Oppenheimer Asset Management Inc. boosted its holdings in Shinhan Financial Group Co Ltd (NYSE:SHG - Free Report) by 45.5% during the first quarter, according to its most recent Form 13F filing with the SEC. The fund owned 27,201 shares of the bank's stock after acquiring an additional 8,507 shares during the period. Oppenheimer Asset Management Inc.'s holdings in Shinhan Financial Group were worth $873,000 at the end of the most recent reporting period.

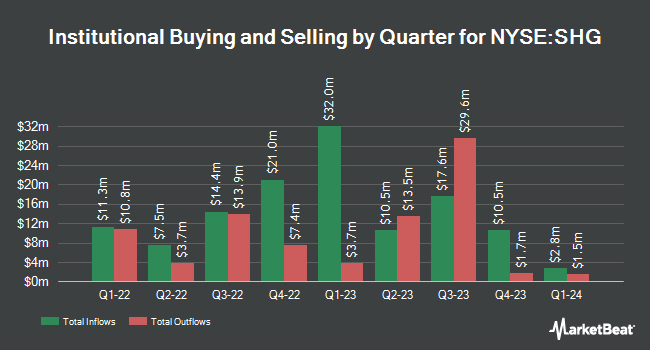

Several other hedge funds also recently added to or reduced their stakes in the business. Ameriprise Financial Inc. raised its stake in shares of Shinhan Financial Group by 4.3% in the 4th quarter. Ameriprise Financial Inc. now owns 8,575 shares of the bank's stock valued at $282,000 after acquiring an additional 351 shares during the period. Aquatic Capital Management LLC increased its holdings in Shinhan Financial Group by 2.8% in the 4th quarter. Aquatic Capital Management LLC now owns 14,471 shares of the bank's stock valued at $476,000 after purchasing an additional 392 shares during the last quarter. Sterling Capital Management LLC raised its position in Shinhan Financial Group by 8.1% in the fourth quarter. Sterling Capital Management LLC now owns 5,564 shares of the bank's stock valued at $183,000 after purchasing an additional 415 shares during the period. Wealth Enhancement Advisory Services LLC lifted its stake in Shinhan Financial Group by 5.6% during the fourth quarter. Wealth Enhancement Advisory Services LLC now owns 8,321 shares of the bank's stock worth $274,000 after purchasing an additional 442 shares in the last quarter. Finally, M&T Bank Corp lifted its stake in Shinhan Financial Group by 11.7% during the fourth quarter. M&T Bank Corp now owns 6,245 shares of the bank's stock worth $205,000 after purchasing an additional 655 shares in the last quarter. 7.76% of the stock is currently owned by hedge funds and other institutional investors.

Shinhan Financial Group Trading Down 0.5%

NYSE SHG traded down $0.25 during trading on Wednesday, hitting $45.40. The stock had a trading volume of 73,771 shares, compared to its average volume of 187,277. The company has a quick ratio of 1.04, a current ratio of 1.04 and a debt-to-equity ratio of 1.51. The company has a market capitalization of $22.51 billion, a PE ratio of 5.92, a PEG ratio of 0.56 and a beta of 0.91. The firm has a 50 day moving average price of $40.11 and a 200 day moving average price of $35.66. Shinhan Financial Group Co Ltd has a twelve month low of $28.76 and a twelve month high of $46.05.

Analysts Set New Price Targets

Separately, Wall Street Zen raised Shinhan Financial Group from a "hold" rating to a "buy" rating in a research note on Monday, May 19th.

Check Out Our Latest Stock Report on Shinhan Financial Group

About Shinhan Financial Group

(

Free Report)

Shinhan Financial Group Co, Ltd. provides financial products and services in South Korea and internationally. The company operates through six segments: Banking, Credit Card, Securities, Insurance, Credit, and Others. It offers retail banking services, including demand, savings, and fixed deposit-taking; checking accounts; mortgage and home equity, and retail lending; electronic banking and automatic teller machines (ATM); and bill paying, payroll and check-cashing, currency exchange, and wire fund transfer services.

Featured Articles

Before you consider Shinhan Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shinhan Financial Group wasn't on the list.

While Shinhan Financial Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.