Liberty One Investment Management LLC cut its stake in shares of PepsiCo, Inc. (NASDAQ:PEP - Free Report) by 68.7% in the 1st quarter, according to its most recent Form 13F filing with the SEC. The fund owned 45,071 shares of the company's stock after selling 98,910 shares during the period. PepsiCo accounts for about 0.7% of Liberty One Investment Management LLC's investment portfolio, making the stock its 29th biggest holding. Liberty One Investment Management LLC's holdings in PepsiCo were worth $6,758,000 as of its most recent filing with the SEC.

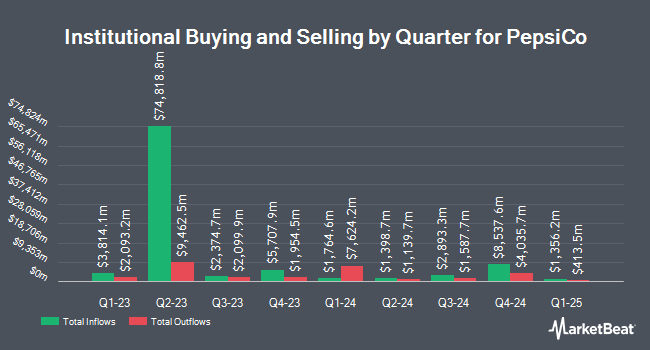

Other large investors have also recently bought and sold shares of the company. TAGStone Capital Inc. raised its stake in shares of PepsiCo by 2.8% during the fourth quarter. TAGStone Capital Inc. now owns 2,527 shares of the company's stock valued at $388,000 after acquiring an additional 70 shares in the last quarter. Lokken Investment Group LLC raised its stake in shares of PepsiCo by 0.9% during the fourth quarter. Lokken Investment Group LLC now owns 7,699 shares of the company's stock valued at $1,171,000 after acquiring an additional 70 shares in the last quarter. Legacy Financial Group LLC raised its stake in shares of PepsiCo by 4.9% during the first quarter. Legacy Financial Group LLC now owns 1,514 shares of the company's stock valued at $227,000 after acquiring an additional 71 shares in the last quarter. Atlantic Private Wealth LLC raised its stake in shares of PepsiCo by 37.5% during the fourth quarter. Atlantic Private Wealth LLC now owns 275 shares of the company's stock valued at $42,000 after acquiring an additional 75 shares in the last quarter. Finally, Pflug Koory LLC raised its stake in shares of PepsiCo by 1.0% during the first quarter. Pflug Koory LLC now owns 7,750 shares of the company's stock valued at $1,162,000 after acquiring an additional 76 shares in the last quarter. 73.07% of the stock is owned by institutional investors and hedge funds.

PepsiCo Stock Up 0.4%

NASDAQ PEP traded up $0.59 on Tuesday, hitting $135.04. The stock had a trading volume of 7,714,987 shares, compared to its average volume of 7,065,402. The stock has a market cap of $185.15 billion, a price-to-earnings ratio of 19.86, a price-to-earnings-growth ratio of 4.23 and a beta of 0.45. The company has a debt-to-equity ratio of 2.13, a current ratio of 0.83 and a quick ratio of 0.65. PepsiCo, Inc. has a 52-week low of $127.60 and a 52-week high of $180.91. The business's fifty day moving average price is $131.42 and its 200 day moving average price is $141.98.

PepsiCo (NASDAQ:PEP - Get Free Report) last announced its quarterly earnings data on Thursday, April 24th. The company reported $1.48 earnings per share for the quarter, missing analysts' consensus estimates of $1.49 by ($0.01). The company had revenue of $17.92 billion for the quarter, compared to analysts' expectations of $17.81 billion. PepsiCo had a net margin of 10.24% and a return on equity of 58.28%. PepsiCo's quarterly revenue was down 1.8% compared to the same quarter last year. During the same period last year, the firm earned $1.61 earnings per share. Equities research analysts anticipate that PepsiCo, Inc. will post 8.3 earnings per share for the current year.

PepsiCo Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Monday, June 30th. Stockholders of record on Friday, June 6th were issued a dividend of $1.4225 per share. The ex-dividend date of this dividend was Friday, June 6th. This is a positive change from PepsiCo's previous quarterly dividend of $1.36. This represents a $5.69 dividend on an annualized basis and a dividend yield of 4.21%. PepsiCo's payout ratio is 83.68%.

Analysts Set New Price Targets

PEP has been the subject of several research analyst reports. Royal Bank Of Canada reaffirmed a "sector perform" rating and set a $148.00 price target on shares of PepsiCo in a research note on Tuesday, June 24th. Evercore ISI set a $140.00 price objective on shares of PepsiCo in a report on Thursday, April 24th. Citigroup cut their price objective on shares of PepsiCo from $170.00 to $160.00 and set a "buy" rating on the stock in a report on Friday, April 25th. UBS Group cut their price objective on shares of PepsiCo from $175.00 to $169.00 and set a "buy" rating on the stock in a report on Friday, April 25th. Finally, Bank of America cut their price objective on shares of PepsiCo from $155.00 to $150.00 and set a "neutral" rating on the stock in a report on Friday, April 25th. One equities research analyst has rated the stock with a sell rating, fifteen have issued a hold rating and four have assigned a buy rating to the company. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus target price of $159.75.

Check Out Our Latest Report on PepsiCo

PepsiCo Profile

(

Free Report)

PepsiCo, Inc engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide. The company operates through seven segments: Frito-Lay North America; Quaker Foods North America; PepsiCo Beverages North America; Latin America; Europe; Africa, Middle East and South Asia; and Asia Pacific, Australia and New Zealand and China Region.

See Also

Before you consider PepsiCo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PepsiCo wasn't on the list.

While PepsiCo currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.