Man Group plc acquired a new stake in Apogee Enterprises, Inc. (NASDAQ:APOG - Free Report) in the 4th quarter, according to the company in its most recent disclosure with the SEC. The fund acquired 12,205 shares of the industrial products company's stock, valued at approximately $872,000. Man Group plc owned about 0.06% of Apogee Enterprises at the end of the most recent quarter.

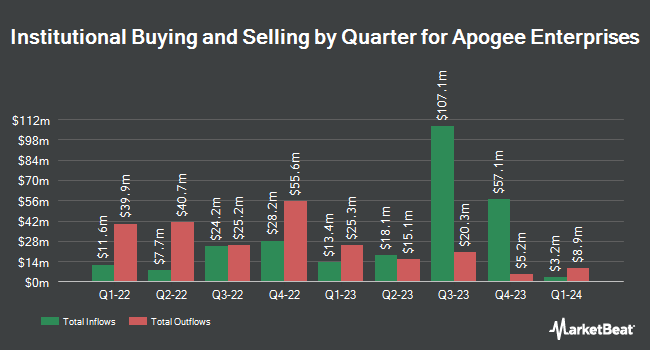

Several other institutional investors and hedge funds have also modified their holdings of the business. Victory Capital Management Inc. lifted its stake in shares of Apogee Enterprises by 7.0% in the 4th quarter. Victory Capital Management Inc. now owns 1,155,967 shares of the industrial products company's stock valued at $82,548,000 after purchasing an additional 75,438 shares during the last quarter. American Century Companies Inc. lifted its stake in shares of Apogee Enterprises by 12.9% in the 4th quarter. American Century Companies Inc. now owns 692,139 shares of the industrial products company's stock valued at $49,426,000 after purchasing an additional 79,009 shares during the last quarter. Northern Trust Corp lifted its stake in shares of Apogee Enterprises by 19.9% in the 4th quarter. Northern Trust Corp now owns 277,942 shares of the industrial products company's stock valued at $19,848,000 after purchasing an additional 46,220 shares during the last quarter. JPMorgan Chase & Co. lifted its stake in shares of Apogee Enterprises by 87.9% in the 4th quarter. JPMorgan Chase & Co. now owns 186,744 shares of the industrial products company's stock valued at $13,335,000 after purchasing an additional 87,356 shares during the last quarter. Finally, Renaissance Technologies LLC lifted its stake in shares of Apogee Enterprises by 196.2% in the 4th quarter. Renaissance Technologies LLC now owns 122,883 shares of the industrial products company's stock valued at $8,775,000 after purchasing an additional 81,400 shares during the last quarter. Institutional investors and hedge funds own 94.05% of the company's stock.

Apogee Enterprises Stock Performance

APOG traded down $0.24 during trading on Thursday, hitting $38.35. The stock had a trading volume of 17,856 shares, compared to its average volume of 193,169. The firm has a market cap of $827.22 million, a PE ratio of 8.56 and a beta of 0.99. Apogee Enterprises, Inc. has a 12 month low of $38.06 and a 12 month high of $87.93. The company has a current ratio of 1.63, a quick ratio of 1.27 and a debt-to-equity ratio of 0.52. The company has a 50 day simple moving average of $43.12 and a 200-day simple moving average of $55.87.

Apogee Enterprises (NASDAQ:APOG - Get Free Report) last announced its earnings results on Thursday, April 24th. The industrial products company reported $0.89 EPS for the quarter, missing the consensus estimate of $0.90 by ($0.01). The firm had revenue of $345.69 million during the quarter, compared to the consensus estimate of $331.82 million. Apogee Enterprises had a return on equity of 23.14% and a net margin of 7.14%. The business's revenue was down 4.4% compared to the same quarter last year. During the same quarter last year, the business earned $1.14 EPS. Analysts expect that Apogee Enterprises, Inc. will post 4.97 EPS for the current year.

Apogee Enterprises Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Wednesday, May 28th. Investors of record on Tuesday, May 13th were issued a $0.26 dividend. The ex-dividend date of this dividend was Tuesday, May 13th. This represents a $1.04 annualized dividend and a yield of 2.71%. Apogee Enterprises's dividend payout ratio (DPR) is presently 26.80%.

Analyst Ratings Changes

Separately, Wall Street Zen lowered shares of Apogee Enterprises from a "buy" rating to a "hold" rating in a research note on Friday, April 25th.

Get Our Latest Stock Report on Apogee Enterprises

Apogee Enterprises Company Profile

(

Free Report)

Apogee Enterprises, Inc provides architectural products and services for enclosing buildings, and glass and acrylic products used for preservation, protection, and enhanced viewing in the United States, Canada, and Brazil. The company operates in four segments: Architectural Framing Systems, Architectural Glass, Architectural Services, and Large-Scale Optical (LSO).

Further Reading

Before you consider Apogee Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apogee Enterprises wasn't on the list.

While Apogee Enterprises currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.