Mad River Investors acquired a new position in Aris Water Solutions, Inc. (NYSE:ARIS - Free Report) in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund acquired 74,900 shares of the company's stock, valued at approximately $2,400,000. Aris Water Solutions accounts for approximately 1.0% of Mad River Investors' investment portfolio, making the stock its 13th biggest position. Mad River Investors owned approximately 0.13% of Aris Water Solutions at the end of the most recent quarter.

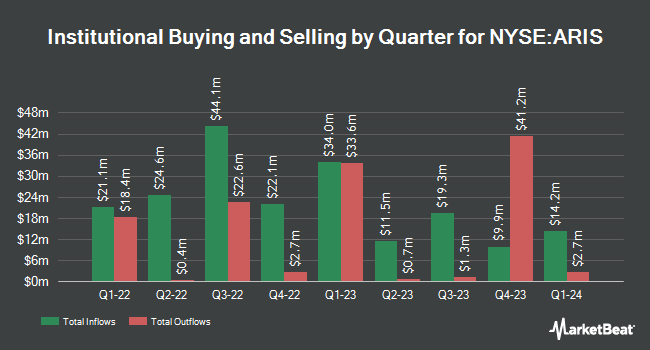

Several other institutional investors have also recently added to or reduced their stakes in the business. Inscription Capital LLC bought a new position in Aris Water Solutions during the 1st quarter worth $449,000. Janney Montgomery Scott LLC boosted its stake in Aris Water Solutions by 233.8% during the 1st quarter. Janney Montgomery Scott LLC now owns 38,898 shares of the company's stock valued at $1,246,000 after purchasing an additional 27,246 shares during the period. Farther Finance Advisors LLC raised its holdings in shares of Aris Water Solutions by 3,062.6% during the first quarter. Farther Finance Advisors LLC now owns 3,637 shares of the company's stock valued at $119,000 after buying an additional 3,522 shares during the last quarter. GAMMA Investing LLC increased its position in Aris Water Solutions by 4,584.0% in the 1st quarter. GAMMA Investing LLC now owns 29,509 shares of the company's stock valued at $921,000 after acquiring an additional 28,879 shares during the period. Finally, Wellington Management Group LLP boosted its position in Aris Water Solutions by 1.0% during the 4th quarter. Wellington Management Group LLP now owns 965,008 shares of the company's stock worth $23,112,000 after acquiring an additional 9,395 shares during the period. Institutional investors own 39.71% of the company's stock.

Aris Water Solutions Stock Performance

Aris Water Solutions stock traded down $1.11 during mid-day trading on Wednesday, reaching $23.44. The company had a trading volume of 839,408 shares, compared to its average volume of 623,482. The company has a 50 day moving average of $24.24 and a 200-day moving average of $26.30. The company has a quick ratio of 1.87, a current ratio of 1.87 and a debt-to-equity ratio of 0.63. Aris Water Solutions, Inc. has a 52 week low of $13.34 and a 52 week high of $33.95. The firm has a market cap of $1.39 billion, a price-to-earnings ratio of 28.58 and a beta of 1.70.

Aris Water Solutions (NYSE:ARIS - Get Free Report) last announced its quarterly earnings results on Tuesday, May 6th. The company reported $0.25 EPS for the quarter, topping analysts' consensus estimates of $0.23 by $0.02. The firm had revenue of $120.49 million during the quarter, compared to analysts' expectations of $115.72 million. Aris Water Solutions had a net margin of 6.15% and a return on equity of 3.77%. On average, sell-side analysts expect that Aris Water Solutions, Inc. will post 0.91 EPS for the current fiscal year.

Aris Water Solutions Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Wednesday, June 18th. Investors of record on Thursday, June 5th were issued a $0.14 dividend. The ex-dividend date of this dividend was Thursday, June 5th. This represents a $0.56 dividend on an annualized basis and a dividend yield of 2.39%. Aris Water Solutions's dividend payout ratio is 68.29%.

Analyst Upgrades and Downgrades

ARIS has been the subject of a number of research analyst reports. The Goldman Sachs Group cut their target price on Aris Water Solutions from $34.00 to $30.00 and set a "buy" rating for the company in a research report on Thursday, May 8th. Wall Street Zen lowered Aris Water Solutions from a "hold" rating to a "sell" rating in a report on Tuesday, May 13th. Citigroup restated a "neutral" rating on shares of Aris Water Solutions in a report on Monday, May 12th. Finally, Wells Fargo & Company lowered their target price on shares of Aris Water Solutions from $29.00 to $23.00 and set an "equal weight" rating on the stock in a research report on Thursday, May 8th. One analyst has rated the stock with a sell rating, four have given a hold rating and two have issued a buy rating to the company's stock. Based on data from MarketBeat, the company currently has a consensus rating of "Hold" and a consensus price target of $26.00.

Read Our Latest Stock Analysis on Aris Water Solutions

Aris Water Solutions Profile

(

Free Report)

Aris Water Solutions, Inc, an environmental infrastructure and solutions company, provides water handling and recycling solutions. The company's produced water handling business gathers, transports, unless recycled, and handles produced water generated from oil and natural gas production. Its water solutions business develops and operates recycling facilities to treat, store, and recycle produced water.

Featured Articles

Before you consider Aris Water Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aris Water Solutions wasn't on the list.

While Aris Water Solutions currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.