Quantinno Capital Management LP boosted its position in DENTSPLY SIRONA Inc. (NASDAQ:XRAY - Free Report) by 58.7% during the fourth quarter, according to its most recent 13F filing with the SEC. The firm owned 185,399 shares of the medical instruments supplier's stock after acquiring an additional 68,591 shares during the period. Quantinno Capital Management LP owned 0.09% of DENTSPLY SIRONA worth $3,519,000 as of its most recent SEC filing.

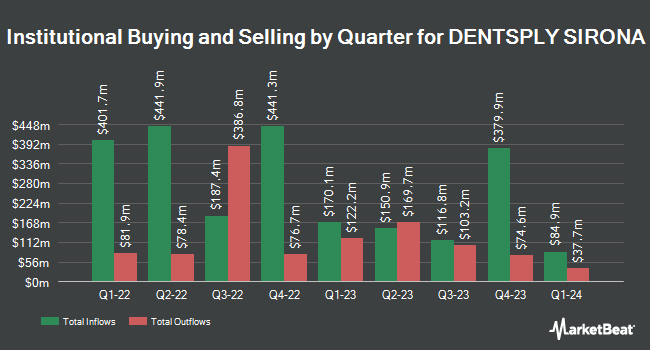

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Treasurer of the State of North Carolina grew its holdings in DENTSPLY SIRONA by 0.6% during the 4th quarter. Treasurer of the State of North Carolina now owns 88,854 shares of the medical instruments supplier's stock valued at $1,686,000 after buying an additional 560 shares in the last quarter. UMB Bank n.a. grew its holdings in DENTSPLY SIRONA by 60.8% during the 4th quarter. UMB Bank n.a. now owns 1,492 shares of the medical instruments supplier's stock valued at $28,000 after buying an additional 564 shares in the last quarter. Blue Trust Inc. grew its holdings in DENTSPLY SIRONA by 10.9% during the 4th quarter. Blue Trust Inc. now owns 7,199 shares of the medical instruments supplier's stock valued at $137,000 after buying an additional 707 shares in the last quarter. Quarry LP grew its holdings in DENTSPLY SIRONA by 25.7% during the 4th quarter. Quarry LP now owns 3,816 shares of the medical instruments supplier's stock valued at $72,000 after buying an additional 780 shares in the last quarter. Finally, Federated Hermes Inc. grew its holdings in DENTSPLY SIRONA by 0.5% during the 4th quarter. Federated Hermes Inc. now owns 169,304 shares of the medical instruments supplier's stock valued at $3,213,000 after buying an additional 915 shares in the last quarter. 95.70% of the stock is currently owned by institutional investors.

DENTSPLY SIRONA Price Performance

XRAY traded down $0.38 during midday trading on Friday, hitting $15.47. The stock had a trading volume of 2,475,144 shares, compared to its average volume of 2,968,748. The company has a market cap of $3.08 billion, a P/E ratio of -7.47, a price-to-earnings-growth ratio of 1.80 and a beta of 0.92. The business has a fifty day moving average of $14.47 and a 200 day moving average of $17.08. The company has a debt-to-equity ratio of 0.72, a quick ratio of 0.84 and a current ratio of 1.25. DENTSPLY SIRONA Inc. has a 1 year low of $12.16 and a 1 year high of $28.25.

DENTSPLY SIRONA (NASDAQ:XRAY - Get Free Report) last issued its earnings results on Thursday, May 8th. The medical instruments supplier reported $0.43 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.29 by $0.14. The business had revenue of $879.00 million during the quarter, compared to analyst estimates of $854.75 million. DENTSPLY SIRONA had a positive return on equity of 12.62% and a negative net margin of 10.59%. DENTSPLY SIRONA's revenue for the quarter was down 7.8% on a year-over-year basis. During the same quarter in the prior year, the firm earned $0.42 earnings per share. As a group, equities analysts forecast that DENTSPLY SIRONA Inc. will post 1.84 earnings per share for the current fiscal year.

DENTSPLY SIRONA Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, April 11th. Shareholders of record on Friday, March 28th were paid a $0.16 dividend. This represents a $0.64 annualized dividend and a yield of 4.14%. The ex-dividend date of this dividend was Friday, March 28th. DENTSPLY SIRONA's dividend payout ratio is currently -14.10%.

Insiders Place Their Bets

In related news, Director Gregory T. Lucier acquired 15,142 shares of the stock in a transaction on Monday, March 3rd. The stock was purchased at an average price of $16.51 per share, for a total transaction of $249,994.42. Following the completion of the transaction, the director now owns 81,971 shares of the company's stock, valued at $1,353,341.21. This trade represents a 22.66% increase in their position. The acquisition was disclosed in a document filed with the SEC, which is available at this hyperlink. 0.52% of the stock is owned by insiders.

Analyst Ratings Changes

XRAY has been the subject of a number of recent analyst reports. Mizuho reduced their target price on DENTSPLY SIRONA from $21.00 to $18.00 and set a "neutral" rating for the company in a report on Thursday, March 13th. Barrington Research boosted their price objective on DENTSPLY SIRONA from $20.00 to $21.00 and gave the stock an "outperform" rating in a report on Monday, May 12th. UBS Group cut their price objective on DENTSPLY SIRONA from $27.00 to $25.00 and set a "buy" rating for the company in a report on Friday, May 9th. Robert W. Baird cut their price objective on DENTSPLY SIRONA from $22.00 to $20.00 and set a "neutral" rating for the company in a report on Friday, February 28th. Finally, Wall Street Zen raised DENTSPLY SIRONA from a "hold" rating to a "buy" rating in a report on Friday, May 9th. Eleven investment analysts have rated the stock with a hold rating and three have issued a buy rating to the company. According to MarketBeat.com, the stock has an average rating of "Hold" and a consensus price target of $20.36.

Read Our Latest Research Report on DENTSPLY SIRONA

About DENTSPLY SIRONA

(

Free Report)

DENTSPLY SIRONA Inc manufactures and sells various dental products and technologies worldwide. It operates in four segments: Connected Technology Solutions, Essential Dental Solutions, Orthodontic and Implant Solutions, and Wellspect Healthcare. The company offers dental equipment comprising imaging equipment, motorized dental handpieces, treatment centers, other instruments, amalgamators, mixing machines, and porcelain furnaces; and dental CAD/CAM technologies to support dental restorations, such as intraoral scanners, 3-D printers, mills, other software and services, and a full-chairside economical restoration of esthetic ceramic dentistry, as well as DS Core, its cloud-based platform.

Featured Stories

Before you consider DENTSPLY SIRONA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DENTSPLY SIRONA wasn't on the list.

While DENTSPLY SIRONA currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.