Retirement Systems of Alabama lifted its position in shares of Rexford Industrial Realty, Inc. (NYSE:REXR - Free Report) by 1.2% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 595,552 shares of the real estate investment trust's stock after purchasing an additional 7,034 shares during the period. Retirement Systems of Alabama owned 0.25% of Rexford Industrial Realty worth $23,316,000 at the end of the most recent quarter.

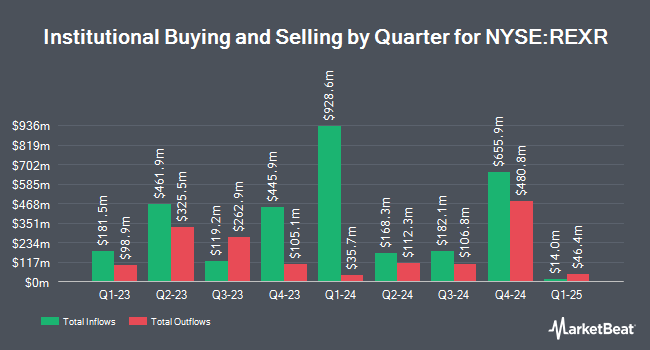

Other institutional investors and hedge funds also recently modified their holdings of the company. Paradigm Asset Management Co. LLC bought a new stake in Rexford Industrial Realty in the fourth quarter valued at approximately $1,082,000. Charles Schwab Investment Management Inc. lifted its holdings in Rexford Industrial Realty by 3.5% during the 4th quarter. Charles Schwab Investment Management Inc. now owns 2,782,904 shares of the real estate investment trust's stock valued at $107,587,000 after purchasing an additional 93,360 shares during the last quarter. Impax Asset Management Group plc increased its holdings in shares of Rexford Industrial Realty by 63.6% in the fourth quarter. Impax Asset Management Group plc now owns 21,691 shares of the real estate investment trust's stock valued at $839,000 after purchasing an additional 8,431 shares during the last quarter. Rothschild Investment LLC raised its position in shares of Rexford Industrial Realty by 760,280.0% in the fourth quarter. Rothschild Investment LLC now owns 38,019 shares of the real estate investment trust's stock valued at $1,470,000 after purchasing an additional 38,014 shares during the period. Finally, GAMMA Investing LLC lifted its stake in shares of Rexford Industrial Realty by 12,084.7% during the 1st quarter. GAMMA Investing LLC now owns 56,415 shares of the real estate investment trust's stock worth $2,209,000 after buying an additional 55,952 shares during the last quarter. 99.52% of the stock is owned by institutional investors.

Rexford Industrial Realty Price Performance

Shares of REXR traded up $0.25 during trading hours on Tuesday, reaching $37.20. The stock had a trading volume of 3,350,281 shares, compared to its average volume of 2,104,649. The company has a debt-to-equity ratio of 0.37, a quick ratio of 4.90 and a current ratio of 4.90. Rexford Industrial Realty, Inc. has a 12 month low of $29.68 and a 12 month high of $52.61. The stock has a market capitalization of $8.81 billion, a PE ratio of 30.00, a PEG ratio of 3.35 and a beta of 1.14. The company's 50-day moving average is $34.83 and its two-hundred day moving average is $37.62.

Rexford Industrial Realty (NYSE:REXR - Get Free Report) last released its quarterly earnings data on Wednesday, April 16th. The real estate investment trust reported $0.62 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.57 by $0.05. Rexford Industrial Realty had a return on equity of 3.31% and a net margin of 28.96%. The company had revenue of $248.82 million during the quarter, compared to the consensus estimate of $246.74 million. Research analysts expect that Rexford Industrial Realty, Inc. will post 2.38 EPS for the current year.

Rexford Industrial Realty Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, July 15th. Stockholders of record on Monday, June 30th will be given a dividend of $0.43 per share. The ex-dividend date is Monday, June 30th. This represents a $1.72 dividend on an annualized basis and a dividend yield of 4.62%. Rexford Industrial Realty's dividend payout ratio (DPR) is 138.71%.

Wall Street Analyst Weigh In

A number of brokerages have recently issued reports on REXR. Truist Financial reduced their price objective on Rexford Industrial Realty from $44.00 to $37.00 and set a "buy" rating for the company in a report on Thursday, May 1st. Wells Fargo & Company dropped their target price on Rexford Industrial Realty from $45.00 to $39.00 and set an "overweight" rating for the company in a report on Monday, May 19th. Robert W. Baird set a $43.00 price target on shares of Rexford Industrial Realty in a research report on Tuesday, May 6th. JPMorgan Chase & Co. decreased their target price on shares of Rexford Industrial Realty from $44.00 to $37.00 and set a "neutral" rating on the stock in a research report on Thursday, April 24th. Finally, Industrial Alliance Securities set a $38.00 price target on shares of Rexford Industrial Realty in a research report on Tuesday, March 25th. Two investment analysts have rated the stock with a sell rating, six have given a hold rating and three have issued a buy rating to the company. According to MarketBeat, Rexford Industrial Realty presently has an average rating of "Hold" and a consensus price target of $40.00.

Get Our Latest Analysis on REXR

Rexford Industrial Realty Company Profile

(

Free Report)

Rexford Industrial Realty, Inc is a self-administered and self-managed real estate investment trust, which engages in owning and operating industrial properties in infill markets. The company was founded by Richard S. Ziman on January 18, 2013 and is headquartered in Los Angeles, CA.

Read More

Before you consider Rexford Industrial Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rexford Industrial Realty wasn't on the list.

While Rexford Industrial Realty currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.