As a group, analysts anticipate that Chemed Corporation will post 21.43 EPS for the current fiscal year.

Chemed Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Tuesday, June 17th. Shareholders of record on Thursday, May 29th were paid a dividend of $0.50 per share. This represents a $2.00 annualized dividend and a yield of 0.44%. The ex-dividend date was Thursday, May 29th. Chemed's dividend payout ratio is currently 9.74%.

Wall Street Analyst Weigh In

Several analysts recently commented on CHE shares. Royal Bank Of Canada reissued an "outperform" rating and set a $640.00 price objective (down from $674.00) on shares of Chemed in a research report on Monday, June 30th. Bank of America cut their price objective on shares of Chemed from $708.00 to $650.00 and set a "buy" rating on the stock in a research report on Monday, June 30th. Finally, Wall Street Zen downgraded shares of Chemed from a "buy" rating to a "hold" rating in a research report on Saturday, July 5th.

Read Our Latest Stock Report on Chemed

Chemed Company Profile

(

Free Report)

Chemed Corporation provides hospice and palliative care services to patients through a network of physicians, registered nurses, home health aides, social workers, clergy, and volunteers primarily in the United States. The company operates in VITAS and Roto-Rooter segments. It offers plumbing, drain cleaning, excavation, water restoration, and other related services to residential and commercial customers through company-owned branches, independent contractors, and franchisees.

See Also

Before you consider Chemed, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chemed wasn't on the list.

While Chemed currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.