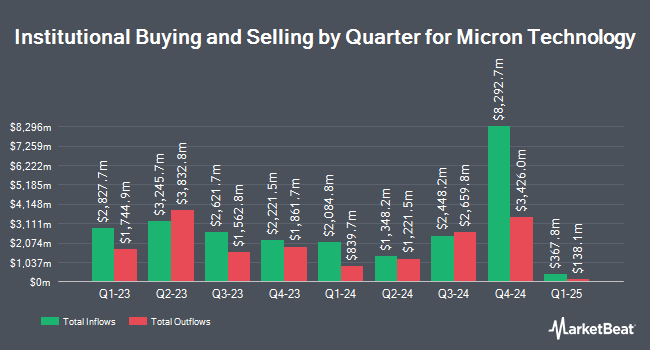

Neo Ivy Capital Management raised its position in Micron Technology, Inc. (NASDAQ:MU - Free Report) by 198.5% in the 4th quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 66,432 shares of the semiconductor manufacturer's stock after purchasing an additional 44,178 shares during the period. Micron Technology makes up about 1.1% of Neo Ivy Capital Management's investment portfolio, making the stock its 12th biggest holding. Neo Ivy Capital Management's holdings in Micron Technology were worth $5,590,000 at the end of the most recent reporting period.

Several other large investors have also recently bought and sold shares of the company. Beacon Capital Management LLC boosted its holdings in Micron Technology by 114.9% during the fourth quarter. Beacon Capital Management LLC now owns 374 shares of the semiconductor manufacturer's stock worth $31,000 after purchasing an additional 200 shares during the last quarter. Midwest Capital Advisors LLC bought a new position in Micron Technology in the 4th quarter valued at about $33,000. Comprehensive Financial Planning Inc. PA acquired a new stake in shares of Micron Technology in the 4th quarter valued at approximately $34,000. Curio Wealth LLC acquired a new stake in Micron Technology during the 4th quarter worth approximately $34,000. Finally, Activest Wealth Management raised its holdings in Micron Technology by 583.3% during the 4th quarter. Activest Wealth Management now owns 410 shares of the semiconductor manufacturer's stock worth $34,000 after purchasing an additional 350 shares during the last quarter. Institutional investors own 80.84% of the company's stock.

Micron Technology Trading Down 1.1%

Shares of MU opened at $94.83 on Friday. The business's 50-day moving average price is $82.99 and its 200-day moving average price is $92.56. Micron Technology, Inc. has a twelve month low of $61.54 and a twelve month high of $157.54. The stock has a market cap of $105.98 billion, a PE ratio of 27.33 and a beta of 1.21. The company has a quick ratio of 1.75, a current ratio of 2.72 and a debt-to-equity ratio of 0.28.

Micron Technology (NASDAQ:MU - Get Free Report) last posted its quarterly earnings data on Thursday, March 20th. The semiconductor manufacturer reported $1.56 earnings per share for the quarter, topping the consensus estimate of $1.43 by $0.13. The company had revenue of $8.05 billion for the quarter, compared to analysts' expectations of $7.93 billion. Micron Technology had a net margin of 13.34% and a return on equity of 8.32%. Micron Technology's revenue for the quarter was up 38.2% compared to the same quarter last year. During the same period in the prior year, the business earned $0.42 earnings per share. On average, equities analysts forecast that Micron Technology, Inc. will post 6.08 EPS for the current fiscal year.

Micron Technology Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, April 15th. Stockholders of record on Monday, March 31st were paid a dividend of $0.115 per share. This represents a $0.46 dividend on an annualized basis and a dividend yield of 0.49%. The ex-dividend date of this dividend was Monday, March 31st. Micron Technology's dividend payout ratio (DPR) is presently 11.03%.

Insider Activity

In other Micron Technology news, Director Mary Pat Mccarthy sold 2,404 shares of the stock in a transaction on Friday, May 2nd. The stock was sold at an average price of $80.00, for a total value of $192,320.00. Following the completion of the transaction, the director now owns 24,954 shares in the company, valued at approximately $1,996,320. This represents a 8.79% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, EVP April S. Arnzen sold 15,000 shares of the stock in a transaction on Tuesday, March 25th. The stock was sold at an average price of $96.18, for a total value of $1,442,700.00. Following the completion of the transaction, the executive vice president now owns 164,769 shares of the company's stock, valued at approximately $15,847,482.42. This trade represents a 8.34% decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 19,808 shares of company stock valued at $1,858,424. 0.30% of the stock is currently owned by company insiders.

Wall Street Analysts Forecast Growth

Several research firms have issued reports on MU. Wedbush restated an "underperform" rating on shares of Micron Technology in a report on Monday, April 28th. Cantor Fitzgerald reiterated an "overweight" rating and issued a $130.00 price objective on shares of Micron Technology in a research note on Friday, March 21st. JPMorgan Chase & Co. lowered their price objective on shares of Micron Technology from $145.00 to $135.00 and set an "overweight" rating for the company in a research note on Friday, March 21st. UBS Group lowered their price objective on shares of Micron Technology from $130.00 to $92.00 and set a "buy" rating for the company in a research note on Monday, April 28th. Finally, Rosenblatt Securities lowered their price objective on shares of Micron Technology from $250.00 to $200.00 and set a "buy" rating for the company in a research note on Friday, March 21st. Two equities research analysts have rated the stock with a sell rating, four have issued a hold rating, eighteen have issued a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, Micron Technology presently has a consensus rating of "Moderate Buy" and an average price target of $126.48.

View Our Latest Research Report on MU

Micron Technology Profile

(

Free Report)

Micron Technology, Inc designs, develops, manufactures, and sells memory and storage products worldwide. The company operates through four segments: Compute and Networking Business Unit, Mobile Business Unit, Embedded Business Unit, and Storage Business Unit. It provides memory and storage technologies comprising dynamic random access memory semiconductor devices with low latency that provide high-speed data retrieval; non-volatile and re-writeable semiconductor storage devices; and non-volatile re-writable semiconductor memory devices that provide fast read speeds under the Micron and Crucial brands, as well as through private labels.

Read More

Want to see what other hedge funds are holding MU? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Micron Technology, Inc. (NASDAQ:MU - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Micron Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Micron Technology wasn't on the list.

While Micron Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report