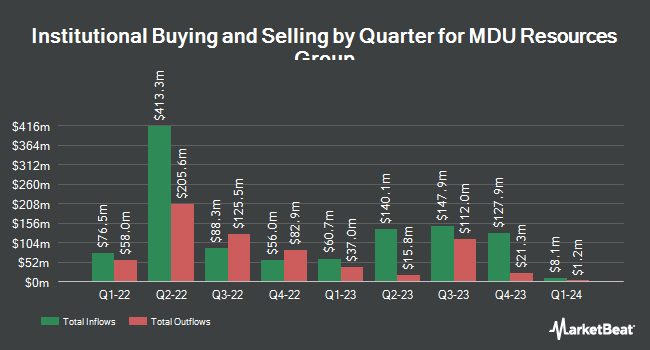

Massachusetts Financial Services Co. MA lowered its position in shares of MDU Resources Group, Inc. (NYSE:MDU - Free Report) by 2.4% during the first quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 1,012,435 shares of the utilities provider's stock after selling 24,464 shares during the quarter. Massachusetts Financial Services Co. MA owned approximately 0.50% of MDU Resources Group worth $17,120,000 as of its most recent filing with the SEC.

A number of other hedge funds have also recently bought and sold shares of MDU. Bessemer Group Inc. raised its stake in shares of MDU Resources Group by 179.0% in the 1st quarter. Bessemer Group Inc. now owns 1,518 shares of the utilities provider's stock valued at $25,000 after acquiring an additional 974 shares during the period. GAMMA Investing LLC raised its stake in shares of MDU Resources Group by 241.9% in the 1st quarter. GAMMA Investing LLC now owns 1,843 shares of the utilities provider's stock valued at $31,000 after acquiring an additional 1,304 shares during the period. Atlas Capital Advisors Inc. raised its stake in shares of MDU Resources Group by 84.4% in the 4th quarter. Atlas Capital Advisors Inc. now owns 2,487 shares of the utilities provider's stock valued at $45,000 after acquiring an additional 1,138 shares during the period. Johnson Financial Group Inc. purchased a new position in shares of MDU Resources Group in the 4th quarter valued at $54,000. Finally, Lee Danner & Bass Inc. purchased a new position in shares of MDU Resources Group in the 4th quarter valued at $77,000. Institutional investors and hedge funds own 71.44% of the company's stock.

MDU Resources Group Stock Up 0.2%

MDU Resources Group stock traded up $0.03 during midday trading on Friday, hitting $17.02. 1,538,126 shares of the stock were exchanged, compared to its average volume of 2,344,265. MDU Resources Group, Inc. has a 1 year low of $13.23 and a 1 year high of $20.39. The firm has a market cap of $3.48 billion, a P/E ratio of 13.19, a P/E/G ratio of 2.58 and a beta of 0.70. The company has a debt-to-equity ratio of 0.74, a current ratio of 0.85 and a quick ratio of 0.82. The company has a 50 day moving average price of $16.77 and a two-hundred day moving average price of $17.00.

MDU Resources Group (NYSE:MDU - Get Free Report) last released its quarterly earnings results on Thursday, May 8th. The utilities provider reported $0.40 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.36 by $0.04. MDU Resources Group had a net margin of 7.93% and a return on equity of 9.86%. The firm had revenue of $674.80 million for the quarter, compared to the consensus estimate of $653.13 million. During the same quarter in the previous year, the firm posted $0.52 EPS. The firm's quarterly revenue was up 14.7% on a year-over-year basis. On average, sell-side analysts predict that MDU Resources Group, Inc. will post 0.94 earnings per share for the current fiscal year.

MDU Resources Group Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Tuesday, July 1st. Stockholders of record on Thursday, June 12th were given a $0.13 dividend. This represents a $0.52 annualized dividend and a dividend yield of 3.06%. MDU Resources Group's payout ratio is currently 40.31%.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen raised shares of MDU Resources Group from a "sell" rating to a "hold" rating in a research note on Monday, May 12th.

View Our Latest Research Report on MDU Resources Group

MDU Resources Group Profile

(

Free Report)

MDU Resources Group, Inc engages in the regulated energy delivery, and construction materials and services businesses in the United States. It operates through four segments: Electric, Natural Gas Distribution, Pipeline, and Construction Services. The Electric segment generates, transmits, and distributes electricity for residential, commercial, industrial, and municipal customers in Montana, North Dakota, South Dakota, and Wyoming; and operates 3,400 miles of transmission lines, 4,800 miles of distribution lines, and 82 transmission and 298 distribution substations.

Featured Articles

Before you consider MDU Resources Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MDU Resources Group wasn't on the list.

While MDU Resources Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.