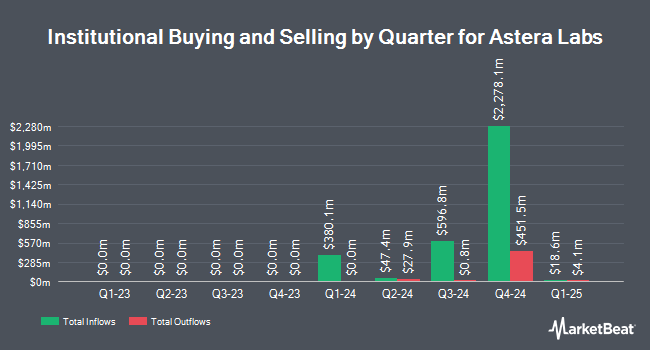

Point72 Asset Management L.P. decreased its stake in Astera Labs, Inc. (NASDAQ:ALAB - Free Report) by 87.5% during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 40,000 shares of the company's stock after selling 278,734 shares during the period. Point72 Asset Management L.P.'s holdings in Astera Labs were worth $5,298,000 at the end of the most recent reporting period.

Several other hedge funds and other institutional investors have also modified their holdings of the stock. Whittier Trust Co. of Nevada Inc. acquired a new stake in Astera Labs during the fourth quarter worth $25,000. Steward Partners Investment Advisory LLC boosted its stake in Astera Labs by 99.0% during the fourth quarter. Steward Partners Investment Advisory LLC now owns 199 shares of the company's stock worth $26,000 after buying an additional 99 shares in the last quarter. Kestra Investment Management LLC acquired a new stake in Astera Labs during the fourth quarter worth $28,000. Geneos Wealth Management Inc. acquired a new stake in Astera Labs during the fourth quarter worth $36,000. Finally, Global Retirement Partners LLC boosted its stake in Astera Labs by 3,155.6% during the fourth quarter. Global Retirement Partners LLC now owns 293 shares of the company's stock worth $39,000 after buying an additional 284 shares in the last quarter. Institutional investors and hedge funds own 60.47% of the company's stock.

Analyst Ratings Changes

A number of research analysts have issued reports on ALAB shares. Northland Capmk raised Astera Labs from a "hold" rating to a "strong-buy" rating in a report on Tuesday, January 28th. Needham & Company LLC cut their price objective on Astera Labs from $140.00 to $100.00 and set a "buy" rating for the company in a report on Wednesday, May 7th. Susquehanna started coverage on Astera Labs in a report on Friday, May 16th. They set a "neutral" rating and a $80.00 price objective for the company. Evercore ISI lifted their price objective on Astera Labs from $87.00 to $104.00 and gave the company an "outperform" rating in a report on Wednesday. Finally, Morgan Stanley raised Astera Labs from an "equal weight" rating to an "overweight" rating and set a $99.00 price objective for the company in a report on Monday, May 12th. One equities research analyst has rated the stock with a hold rating, fourteen have assigned a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Buy" and an average price target of $100.00.

Read Our Latest Report on Astera Labs

Insiders Place Their Bets

In other news, CEO Jitendra Mohan sold 75,000 shares of the business's stock in a transaction dated Thursday, May 8th. The stock was sold at an average price of $71.05, for a total transaction of $5,328,750.00. Following the completion of the transaction, the chief executive officer now directly owns 575,000 shares in the company, valued at approximately $40,853,750. The trade was a 11.54% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, General Counsel Philip Mazzara sold 3,809 shares of the business's stock in a transaction dated Friday, May 16th. The stock was sold at an average price of $90.67, for a total value of $345,362.03. Following the transaction, the general counsel now owns 187,596 shares of the company's stock, valued at $17,009,329.32. The trade was a 1.99% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders sold 852,640 shares of company stock valued at $69,893,694.

Astera Labs Stock Performance

NASDAQ:ALAB traded up $0.32 on Friday, hitting $94.62. 3,223,727 shares of the stock were exchanged, compared to its average volume of 3,988,631. The stock has a market capitalization of $15.60 billion, a price-to-earnings ratio of -54.69, a P/E/G ratio of 6.18 and a beta of 0.33. Astera Labs, Inc. has a 52 week low of $36.22 and a 52 week high of $147.39. The company's 50-day moving average price is $68.99 and its 200 day moving average price is $92.52.

Astera Labs (NASDAQ:ALAB - Get Free Report) last announced its quarterly earnings data on Tuesday, May 6th. The company reported $0.33 earnings per share for the quarter, topping the consensus estimate of $0.28 by $0.05. The firm had revenue of $159.44 million during the quarter, compared to analysts' expectations of $151.55 million. Astera Labs had a negative return on equity of 10.40% and a negative net margin of 21.05%. The company's quarterly revenue was up 144.1% compared to the same quarter last year. During the same period in the previous year, the business posted $0.10 EPS. As a group, equities research analysts predict that Astera Labs, Inc. will post 0.34 earnings per share for the current year.

About Astera Labs

(

Free Report)

Astera Labs, Inc designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure. Its Intelligent Connectivity Platform is comprised of a portfolio of data, network, and memory connectivity products, which are built on a unifying software-defined architecture that enables customers to deploy and operate high performance cloud and AI infrastructure at scale.

Further Reading

Before you consider Astera Labs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Astera Labs wasn't on the list.

While Astera Labs currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.