Sabal Trust CO increased its stake in Sysco Corporation (NYSE:SYY - Free Report) by 23.4% in the 1st quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 19,686 shares of the company's stock after purchasing an additional 3,730 shares during the quarter. Sabal Trust CO's holdings in Sysco were worth $1,477,000 at the end of the most recent quarter.

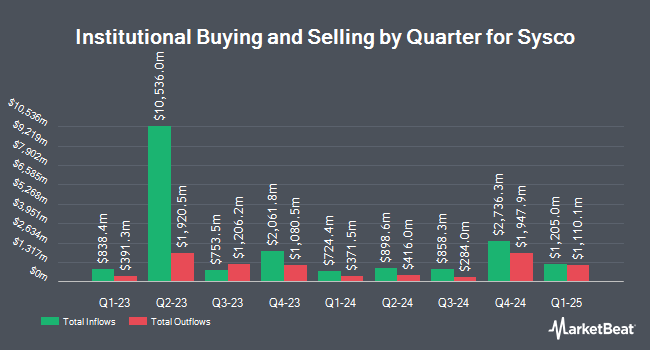

A number of other hedge funds and other institutional investors also recently made changes to their positions in the stock. Buckley Wealth Management LLC increased its position in shares of Sysco by 0.8% during the fourth quarter. Buckley Wealth Management LLC now owns 18,188 shares of the company's stock valued at $1,391,000 after buying an additional 150 shares during the period. WR Wealth Planners LLC grew its stake in Sysco by 9.9% during the fourth quarter. WR Wealth Planners LLC now owns 4,270 shares of the company's stock valued at $326,000 after acquiring an additional 386 shares in the last quarter. SBI Securities Co. Ltd. bought a new stake in Sysco during the 4th quarter worth approximately $54,000. Wealth Enhancement Advisory Services LLC lifted its stake in Sysco by 2.3% in the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 223,510 shares of the company's stock worth $16,772,000 after purchasing an additional 4,932 shares in the last quarter. Finally, Fiduciary Trust Co boosted its holdings in Sysco by 0.3% in the 4th quarter. Fiduciary Trust Co now owns 66,495 shares of the company's stock valued at $5,084,000 after purchasing an additional 196 shares during the period. 83.41% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other news, Director Sheila Talton sold 356 shares of the stock in a transaction that occurred on Thursday, May 1st. The stock was sold at an average price of $70.84, for a total transaction of $25,219.04. Following the completion of the sale, the director now owns 12,738 shares of the company's stock, valued at approximately $902,359.92. This represents a 2.72% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Insiders own 0.54% of the company's stock.

Sysco Price Performance

Shares of SYY stock traded down $0.46 during trading hours on Thursday, hitting $74.59. 2,265,188 shares of the company's stock were exchanged, compared to its average volume of 3,271,514. The company has a market capitalization of $36.16 billion, a PE ratio of 19.32, a PEG ratio of 2.46 and a beta of 0.81. The company has a current ratio of 1.26, a quick ratio of 0.76 and a debt-to-equity ratio of 6.37. Sysco Corporation has a 12-month low of $67.12 and a 12-month high of $82.23. The business's 50 day simple moving average is $72.67 and its 200-day simple moving average is $73.48.

Sysco (NYSE:SYY - Get Free Report) last issued its earnings results on Tuesday, April 29th. The company reported $0.96 EPS for the quarter, missing analysts' consensus estimates of $1.02 by ($0.06). Sysco had a return on equity of 107.96% and a net margin of 2.36%. The business had revenue of $19.60 billion during the quarter, compared to analysts' expectations of $20.11 billion. During the same quarter in the previous year, the business earned $0.96 EPS. Sysco's revenue for the quarter was up 1.1% compared to the same quarter last year. On average, equities research analysts anticipate that Sysco Corporation will post 4.58 earnings per share for the current year.

Sysco Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, July 25th. Investors of record on Thursday, July 3rd will be given a dividend of $0.54 per share. This represents a $2.16 annualized dividend and a yield of 2.90%. This is a positive change from Sysco's previous quarterly dividend of $0.51. The ex-dividend date is Thursday, July 3rd. Sysco's dividend payout ratio (DPR) is presently 52.85%.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently issued reports on SYY shares. Wells Fargo & Company lowered their price objective on Sysco from $87.00 to $80.00 and set an "overweight" rating on the stock in a research report on Wednesday, April 30th. Sanford C. Bernstein set a $87.00 target price on Sysco and gave the stock an "overweight" rating in a research note on Tuesday, April 22nd. Wall Street Zen downgraded Sysco from a "strong-buy" rating to a "buy" rating in a research report on Thursday, March 20th. Citigroup began coverage on Sysco in a report on Thursday, May 22nd. They set a "neutral" rating and a $78.00 price objective for the company. Finally, JPMorgan Chase & Co. raised their target price on shares of Sysco from $82.00 to $85.00 and gave the company an "overweight" rating in a research note on Tuesday, May 20th. Four analysts have rated the stock with a hold rating and eleven have given a buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $83.00.

Get Our Latest Analysis on SYY

Sysco Company Profile

(

Free Report)

Sysco Corporation, through its subsidiaries, engages in the marketing and distribution of various food and related products to the foodservice or food-away-from-home industry in the United States, Canada, the United Kingdom, France, and internationally. It operates through U.S. Foodservice Operations, International Foodservice Operations, SYGMA, and Other segments.

See Also

Before you consider Sysco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sysco wasn't on the list.

While Sysco currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.