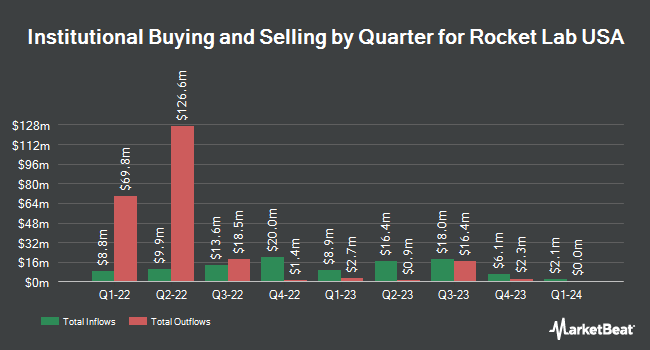

Royal Bank of Canada cut its position in shares of Rocket Lab USA, Inc. (NASDAQ:RKLB - Free Report) by 10.1% in the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 1,999,629 shares of the rocket manufacturer's stock after selling 223,784 shares during the period. Royal Bank of Canada owned approximately 0.40% of Rocket Lab USA worth $50,930,000 as of its most recent SEC filing.

Other institutional investors have also added to or reduced their stakes in the company. Rafferty Asset Management LLC grew its stake in shares of Rocket Lab USA by 5.4% in the 4th quarter. Rafferty Asset Management LLC now owns 89,586 shares of the rocket manufacturer's stock worth $2,282,000 after buying an additional 4,591 shares in the last quarter. ProShare Advisors LLC lifted its holdings in shares of Rocket Lab USA by 49.0% in the 4th quarter. ProShare Advisors LLC now owns 97,985 shares of the rocket manufacturer's stock valued at $2,496,000 after acquiring an additional 32,239 shares during the last quarter. Quantinno Capital Management LP purchased a new position in Rocket Lab USA in the fourth quarter worth about $257,000. Man Group plc bought a new stake in Rocket Lab USA during the fourth quarter worth approximately $10,157,000. Finally, Nomura Holdings Inc. bought a new stake in Rocket Lab USA during the fourth quarter worth approximately $1,339,000. Hedge funds and other institutional investors own 71.78% of the company's stock.

Rocket Lab USA Price Performance

Shares of RKLB stock opened at $25.17 on Thursday. Rocket Lab USA, Inc. has a 1-year low of $4.15 and a 1-year high of $33.34. The stock's 50-day moving average is $20.64 and its 200 day moving average is $22.71. The company has a market cap of $11.42 billion, a P/E ratio of -68.03 and a beta of 2.04. The company has a debt-to-equity ratio of 0.97, a current ratio of 2.58 and a quick ratio of 2.16.

Rocket Lab USA (NASDAQ:RKLB - Get Free Report) last released its quarterly earnings results on Thursday, May 8th. The rocket manufacturer reported ($0.12) EPS for the quarter, missing the consensus estimate of ($0.10) by ($0.02). Rocket Lab USA had a negative net margin of 51.76% and a negative return on equity of 39.47%. The firm had revenue of $122.57 million for the quarter, compared to analysts' expectations of $120.74 million. During the same period in the previous year, the company posted ($0.09) earnings per share. The business's quarterly revenue was up 32.1% compared to the same quarter last year. Research analysts predict that Rocket Lab USA, Inc. will post -0.38 earnings per share for the current fiscal year.

Analysts Set New Price Targets

RKLB has been the subject of several recent analyst reports. Wells Fargo & Company dropped their price objective on shares of Rocket Lab USA from $21.00 to $18.00 and set an "equal weight" rating for the company in a research note on Tuesday, April 8th. KeyCorp dropped their price target on shares of Rocket Lab USA from $32.00 to $28.00 and set an "overweight" rating for the company in a research note on Friday, February 28th. The Goldman Sachs Group upped their price target on shares of Rocket Lab USA from $14.35 to $16.00 and gave the company a "neutral" rating in a report on Monday, May 12th. Morgan Stanley raised their price objective on shares of Rocket Lab USA from $18.00 to $20.00 and gave the stock an "equal weight" rating in a research note on Monday, March 10th. Finally, Citigroup cut their target price on Rocket Lab USA from $35.00 to $33.00 and set a "buy" rating on the stock in a research note on Friday, February 28th. Five analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $23.50.

View Our Latest Stock Report on Rocket Lab USA

Insider Activity at Rocket Lab USA

In related news, insider Frank Klein sold 1,835 shares of the business's stock in a transaction on Monday, March 17th. The stock was sold at an average price of $19.93, for a total transaction of $36,571.55. Following the transaction, the insider now directly owns 1,417,644 shares in the company, valued at $28,253,644.92. The trade was a 0.13% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. 13.70% of the stock is currently owned by corporate insiders.

Rocket Lab USA Profile

(

Free Report)

Rocket Lab USA, Inc, a space company, provides launch services and space systems solutions for the space and defense industries. The company provides launch services, spacecraft design services, spacecraft components, spacecraft manufacturing, and other spacecraft and on-orbit management solutions; and constellation management services, as well as designs and manufactures small and medium-class rockets.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Rocket Lab USA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rocket Lab USA wasn't on the list.

While Rocket Lab USA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.