Nomura Holdings Inc. lessened its position in Hub Group, Inc. (NASDAQ:HUBG - Free Report) by 44.7% in the 4th quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 24,786 shares of the transportation company's stock after selling 20,021 shares during the period. Nomura Holdings Inc.'s holdings in Hub Group were worth $1,104,000 as of its most recent filing with the SEC.

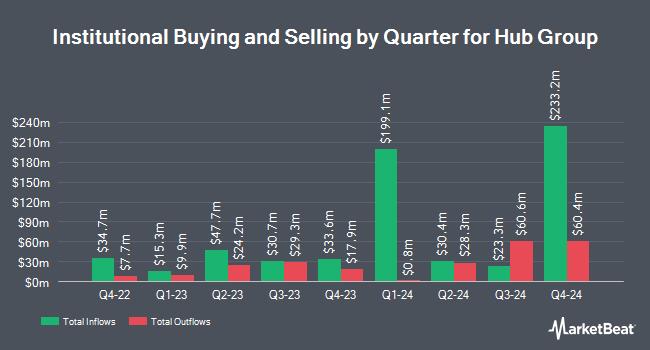

Several other hedge funds have also added to or reduced their stakes in HUBG. Nomura Asset Management Co. Ltd. increased its position in shares of Hub Group by 48.4% during the fourth quarter. Nomura Asset Management Co. Ltd. now owns 950 shares of the transportation company's stock worth $42,000 after acquiring an additional 310 shares in the last quarter. Smartleaf Asset Management LLC increased its position in shares of Hub Group by 286.2% during the fourth quarter. Smartleaf Asset Management LLC now owns 1,541 shares of the transportation company's stock worth $68,000 after acquiring an additional 1,142 shares in the last quarter. Sterling Capital Management LLC increased its position in shares of Hub Group by 803.3% during the fourth quarter. Sterling Capital Management LLC now owns 1,888 shares of the transportation company's stock worth $84,000 after acquiring an additional 1,679 shares in the last quarter. Blue Trust Inc. increased its position in shares of Hub Group by 24.8% during the fourth quarter. Blue Trust Inc. now owns 2,261 shares of the transportation company's stock worth $103,000 after acquiring an additional 450 shares in the last quarter. Finally, KBC Group NV increased its position in shares of Hub Group by 35.3% during the fourth quarter. KBC Group NV now owns 2,568 shares of the transportation company's stock worth $114,000 after acquiring an additional 670 shares in the last quarter. Institutional investors and hedge funds own 46.77% of the company's stock.

Hub Group Stock Down 2.1%

Shares of NASDAQ:HUBG traded down $0.73 during trading on Friday, hitting $33.32. 412,260 shares of the company were exchanged, compared to its average volume of 536,402. The stock has a market cap of $2.04 billion, a price-to-earnings ratio of 19.60 and a beta of 1.13. Hub Group, Inc. has a fifty-two week low of $30.75 and a fifty-two week high of $53.21. The firm has a fifty day moving average price of $34.23 and a two-hundred day moving average price of $41.35. The company has a current ratio of 1.33, a quick ratio of 1.30 and a debt-to-equity ratio of 0.10.

Hub Group (NASDAQ:HUBG - Get Free Report) last posted its quarterly earnings results on Thursday, May 8th. The transportation company reported $0.44 earnings per share for the quarter, topping the consensus estimate of $0.42 by $0.02. Hub Group had a return on equity of 7.10% and a net margin of 2.64%. The firm had revenue of $915.22 million for the quarter, compared to analyst estimates of $973.86 million. During the same quarter in the previous year, the firm earned $0.44 EPS. The business's quarterly revenue was down 8.5% on a year-over-year basis. As a group, research analysts anticipate that Hub Group, Inc. will post 2.2 earnings per share for the current fiscal year.

Hub Group Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Friday, March 28th. Shareholders of record on Tuesday, March 18th were paid a $0.125 dividend. The ex-dividend date of this dividend was Tuesday, March 18th. This represents a $0.50 annualized dividend and a yield of 1.50%. Hub Group's dividend payout ratio is 29.41%.

Analysts Set New Price Targets

HUBG has been the subject of several research reports. Susquehanna lowered their price objective on shares of Hub Group from $55.00 to $48.00 and set a "positive" rating for the company in a research report on Wednesday, March 26th. Deutsche Bank Aktiengesellschaft initiated coverage on shares of Hub Group in a research report on Friday, March 7th. They set a "hold" rating and a $41.00 price objective for the company. TD Cowen lowered their price objective on shares of Hub Group from $40.00 to $36.00 and set a "hold" rating for the company in a research report on Friday, May 9th. Benchmark lowered their price objective on shares of Hub Group from $40.00 to $33.13 and set a "buy" rating for the company in a research report on Friday, May 9th. Finally, Barclays lowered their price objective on shares of Hub Group from $45.00 to $40.00 and set an "equal weight" rating for the company in a research report on Monday, May 12th. Six investment analysts have rated the stock with a hold rating and three have issued a buy rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Hold" and a consensus target price of $43.68.

Get Our Latest Stock Report on HUBG

Hub Group Profile

(

Free Report)

Hub Group, Inc, a supply chain solutions provider, offers transportation and logistics management services in North America. The company's transportation services include intermodal, truckload, less-than-truckload, flatbed, temperature-controlled, and dedicated and regional trucking, as well as final mile, railcar, small parcel, and international transportation.

Featured Stories

Before you consider Hub Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hub Group wasn't on the list.

While Hub Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.