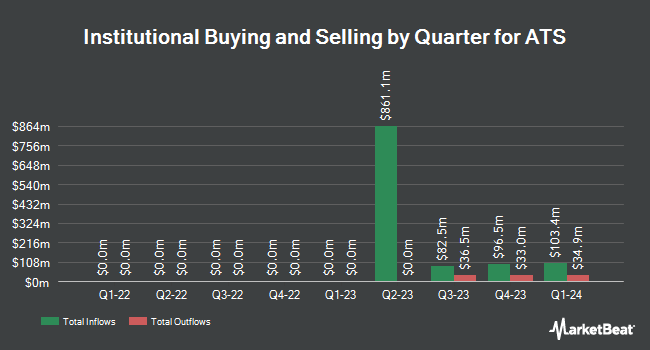

Mackenzie Financial Corp increased its position in ATS Co. (NYSE:ATS - Free Report) by 24.4% in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,131,921 shares of the company's stock after buying an additional 221,816 shares during the quarter. Mackenzie Financial Corp owned 1.16% of ATS worth $34,485,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other hedge funds also recently bought and sold shares of ATS. abrdn plc lifted its stake in ATS by 38.5% in the fourth quarter. abrdn plc now owns 13,267 shares of the company's stock worth $401,000 after purchasing an additional 3,685 shares during the last quarter. Heathbridge Capital Management Ltd. purchased a new position in shares of ATS in the fourth quarter worth about $10,024,000. Principal Financial Group Inc. lifted its stake in shares of ATS by 1.1% in the 4th quarter. Principal Financial Group Inc. now owns 668,140 shares of the company's stock valued at $20,367,000 after acquiring an additional 7,100 shares during the last quarter. Alberta Investment Management Corp boosted its holdings in ATS by 15.9% during the 4th quarter. Alberta Investment Management Corp now owns 1,086,700 shares of the company's stock valued at $33,125,000 after acquiring an additional 148,700 shares during the period. Finally, Charles Schwab Investment Management Inc. grew its position in ATS by 2.9% during the 4th quarter. Charles Schwab Investment Management Inc. now owns 198,402 shares of the company's stock worth $6,048,000 after acquiring an additional 5,525 shares during the last quarter. Institutional investors own 75.84% of the company's stock.

Analysts Set New Price Targets

Separately, Scotiabank upgraded ATS to a "hold" rating in a research report on Tuesday, April 29th.

Read Our Latest Stock Analysis on ATS

ATS Stock Down 4.4%

Shares of ATS stock traded down $1.34 during midday trading on Friday, hitting $28.87. The company had a trading volume of 42,712 shares, compared to its average volume of 126,833. The company has a 50 day moving average of $25.65 and a 200 day moving average of $27.88. The stock has a market capitalization of $2.82 billion, a P/E ratio of 43.76 and a beta of 1.06. ATS Co. has a 52-week low of $20.90 and a 52-week high of $34.32. The company has a debt-to-equity ratio of 0.97, a quick ratio of 1.58 and a current ratio of 1.92.

ATS (NYSE:ATS - Get Free Report) last issued its earnings results on Wednesday, May 28th. The company reported $0.28 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.26 by $0.02. ATS had a net margin of 3.27% and a return on equity of 9.95%. The business had revenue of $503.20 million during the quarter, compared to analysts' expectations of $687.03 million. The firm's revenue for the quarter was down 27.5% compared to the same quarter last year. On average, equities analysts predict that ATS Co. will post 1.02 earnings per share for the current fiscal year.

ATS Company Profile

(

Free Report)

ATS Corporation, together with its subsidiaries, provides automation solutions worldwide. The company is also involved in planning, designing, building, commissioning, and servicing automated manufacturing and assembly systems, including automation products and test solutions. In addition, it offers pre-automation services comprising discovery and analysis, concept development, simulation, and total cost of ownership modelling; post automation services, including training, process optimization, preventative maintenance, emergency and on-call support, spare parts, retooling, retrofits, and equipment relocation; and contract manufacturing services, as well as after sales and services.

See Also

Before you consider ATS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ATS wasn't on the list.

While ATS currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.