Praxis Investment Management Inc. lifted its stake in shares of Skyworks Solutions, Inc. (NASDAQ:SWKS - Free Report) by 205.2% in the first quarter, according to its most recent filing with the SEC. The fund owned 7,020 shares of the semiconductor manufacturer's stock after acquiring an additional 4,720 shares during the period. Praxis Investment Management Inc.'s holdings in Skyworks Solutions were worth $454,000 as of its most recent SEC filing.

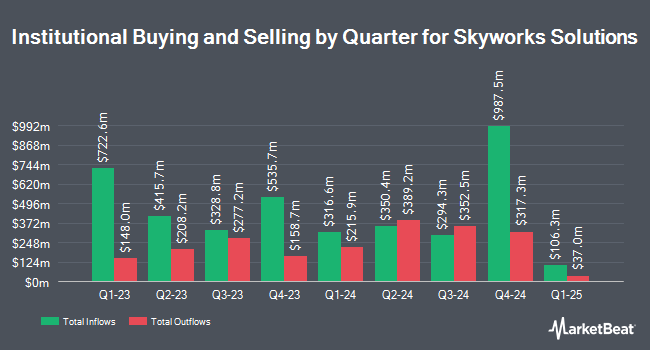

A number of other hedge funds also recently made changes to their positions in SWKS. Norges Bank bought a new stake in shares of Skyworks Solutions during the 4th quarter worth $228,646,000. Pzena Investment Management LLC lifted its holdings in shares of Skyworks Solutions by 37.5% during the 4th quarter. Pzena Investment Management LLC now owns 5,630,049 shares of the semiconductor manufacturer's stock worth $499,273,000 after acquiring an additional 1,536,289 shares during the last quarter. Marshall Wace LLP lifted its holdings in shares of Skyworks Solutions by 4,364.4% during the 4th quarter. Marshall Wace LLP now owns 1,421,647 shares of the semiconductor manufacturer's stock worth $126,072,000 after acquiring an additional 1,389,803 shares during the last quarter. Vulcan Value Partners LLC lifted its stake in Skyworks Solutions by 29.2% in the fourth quarter. Vulcan Value Partners LLC now owns 5,290,813 shares of the semiconductor manufacturer's stock worth $469,162,000 after purchasing an additional 1,194,782 shares during the last quarter. Finally, Vanguard Group Inc. lifted its stake in Skyworks Solutions by 2.8% in the fourth quarter. Vanguard Group Inc. now owns 20,341,842 shares of the semiconductor manufacturer's stock worth $1,803,915,000 after purchasing an additional 562,783 shares during the last quarter. 85.43% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several analysts have weighed in on SWKS shares. JPMorgan Chase & Co. lowered their price target on shares of Skyworks Solutions from $70.00 to $66.00 and set a "neutral" rating for the company in a research note on Thursday, May 8th. UBS Group lowered their price target on shares of Skyworks Solutions from $70.00 to $65.00 and set a "neutral" rating for the company in a research note on Tuesday, April 29th. Stifel Nicolaus boosted their price target on shares of Skyworks Solutions from $62.00 to $72.00 and gave the stock a "hold" rating in a research note on Thursday, May 8th. Needham & Company LLC reissued a "hold" rating on shares of Skyworks Solutions in a research note on Thursday, May 8th. Finally, Barclays boosted their price target on shares of Skyworks Solutions from $45.00 to $52.00 and gave the stock an "underweight" rating in a research note on Thursday, May 8th. Three investment analysts have rated the stock with a sell rating, sixteen have issued a hold rating and one has assigned a buy rating to the company. According to MarketBeat.com, Skyworks Solutions has a consensus rating of "Hold" and an average price target of $78.29.

Check Out Our Latest Research Report on SWKS

Skyworks Solutions Stock Performance

Shares of NASDAQ:SWKS opened at $72.13 on Monday. The company has a market cap of $10.83 billion, a price-to-earnings ratio of 28.29, a price-to-earnings-growth ratio of 1.81 and a beta of 1.16. The company has a 50-day moving average price of $67.58 and a 200-day moving average price of $73.57. The company has a current ratio of 4.95, a quick ratio of 3.84 and a debt-to-equity ratio of 0.17. Skyworks Solutions, Inc. has a 12 month low of $47.93 and a 12 month high of $120.86.

Skyworks Solutions (NASDAQ:SWKS - Get Free Report) last released its quarterly earnings results on Wednesday, May 7th. The semiconductor manufacturer reported $1.24 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.20 by $0.04. Skyworks Solutions had a net margin of 10.43% and a return on equity of 11.53%. The company had revenue of $953.20 million during the quarter, compared to the consensus estimate of $951.50 million. During the same period in the prior year, the firm earned $1.55 earnings per share. Skyworks Solutions's revenue was down 8.9% on a year-over-year basis. As a group, equities analysts anticipate that Skyworks Solutions, Inc. will post 3.7 EPS for the current year.

Skyworks Solutions Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Tuesday, June 17th. Investors of record on Tuesday, May 27th were paid a $0.70 dividend. This represents a $2.80 dividend on an annualized basis and a yield of 3.88%. The ex-dividend date of this dividend was Tuesday, May 27th. Skyworks Solutions's payout ratio is currently 109.80%.

Skyworks Solutions Company Profile

(

Free Report)

Skyworks Solutions, Inc, together with its subsidiaries, designs, develops, manufactures, and markets proprietary semiconductor products in the United States, China, South Korea, Taiwan, Europe, the Middle East, Africa, and the rest of Asia-Pacific. Its product portfolio includes amplifiers, antenna tuners, attenuators, automotive tuners and digital radios, DC/DC converters, demodulators, detectors, diodes, wireless analog system on chip products, directional couplers, diversity receive modules, filters, front-end modules, hybrids, light emitting diode drivers, low noise amplifiers, mixers, modulators, optocouplers/optoisolators, phase locked loops, phase shifters, power dividers/combiners, power over ethernet, power isolators, receivers, switches, synthesizers, timing devices, voltage controlled oscillators/synthesizers, and voltage regulators.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Skyworks Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Skyworks Solutions wasn't on the list.

While Skyworks Solutions currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report