Portside Wealth Group LLC acquired a new position in shares of Willis Towers Watson Public Limited (NASDAQ:WTW - Free Report) in the 1st quarter, according to its most recent filing with the Securities & Exchange Commission. The fund acquired 837 shares of the company's stock, valued at approximately $262,000.

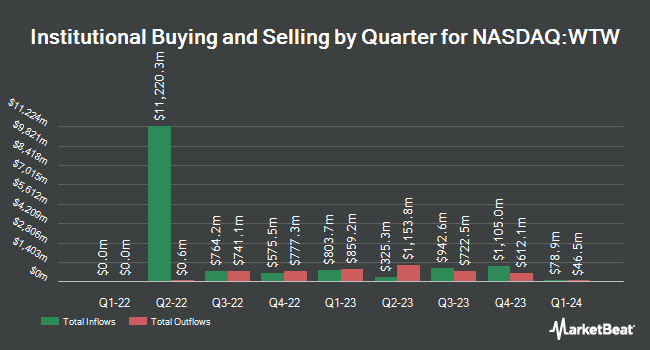

A number of other institutional investors and hedge funds have also added to or reduced their stakes in the business. Norges Bank bought a new position in shares of Willis Towers Watson Public during the 4th quarter valued at about $484,210,000. FMR LLC lifted its holdings in shares of Willis Towers Watson Public by 52.4% in the fourth quarter. FMR LLC now owns 3,682,939 shares of the company's stock valued at $1,153,644,000 after purchasing an additional 1,266,484 shares in the last quarter. T. Rowe Price Investment Management Inc. boosted its position in Willis Towers Watson Public by 77.5% during the 4th quarter. T. Rowe Price Investment Management Inc. now owns 2,788,542 shares of the company's stock worth $873,483,000 after acquiring an additional 1,217,714 shares during the period. GAMMA Investing LLC grew its position in Willis Towers Watson Public by 40,489.4% during the first quarter. GAMMA Investing LLC now owns 1,007,429 shares of the company's stock valued at $340,461,000 after purchasing an additional 1,004,947 shares in the last quarter. Finally, Wellington Management Group LLP lifted its position in Willis Towers Watson Public by 6,676.1% in the 4th quarter. Wellington Management Group LLP now owns 988,430 shares of the company's stock worth $309,616,000 after buying an additional 973,843 shares in the last quarter. 93.09% of the stock is owned by institutional investors.

Willis Towers Watson Public Stock Performance

NASDAQ WTW opened at $307.67 on Friday. Willis Towers Watson Public Limited has a twelve month low of $253.03 and a twelve month high of $344.14. The company has a quick ratio of 1.72, a current ratio of 1.98 and a debt-to-equity ratio of 0.66. The stock has a market cap of $30.51 billion, a P/E ratio of -307.67, a PEG ratio of 2.95 and a beta of 0.70. The company's 50-day simple moving average is $313.26 and its 200 day simple moving average is $319.16.

Willis Towers Watson Public (NASDAQ:WTW - Get Free Report) last released its quarterly earnings data on Thursday, April 24th. The company reported $3.13 earnings per share for the quarter, missing the consensus estimate of $3.27 by ($0.14). Willis Towers Watson Public had a negative net margin of 0.99% and a positive return on equity of 20.02%. The company had revenue of $2.22 billion during the quarter, compared to the consensus estimate of $2.29 billion. During the same quarter in the prior year, the company posted $3.13 earnings per share. The company's revenue for the quarter was down 5.0% on a year-over-year basis. As a group, research analysts forecast that Willis Towers Watson Public Limited will post 17.32 earnings per share for the current fiscal year.

Willis Towers Watson Public Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, July 15th. Shareholders of record on Monday, June 30th will be paid a dividend of $0.92 per share. The ex-dividend date of this dividend is Monday, June 30th. This represents a $3.68 annualized dividend and a yield of 1.20%. Willis Towers Watson Public's dividend payout ratio is currently -736.00%.

Insider Buying and Selling at Willis Towers Watson Public

In other news, CFO Andrew Jay Krasner sold 1,600 shares of Willis Towers Watson Public stock in a transaction that occurred on Tuesday, June 3rd. The shares were sold at an average price of $315.75, for a total value of $505,200.00. Following the completion of the transaction, the chief financial officer now owns 11,982 shares in the company, valued at approximately $3,783,316.50. The trade was a 11.78% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Company insiders own 0.32% of the company's stock.

Analyst Upgrades and Downgrades

WTW has been the subject of several recent research reports. Jefferies Financial Group lowered their price target on Willis Towers Watson Public from $373.00 to $371.00 and set a "buy" rating for the company in a research note on Friday, April 11th. UBS Group upgraded Willis Towers Watson Public from a "neutral" rating to a "buy" rating and lifted their price objective for the stock from $344.00 to $395.00 in a research note on Tuesday, March 18th. Keefe, Bruyette & Woods decreased their target price on Willis Towers Watson Public from $371.00 to $366.00 and set an "outperform" rating for the company in a research note on Monday, April 28th. Finally, Barclays upped their target price on shares of Willis Towers Watson Public from $302.00 to $316.00 and gave the company an "underweight" rating in a research note on Friday, April 11th. One investment analyst has rated the stock with a sell rating, one has given a hold rating, seven have assigned a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $356.30.

Read Our Latest Report on Willis Towers Watson Public

About Willis Towers Watson Public

(

Free Report)

Willis Towers Watson Public Limited Company operates as an advisory, broking, and solutions company worldwide. It operates through two segments: Health, Wealth & Career and Risk & Broking. The company offers strategy and design consulting, plan management service and support, broking and administration services for health, wellbeing, and other group benefit program, including medical, dental, disability, life, voluntary benefits and other coverages; actuarial support, plan design, and administrative services for pension and retirement savings plans; retirement consulting services and solutions; and integrated solutions that consists of investment discretionary management, pension administration, core actuarial, and communication and change management assistance services.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Willis Towers Watson Public, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Willis Towers Watson Public wasn't on the list.

While Willis Towers Watson Public currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report