Rhumbline Advisers increased its stake in shares of Match Group, Inc. (NASDAQ:MTCH - Free Report) by 7.3% during the first quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 496,114 shares of the technology company's stock after buying an additional 33,948 shares during the quarter. Rhumbline Advisers owned about 0.20% of Match Group worth $15,479,000 at the end of the most recent reporting period.

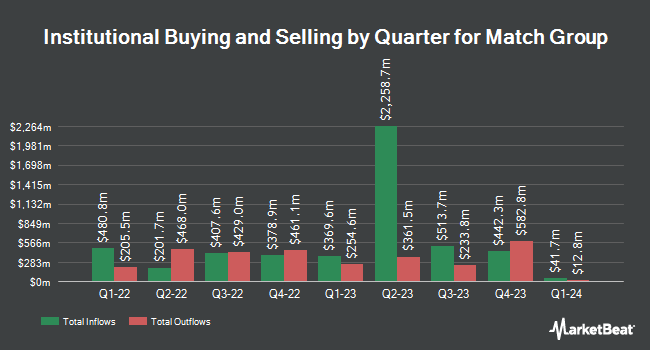

Other institutional investors have also recently added to or reduced their stakes in the company. Canada Post Corp Registered Pension Plan purchased a new position in Match Group during the fourth quarter worth approximately $43,000. Kayne Anderson Rudnick Investment Management LLC raised its position in Match Group by 30,240.0% in the fourth quarter. Kayne Anderson Rudnick Investment Management LLC now owns 1,517 shares of the technology company's stock valued at $50,000 after purchasing an additional 1,512 shares during the period. Assetmark Inc. raised its position in Match Group by 14.2% in the fourth quarter. Assetmark Inc. now owns 3,035 shares of the technology company's stock valued at $99,000 after purchasing an additional 378 shares during the period. Principal Securities Inc. raised its position in Match Group by 420.3% in the fourth quarter. Principal Securities Inc. now owns 3,283 shares of the technology company's stock valued at $107,000 after purchasing an additional 2,652 shares during the period. Finally, State of Wyoming raised its position in Match Group by 245.5% in the fourth quarter. State of Wyoming now owns 3,507 shares of the technology company's stock valued at $115,000 after purchasing an additional 2,492 shares during the period. Hedge funds and other institutional investors own 94.05% of the company's stock.

Analyst Upgrades and Downgrades

MTCH has been the topic of a number of research analyst reports. Barclays reduced their target price on Match Group from $52.00 to $46.00 and set an "overweight" rating on the stock in a research report on Friday, May 9th. Citigroup reduced their target price on Match Group from $31.00 to $30.00 and set a "neutral" rating on the stock in a research report on Friday, May 9th. JPMorgan Chase & Co. reduced their target price on Match Group from $29.00 to $28.00 and set a "neutral" rating on the stock in a research report on Friday, May 9th. Wells Fargo & Company reduced their target price on Match Group from $32.00 to $31.00 and set an "equal weight" rating on the stock in a research report on Wednesday, April 9th. Finally, Evercore ISI restated a "cautious" rating and issued a $32.00 target price on shares of Match Group in a research report on Wednesday, May 21st. One analyst has rated the stock with a sell rating, fifteen have assigned a hold rating and nine have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus price target of $35.91.

Get Our Latest Report on Match Group

Insider Buying and Selling

In other Match Group news, CEO Spencer M. Rascoff acquired 70,885 shares of the stock in a transaction dated Friday, May 9th. The stock was acquired at an average cost of $28.05 per share, with a total value of $1,988,324.25. Following the transaction, the chief executive officer now owns 137,478 shares in the company, valued at $3,856,257.90. The trade was a 106.45% increase in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. 0.64% of the stock is currently owned by insiders.

Match Group Price Performance

MTCH opened at $31.84 on Friday. Match Group, Inc. has a 12 month low of $26.39 and a 12 month high of $38.84. The stock has a market capitalization of $7.97 billion, a price-to-earnings ratio of 15.76, a PEG ratio of 0.82 and a beta of 1.35. The business has a fifty day moving average price of $29.47 and a 200 day moving average price of $31.53.

Match Group Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, July 18th. Investors of record on Thursday, July 3rd will be paid a dividend of $0.19 per share. The ex-dividend date of this dividend is Thursday, July 3rd. This represents a $0.76 annualized dividend and a yield of 2.39%. Match Group's payout ratio is 37.62%.

About Match Group

(

Free Report)

Match Group, Inc engages in the provision of dating products. Its portfolio of brands includes Tinder, Hinge, Match, Meetic, OkCupid, Pairs, Plenty Of Fish, Azar, BLK, and Hakuna, as well as a various other brands, each built to increase users' likelihood of connecting with others. Its services are available in over 40 languages to users worldwide.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Match Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Match Group wasn't on the list.

While Match Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.