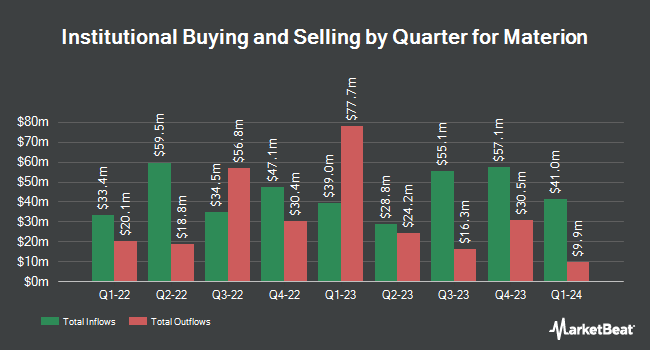

Millennium Management LLC lifted its stake in shares of Materion Co. (NYSE:MTRN - Free Report) by 290.6% during the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 57,907 shares of the basic materials company's stock after acquiring an additional 43,083 shares during the period. Millennium Management LLC owned 0.28% of Materion worth $5,726,000 as of its most recent SEC filing.

Several other large investors have also modified their holdings of MTRN. Capital Research Global Investors lifted its holdings in shares of Materion by 16.3% during the 4th quarter. Capital Research Global Investors now owns 1,838,484 shares of the basic materials company's stock worth $181,789,000 after acquiring an additional 257,637 shares during the period. Raymond James Financial Inc. purchased a new position in shares of Materion during the 4th quarter worth about $10,399,000. Norges Bank purchased a new position in shares of Materion during the 4th quarter worth about $5,037,000. JPMorgan Chase & Co. increased its position in Materion by 69.1% during the 4th quarter. JPMorgan Chase & Co. now owns 103,799 shares of the basic materials company's stock worth $10,264,000 after purchasing an additional 42,414 shares in the last quarter. Finally, Barrow Hanley Mewhinney & Strauss LLC increased its position in Materion by 6.8% during the 4th quarter. Barrow Hanley Mewhinney & Strauss LLC now owns 473,606 shares of the basic materials company's stock worth $46,830,000 after purchasing an additional 30,262 shares in the last quarter. 93.56% of the stock is currently owned by hedge funds and other institutional investors.

Insider Buying and Selling at Materion

In other news, VP Gregory R. Chemnitz sold 2,000 shares of the firm's stock in a transaction that occurred on Monday, May 5th. The shares were sold at an average price of $80.45, for a total transaction of $160,900.00. Following the completion of the sale, the vice president now owns 13,376 shares of the company's stock, valued at approximately $1,076,099.20. This trade represents a 13.01% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. 2.60% of the stock is owned by corporate insiders.

Materion Trading Down 0.8%

MTRN traded down $0.66 on Friday, reaching $77.52. 154,488 shares of the company's stock were exchanged, compared to its average volume of 107,164. The company's 50 day moving average is $78.98 and its 200-day moving average is $92.81. The company has a market cap of $1.61 billion, a price-to-earnings ratio of 267.31 and a beta of 0.85. Materion Co. has a twelve month low of $69.10 and a twelve month high of $123.21. The company has a debt-to-equity ratio of 0.48, a quick ratio of 1.26 and a current ratio of 3.19.

Materion (NYSE:MTRN - Get Free Report) last issued its quarterly earnings data on Thursday, May 1st. The basic materials company reported $1.13 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.12 by $0.01. Materion had a net margin of 0.35% and a return on equity of 12.42%. The company had revenue of $420.33 million during the quarter, compared to the consensus estimate of $396.83 million. During the same quarter last year, the company earned $0.96 earnings per share. Materion's revenue for the quarter was up 9.1% on a year-over-year basis. Equities analysts predict that Materion Co. will post 5.5 earnings per share for the current year.

Materion Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, June 13th. Shareholders of record on Thursday, May 29th will be given a $0.14 dividend. This is an increase from Materion's previous quarterly dividend of $0.14. The ex-dividend date of this dividend is Thursday, May 29th. This represents a $0.56 annualized dividend and a yield of 0.72%. Materion's dividend payout ratio (DPR) is 112.00%.

Analyst Ratings Changes

Separately, KeyCorp reissued a "sector weight" rating on shares of Materion in a research report on Wednesday, May 7th.

Read Our Latest Report on Materion

About Materion

(

Free Report)

Materion Corporation, together with its subsidiaries, produces advanced engineered materials used in semiconductor, industrial, aerospace and defense, automotive, energy, consumer electronics, and telecom and data center in the United States, Asia, Europe, and internationally. The company operates in four segments: Performance Materials, Electronic Materials, Precision Optics, and Other.

Featured Articles

Before you consider Materion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Materion wasn't on the list.

While Materion currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.