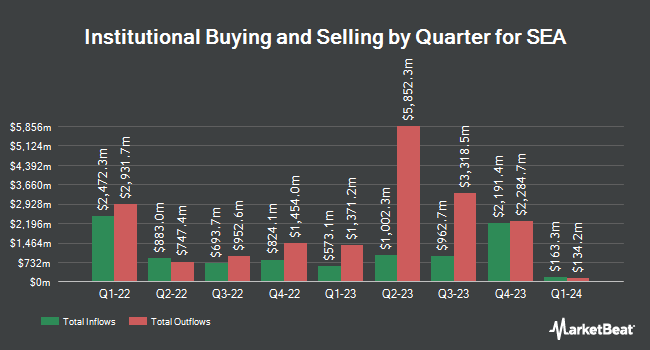

FDx Advisors Inc. lifted its holdings in shares of Sea Limited Sponsored ADR (NYSE:SE - Free Report) by 20.8% during the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 10,118 shares of the Internet company based in Singapore's stock after acquiring an additional 1,740 shares during the period. FDx Advisors Inc.'s holdings in SEA were worth $1,320,000 at the end of the most recent reporting period.

A number of other hedge funds have also modified their holdings of SE. State of Wyoming lifted its holdings in SEA by 3.1% in the fourth quarter. State of Wyoming now owns 3,010 shares of the Internet company based in Singapore's stock valued at $319,000 after acquiring an additional 90 shares during the period. Blue Trust Inc. increased its position in shares of SEA by 4.8% in the first quarter. Blue Trust Inc. now owns 2,043 shares of the Internet company based in Singapore's stock valued at $267,000 after buying an additional 93 shares in the last quarter. SOA Wealth Advisors LLC. increased its position in shares of SEA by 13.3% in the first quarter. SOA Wealth Advisors LLC. now owns 850 shares of the Internet company based in Singapore's stock valued at $111,000 after buying an additional 100 shares in the last quarter. Tradewinds Capital Management LLC increased its position in shares of SEA by 100.0% in the first quarter. Tradewinds Capital Management LLC now owns 200 shares of the Internet company based in Singapore's stock valued at $26,000 after buying an additional 100 shares in the last quarter. Finally, Covenant Partners LLC increased its position in shares of SEA by 2.4% in the fourth quarter. Covenant Partners LLC now owns 4,248 shares of the Internet company based in Singapore's stock valued at $451,000 after buying an additional 101 shares in the last quarter. 59.53% of the stock is currently owned by hedge funds and other institutional investors.

SEA Trading Down 0.8%

Shares of NYSE SE traded down $1.24 during midday trading on Friday, hitting $148.16. The stock had a trading volume of 2,875,024 shares, compared to its average volume of 4,356,027. The company has a market capitalization of $87.28 billion, a price-to-earnings ratio of 104.34 and a beta of 1.60. Sea Limited Sponsored ADR has a 1-year low of $55.00 and a 1-year high of $172.65. The company has a quick ratio of 1.49, a current ratio of 1.51 and a debt-to-equity ratio of 0.18. The company has a fifty day moving average price of $156.46 and a 200 day moving average price of $134.23.

SEA (NYSE:SE - Get Free Report) last released its quarterly earnings results on Tuesday, May 13th. The Internet company based in Singapore reported $0.65 EPS for the quarter, missing the consensus estimate of $0.93 by ($0.28). The company had revenue of $4.84 billion for the quarter, compared to analyst estimates of $4.90 billion. SEA had a return on equity of 10.74% and a net margin of 4.87%. The business's revenue was up 29.6% on a year-over-year basis. During the same period last year, the firm posted ($0.04) earnings per share. On average, analysts predict that Sea Limited Sponsored ADR will post 0.74 earnings per share for the current year.

Analyst Ratings Changes

SE has been the subject of a number of research analyst reports. Arete Research upgraded SEA to a "strong-buy" rating in a research report on Sunday, March 23rd. Wedbush restated an "outperform" rating on shares of SEA in a research report on Wednesday, May 14th. Sanford C. Bernstein restated an "outperform" rating and issued a $170.00 price target on shares of SEA in a research report on Wednesday, May 14th. Benchmark lifted their price objective on SEA from $150.00 to $180.00 and gave the stock a "buy" rating in a research report on Wednesday, May 14th. Finally, JPMorgan Chase & Co. upgraded SEA from a "neutral" rating to an "overweight" rating and lifted their price objective for the stock from $135.00 to $190.00 in a research report on Tuesday, May 13th. Four equities research analysts have rated the stock with a hold rating, nine have assigned a buy rating and two have given a strong buy rating to the company's stock. Based on data from MarketBeat, SEA presently has an average rating of "Moderate Buy" and a consensus target price of $153.17.

Check Out Our Latest Research Report on SE

SEA Profile

(

Free Report)

Sea Ltd. is an internet and mobile platform company, which engages in the provision of online gaming services. It operates through the following segments: Digital Entertainment, E-Commerce, and Digital Financial Services. The Digital Entertainment segment offers and develops mobile and PC online games.

Recommended Stories

Before you consider SEA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SEA wasn't on the list.

While SEA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.