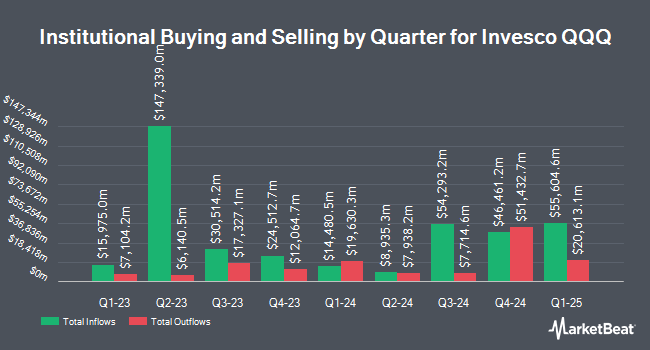

Quad Cities Investment Group LLC cut its holdings in shares of Invesco QQQ (NASDAQ:QQQ - Free Report) by 11.1% during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 8,550 shares of the exchange traded fund's stock after selling 1,066 shares during the period. Invesco QQQ makes up approximately 2.0% of Quad Cities Investment Group LLC's investment portfolio, making the stock its 13th largest holding. Quad Cities Investment Group LLC's holdings in Invesco QQQ were worth $4,009,000 at the end of the most recent quarter.

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Wilkins Miller Wealth Management LLC acquired a new stake in shares of Invesco QQQ in the fourth quarter valued at about $1,018,000. Synergy Investment Management LLC acquired a new position in Invesco QQQ during the fourth quarter worth approximately $723,000. Grant Private Wealth Management Inc acquired a new position in Invesco QQQ during the fourth quarter worth approximately $815,000. Tandem Investment Partners LLC acquired a new position in Invesco QQQ during the fourth quarter worth approximately $4,623,000. Finally, Gemsstock Ltd. increased its position in Invesco QQQ by 266.4% during the fourth quarter. Gemsstock Ltd. now owns 293,500 shares of the exchange traded fund's stock worth $150,046,000 after buying an additional 213,400 shares during the last quarter. 44.58% of the stock is currently owned by institutional investors.

Invesco QQQ Trading Up 0.1%

Shares of NASDAQ:QQQ traded up $0.73 during trading on Thursday, reaching $529.50. 34,096,379 shares of the stock were exchanged, compared to its average volume of 44,967,383. Invesco QQQ has a 12 month low of $402.39 and a 12 month high of $540.81. The firm has a market cap of $340.39 billion, a PE ratio of 32.66 and a beta of 1.18. The stock has a 50-day moving average price of $480.94 and a 200-day moving average price of $501.53.

Invesco QQQ Cuts Dividend

The business also recently declared a dividend, which was paid on Wednesday, April 30th. Investors of record on Monday, March 24th were paid a $0.7157 dividend. The ex-dividend date of this dividend was Monday, March 24th.

About Invesco QQQ

(

Free Report)

PowerShares QQQ Trust, Series 1 is a unit investment trust that issues securities called Nasdaq-100 Index Tracking Stock. The Trust's investment objective is to provide investment results that generally correspond to the price and yield performance of the Nasdaq-100 Index. The Trust provides investors with the opportunity to purchase units of beneficial interest in the Trust representing proportionate undivided interests in the portfolio of securities held by the Trust, which consists of substantially all of the securities, in substantially the same weighting, as the component securities of the Nasdaq-100 Index.

See Also

Before you consider Invesco QQQ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Invesco QQQ wasn't on the list.

While Invesco QQQ currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.