Quantinno Capital Management LP boosted its stake in shares of Barclays PLC (NYSE:BCS - Free Report) by 7.7% in the 4th quarter, according to its most recent disclosure with the SEC. The institutional investor owned 390,237 shares of the financial services provider's stock after acquiring an additional 27,851 shares during the period. Quantinno Capital Management LP's holdings in Barclays were worth $5,186,000 at the end of the most recent quarter.

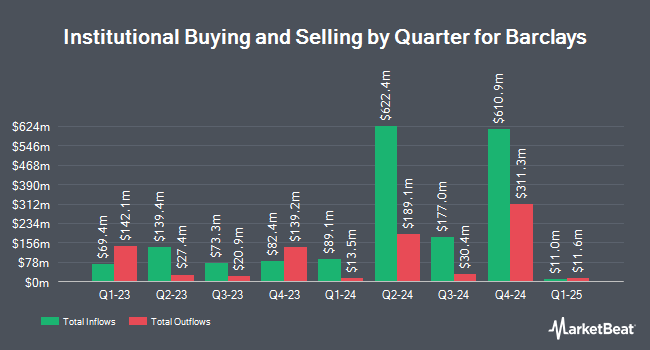

Several other institutional investors have also bought and sold shares of BCS. Bank of America Corp DE boosted its holdings in Barclays by 485.0% during the 4th quarter. Bank of America Corp DE now owns 6,680,869 shares of the financial services provider's stock valued at $88,789,000 after acquiring an additional 5,538,912 shares during the period. Raymond James Financial Inc. purchased a new stake in shares of Barclays during the fourth quarter valued at $59,373,000. Deutsche Bank AG bought a new position in shares of Barclays in the fourth quarter worth about $50,189,000. Bank of Montreal Can lifted its holdings in Barclays by 667.4% during the 4th quarter. Bank of Montreal Can now owns 3,603,127 shares of the financial services provider's stock valued at $47,886,000 after buying an additional 3,133,632 shares in the last quarter. Finally, Wells Fargo & Company MN boosted its position in Barclays by 423.9% in the 4th quarter. Wells Fargo & Company MN now owns 2,897,984 shares of the financial services provider's stock valued at $38,514,000 after buying an additional 2,344,858 shares during the period. Institutional investors own 3.39% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts have recently weighed in on BCS shares. StockNews.com downgraded shares of Barclays from a "buy" rating to a "hold" rating in a research note on Thursday, February 27th. BNP Paribas upgraded Barclays from a "neutral" rating to an "outperform" rating in a research note on Tuesday, March 4th.

Read Our Latest Stock Report on Barclays

Barclays Stock Performance

BCS stock traded up $0.11 during trading on Tuesday, reaching $17.84. The company had a trading volume of 12,342,784 shares, compared to its average volume of 14,655,254. The company has a market cap of $63.62 billion, a price-to-earnings ratio of 9.70, a price-to-earnings-growth ratio of 0.39 and a beta of 1.10. Barclays PLC has a twelve month low of $10.17 and a twelve month high of $17.87. The firm has a 50-day simple moving average of $15.50 and a 200-day simple moving average of $14.56. The company has a debt-to-equity ratio of 5.33, a quick ratio of 1.29 and a current ratio of 1.29.

Barclays (NYSE:BCS - Get Free Report) last posted its quarterly earnings results on Wednesday, April 30th. The financial services provider reported $0.65 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.61 by $0.04. Barclays had a return on equity of 7.74% and a net margin of 20.81%. The business had revenue of $10.32 billion during the quarter, compared to analyst estimates of $8.37 billion. As a group, sell-side analysts expect that Barclays PLC will post 2 earnings per share for the current year.

Barclays Company Profile

(

Free Report)

Barclays PLC provides various financial services in the United Kingdom, Europe, the Americas, Africa, the Middle East, and Asia. The company operates through Barclays UK and Barclays International division segments. It offers financial services, such as retail banking, credit cards, wholesale banking, investment banking, wealth management, and investment management services.

Read More

Before you consider Barclays, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Barclays wasn't on the list.

While Barclays currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.