Jacobs Levy Equity Management Inc. trimmed its stake in Resideo Technologies, Inc. (NYSE:REZI - Free Report) by 82.1% during the fourth quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 8,726 shares of the company's stock after selling 39,960 shares during the period. Jacobs Levy Equity Management Inc.'s holdings in Resideo Technologies were worth $201,000 at the end of the most recent reporting period.

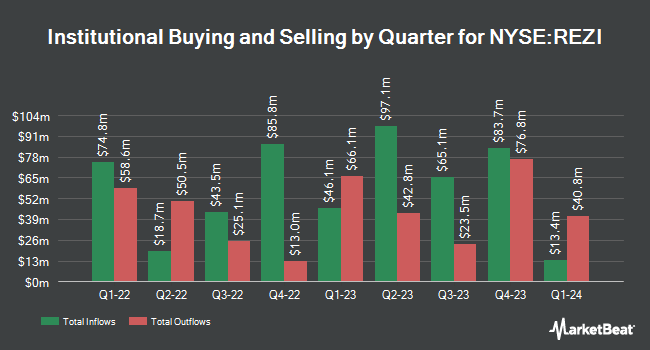

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in REZI. Vanguard Group Inc. lifted its position in Resideo Technologies by 0.5% during the 4th quarter. Vanguard Group Inc. now owns 16,137,439 shares of the company's stock worth $371,968,000 after acquiring an additional 75,940 shares during the last quarter. Boston Partners lifted its position in shares of Resideo Technologies by 25.1% during the 4th quarter. Boston Partners now owns 9,797,883 shares of the company's stock worth $225,865,000 after purchasing an additional 1,966,706 shares during the last quarter. Dimensional Fund Advisors LP lifted its position in shares of Resideo Technologies by 1.1% during the 4th quarter. Dimensional Fund Advisors LP now owns 7,982,342 shares of the company's stock worth $183,996,000 after purchasing an additional 88,273 shares during the last quarter. Pacer Advisors Inc. bought a new stake in Resideo Technologies during the 4th quarter valued at approximately $122,145,000. Finally, Prudential Financial Inc. grew its holdings in Resideo Technologies by 11.2% in the 4th quarter. Prudential Financial Inc. now owns 1,917,221 shares of the company's stock valued at $44,192,000 after buying an additional 192,511 shares during the last quarter. 91.71% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity at Resideo Technologies

In other Resideo Technologies news, major shareholder Channel Holdings Ii L.P. Cd&R purchased 5,754,501 shares of the firm's stock in a transaction on Friday, May 9th. The shares were purchased at an average price of $17.38 per share, for a total transaction of $100,013,227.38. Following the completion of the purchase, the insider now directly owns 5,754,501 shares of the company's stock, valued at approximately $100,013,227.38. This represents a ∞ increase in their ownership of the stock. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. Corporate insiders own 1.50% of the company's stock.

Wall Street Analyst Weigh In

Separately, JPMorgan Chase & Co. lowered Resideo Technologies from an "overweight" rating to a "neutral" rating and cut their price target for the stock from $31.00 to $16.00 in a report on Tuesday, April 22nd.

Check Out Our Latest Report on Resideo Technologies

Resideo Technologies Stock Performance

NYSE:REZI traded down $0.29 during trading hours on Friday, hitting $19.89. 693,489 shares of the company traded hands, compared to its average volume of 973,817. The company has a current ratio of 1.82, a quick ratio of 1.10 and a debt-to-equity ratio of 0.69. Resideo Technologies, Inc. has a twelve month low of $14.18 and a twelve month high of $28.28. The firm has a 50-day moving average of $17.66 and a 200 day moving average of $21.14. The stock has a market capitalization of $2.95 billion, a price-to-earnings ratio of 31.57 and a beta of 2.23.

Resideo Technologies (NYSE:REZI - Get Free Report) last posted its quarterly earnings data on Thursday, February 20th. The company reported $0.51 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.59 by ($0.08). Resideo Technologies had a return on equity of 11.12% and a net margin of 1.69%. The company had revenue of $1.86 billion for the quarter, compared to the consensus estimate of $1.84 billion. On average, analysts forecast that Resideo Technologies, Inc. will post 2.13 EPS for the current year.

Resideo Technologies Profile

(

Free Report)

Resideo Technologies, Inc develops, manufactures, and sells comfort, energy management, and safety and security solutions to the commercial and residential end markets in the United States, Europe, and internationally. The company operates in two segments, Products and Solutions, and ADI Global Distribution.

Read More

Before you consider Resideo Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Resideo Technologies wasn't on the list.

While Resideo Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.