Meritage Portfolio Management cut its stake in ASML Holding N.V. (NASDAQ:ASML - Free Report) by 2.1% in the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 25,543 shares of the semiconductor company's stock after selling 548 shares during the quarter. ASML accounts for about 1.1% of Meritage Portfolio Management's investment portfolio, making the stock its 13th largest holding. Meritage Portfolio Management's holdings in ASML were worth $16,925,000 as of its most recent filing with the Securities & Exchange Commission.

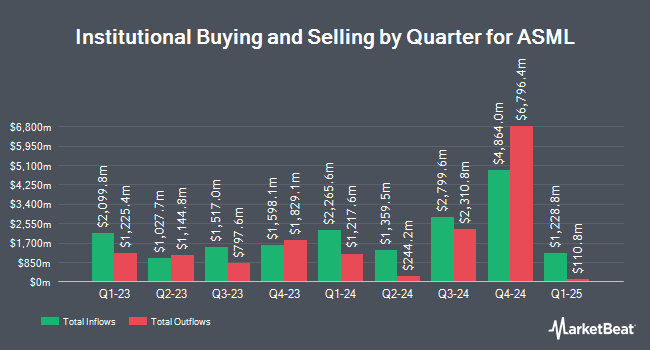

A number of other large investors have also recently made changes to their positions in ASML. Putney Financial Group LLC grew its stake in shares of ASML by 322.2% in the first quarter. Putney Financial Group LLC now owns 38 shares of the semiconductor company's stock worth $25,000 after acquiring an additional 29 shares during the period. Wellington Shields & Co. LLC grew its stake in shares of ASML by 740.0% in the fourth quarter. Wellington Shields & Co. LLC now owns 42 shares of the semiconductor company's stock worth $29,000 after acquiring an additional 37 shares during the period. Pinnacle Bancorp Inc. bought a new stake in shares of ASML in the first quarter worth approximately $42,000. Alpine Bank Wealth Management bought a new stake in ASML during the first quarter valued at approximately $43,000. Finally, Investment Management Corp VA ADV bought a new stake in ASML during the fourth quarter valued at approximately $46,000. 26.07% of the stock is currently owned by institutional investors.

ASML Price Performance

NASDAQ:ASML traded down $5.40 during trading hours on Friday, hitting $794.20. 910,715 shares of the stock traded hands, compared to its average volume of 1,710,906. The company has a quick ratio of 0.91, a current ratio of 1.52 and a debt-to-equity ratio of 0.21. ASML Holding N.V. has a 1 year low of $578.51 and a 1 year high of $1,110.09. The company has a market cap of $312.45 billion, a price-to-earnings ratio of 33.47, a price-to-earnings-growth ratio of 1.66 and a beta of 1.73. The stock has a 50 day moving average price of $749.55 and a 200 day moving average price of $722.72.

ASML (NASDAQ:ASML - Get Free Report) last issued its quarterly earnings results on Wednesday, April 16th. The semiconductor company reported $6.31 earnings per share for the quarter, beating the consensus estimate of $6.12 by $0.19. ASML had a net margin of 28.32% and a return on equity of 51.82%. The business had revenue of $8.77 billion for the quarter, compared to the consensus estimate of $7.90 billion. Sell-side analysts forecast that ASML Holding N.V. will post 25.17 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

ASML has been the subject of several recent research reports. Sanford C. Bernstein initiated coverage on shares of ASML in a research report on Tuesday, June 17th. They set a "market perform" rating and a $806.00 target price for the company. Susquehanna cut their target price on shares of ASML from $1,100.00 to $965.00 and set a "positive" rating for the company in a research report on Thursday, April 17th. Citigroup restated a "buy" rating on shares of ASML in a research report on Monday, May 19th. Jefferies Financial Group lowered shares of ASML from a "buy" rating to a "hold" rating in a research report on Thursday, June 26th. Finally, Wells Fargo & Company cut their target price on shares of ASML from $860.00 to $840.00 and set an "overweight" rating for the company in a research report on Thursday, April 17th. Five analysts have rated the stock with a hold rating, six have issued a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat.com, ASML currently has a consensus rating of "Moderate Buy" and an average target price of $913.80.

Check Out Our Latest Analysis on ASML

ASML Company Profile

(

Free Report)

ASML Holding N.V. develops, produces, markets, sells, and services advanced semiconductor equipment systems for chipmakers. It offers advanced semiconductor equipment systems, including lithography, metrology, and inspection systems. The company also provides extreme ultraviolet lithography systems; and deep ultraviolet lithography systems comprising immersion and dry lithography solutions to manufacture various range of semiconductor nodes and technologies.

Further Reading

Before you consider ASML, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ASML wasn't on the list.

While ASML currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.