Millennium Management LLC decreased its holdings in Harrow, Inc. (NASDAQ:HROW - Free Report) by 60.2% during the 4th quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 67,262 shares of the company's stock after selling 101,671 shares during the quarter. Millennium Management LLC owned approximately 0.19% of Harrow worth $2,257,000 as of its most recent filing with the SEC.

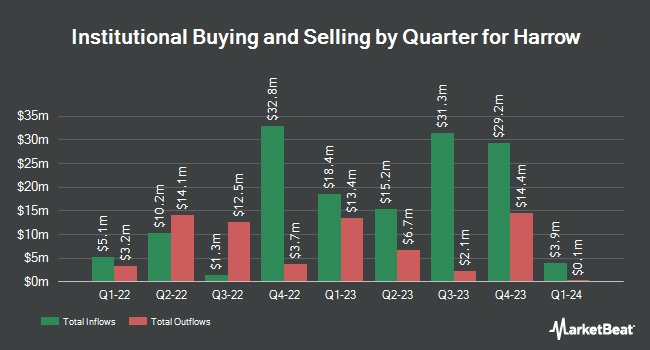

Several other institutional investors have also modified their holdings of the business. Vanguard Group Inc. lifted its stake in shares of Harrow by 0.3% in the fourth quarter. Vanguard Group Inc. now owns 1,872,100 shares of the company's stock worth $62,809,000 after acquiring an additional 5,225 shares in the last quarter. Braidwell LP increased its holdings in Harrow by 106.3% in the fourth quarter. Braidwell LP now owns 907,039 shares of the company's stock valued at $30,431,000 after buying an additional 467,401 shares during the last quarter. D. E. Shaw & Co. Inc. grew its holdings in Harrow by 6.7% in the 4th quarter. D. E. Shaw & Co. Inc. now owns 664,714 shares of the company's stock worth $22,301,000 after buying an additional 41,896 shares in the last quarter. Northern Trust Corp grew its holdings in Harrow by 7.5% in the 4th quarter. Northern Trust Corp now owns 319,084 shares of the company's stock worth $10,705,000 after buying an additional 22,266 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. lifted its position in Harrow by 1.4% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 255,218 shares of the company's stock worth $8,563,000 after purchasing an additional 3,589 shares during the period. Institutional investors and hedge funds own 72.76% of the company's stock.

Harrow Price Performance

HROW traded down $0.79 during trading on Thursday, reaching $28.72. The stock had a trading volume of 469,481 shares, compared to its average volume of 498,650. The firm has a market capitalization of $1.05 billion, a price-to-earnings ratio of -30.55 and a beta of 0.41. The company has a quick ratio of 1.44, a current ratio of 1.55 and a debt-to-equity ratio of 3.23. Harrow, Inc. has a 1-year low of $16.87 and a 1-year high of $59.23. The stock has a 50 day moving average of $25.36 and a two-hundred day moving average of $30.16.

Harrow (NASDAQ:HROW - Get Free Report) last issued its earnings results on Thursday, May 8th. The company reported ($0.38) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.02 by ($0.40). The company had revenue of $47.83 million during the quarter, compared to analyst estimates of $57.00 million. Harrow had a negative return on equity of 45.57% and a negative net margin of 19.75%. As a group, equities analysts anticipate that Harrow, Inc. will post -0.53 EPS for the current fiscal year.

Wall Street Analyst Weigh In

HROW has been the subject of a number of research analyst reports. HC Wainwright upped their target price on Harrow from $57.00 to $60.00 and gave the stock a "buy" rating in a research report on Monday, May 12th. B. Riley cut their target price on Harrow from $69.00 to $65.00 and set a "buy" rating for the company in a research report on Tuesday, April 1st.

View Our Latest Stock Report on Harrow

Harrow Company Profile

(

Free Report)

Harrow, Inc operates as an ophthalmic-focused healthcare company. The company owns ImprimisRx, an ophthalmology outsourcing and pharmaceutical compounding business. The company was formerly known as Imprimis Pharmaceuticals, Inc and changed its name to Harrow Health, Inc in December 2018. Harrow Health, Inc was incorporated in 2006 and is headquartered in Nashville, Tennessee.

Featured Articles

Before you consider Harrow, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Harrow wasn't on the list.

While Harrow currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.